Andreas Halvorsen's Viking Global Investors LP Bolsters Position in Verastem Inc

Introduction to the Transaction

Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors LP has recently made a notable addition to its investment portfolio by increasing its stake in Verastem Inc (NASDAQ:VSTM), a biopharmaceutical company. The transaction, which took place on December 31, 2023, involved the acquisition of 75,537 shares at a trade price of $8.14 per share. This strategic move has expanded Viking Global's holding to a total of 2,531,829 shares in Verastem Inc, reflecting the firm's confidence in the company's future prospects.

Guru Profile: Andreas Halvorsen (Trades, Portfolio)

Andreas Halvorsen (Trades, Portfolio), a founding partner of Viking Global Investors LP, has established a reputation for a research-intensive and long-term focused investment approach. Viking Global Investors, now under the leadership of CIO Ning Jin, has been a significant player in the equity investment landscape since its inception in 1999. The firm's investment philosophy is grounded in fundamental analysis, with a keen eye on business models, management quality, and industry trends. Viking Global Investors manages a diverse portfolio, with top holdings including Meta Platforms Inc (NASDAQ:META), United Parcel Service Inc (NYSE:UPS), and Visa Inc (NYSE:V). With an equity portfolio valued at $27.27 billion, the firm has a strong inclination towards the healthcare and financial services sectors.

Details of the Trade

The acquisition of Verastem Inc shares by Viking Global Investors LP on December 31, 2023, marks a significant addition to the firm's portfolio. The trade, executed at $8.14 per share, has increased the firm's total shareholding to 2,531,829, representing a 0.08% position in the portfolio and a 9.99% ownership of the company. Despite the trade's negligible impact on the overall portfolio, it signifies a strategic investment in the biotechnology sector, which aligns with the firm's top sector holdings.

Verastem Inc Company Overview

Verastem Inc, a late-stage development biopharmaceutical company based in the USA, is dedicated to advancing new cancer treatments. The company's focus is on developing anticancer agents that target critical signaling pathways, such as RAF/MEK and FAK inhibition. With a market capitalization of $297.153 million, Verastem Inc is poised to make significant strides in the biotechnology industry. The company's stock performance indicators will be closely watched by investors following this recent transaction by Viking Global Investors LP.

Stock Performance and Valuation

Verastem Inc's current stock price stands at $11.76, which is a substantial increase from the trade price of $8.14. This represents a 44.47% gain since the transaction date. However, the stock is still significantly overvalued according to the GF Value, with a price to GF Value ratio of 8.52. Despite the year-to-date increase of 41.69%, the stock has experienced a significant decline of 91.09% since its IPO in 2012.

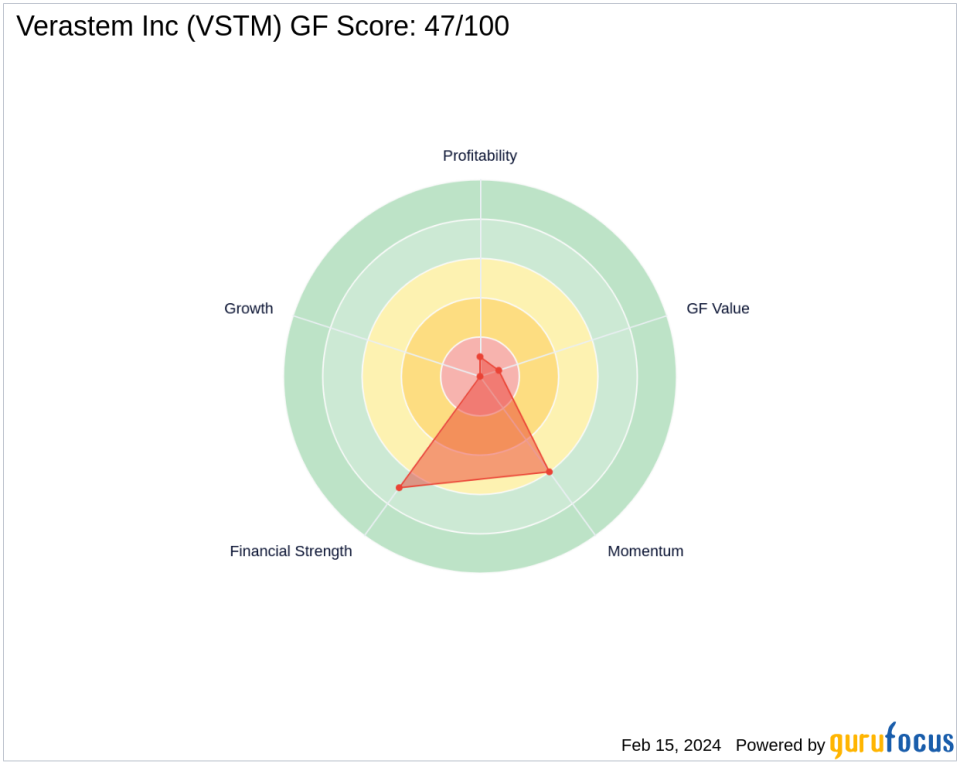

Financial and Growth Metrics

Verastem Inc's financial health and profitability have been areas of concern, as reflected by its Profitability Rank of 1/10 and a Growth Rank of 0/10. The company's financial strength, however, is more promising with a Financial Strength rank of 7/10 and a Cash to Debt ratio of 3.94. The Piotroski F-Score of 2 and an Altman Z score of 0.00 further highlight the need for careful evaluation of the company's stability and performance.

Comparative Analysis

In the biotechnology industry, Verastem Inc's position is challenged by its financial metrics and growth prospects. When compared to the largest guru shareholder in Verastem Inc, Leucadia National, the recent increase in Viking Global Investors LP's stake is a significant move that could influence the company's shareholder dynamics.

Conclusion

The recent acquisition of Verastem Inc shares by Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors LP is a strategic move that aligns with the firm's investment philosophy and sector focus. While the trade has a minimal immediate impact on the portfolio, it reflects a long-term investment vision that could potentially yield significant returns as Verastem Inc navigates the competitive biotechnology landscape. Investors will be watching closely to see how this transaction influences both the stock's performance and Viking Global's portfolio in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.