Andreas Halvorsen's Viking Global Investors Trims Stake in APi Group Corp

Overview of Recent Stock Transaction by Andreas Halvorsen (Trades, Portfolio)

On March 5, 2024, Viking Global Investors, led by founding partner Andreas Halvorsen (Trades, Portfolio), adjusted its investment portfolio by reducing its stake in APi Group Corp (NYSE:APG). The firm sold 4,990,399 shares of APG at a trade price of $34.25. Following the transaction, Viking Global Investors holds a total of 27,032,516 shares in the company, which now represents 3.42% of their portfolio and 11.03% of the company's outstanding shares. This move has had a -0.63% impact on the firm's equity portfolio.

Profile of Andreas Halvorsen (Trades, Portfolio) and Viking Global Investors

Andreas Halvorsen (Trades, Portfolio), a notable figure in the investment world, is the founding partner of Viking Global Investors LP, a firm that has been managing hedge funds with a focus on equities worldwide since 1999. The firm, now under the leadership of CIO Ning Jin, is known for its research-intensive and long-term investment approach, utilizing fundamental analysis to select investments across various industries and geographies. Viking Global Investors prides itself on a decentralized research structure coupled with centralized risk management, allowing for a broad range of ideas and expertise while maintaining comprehensive risk oversight. As of the latest data, Viking Global Investors oversees an equity portfolio valued at $27.27 billion, with top holdings including Meta Platforms Inc (NASDAQ:META), United Parcel Service Inc (NYSE:UPS), Visa Inc (NYSE:V), Workday Inc (NASDAQ:WDAY), and APi Group Corp (NYSE:APG).

APi Group Corp Stock Overview

APi Group Corp, trading under the symbol APG, is a US-based company that went public on October 5, 2017. The company operates primarily in two segments: Safety Services and Specialty Services. APi Group Corp provides a range of services including fire protection solutions, HVAC, and entry systems design, installation, inspection, and service, as well as maintenance and repair of critical infrastructure. With a market capitalization of $9.62 billion, APG has been categorized as significantly overvalued by GuruFocus, with a GF Value of $28.18 and a price to GF Value ratio of 1.39. The stock has seen a year-to-date percentage change of 19.37% and a gain of 14.6% since the reported transaction date.

Impact of the Trade on Halvorsen's Portfolio

The recent sale of APi Group Corp shares by Viking Global Investors has slightly decreased the firm's exposure to the stock, which remains a significant holding in their portfolio. The trade price of $34.25 is notably lower than the current stock price of $39.25, indicating a positive price movement post-transaction. However, with APG's GF Value being $28.18, the stock is currently trading above its intrinsic value, suggesting a cautious outlook for potential investors.

APi Group Corp's Financial Health and Market Performance

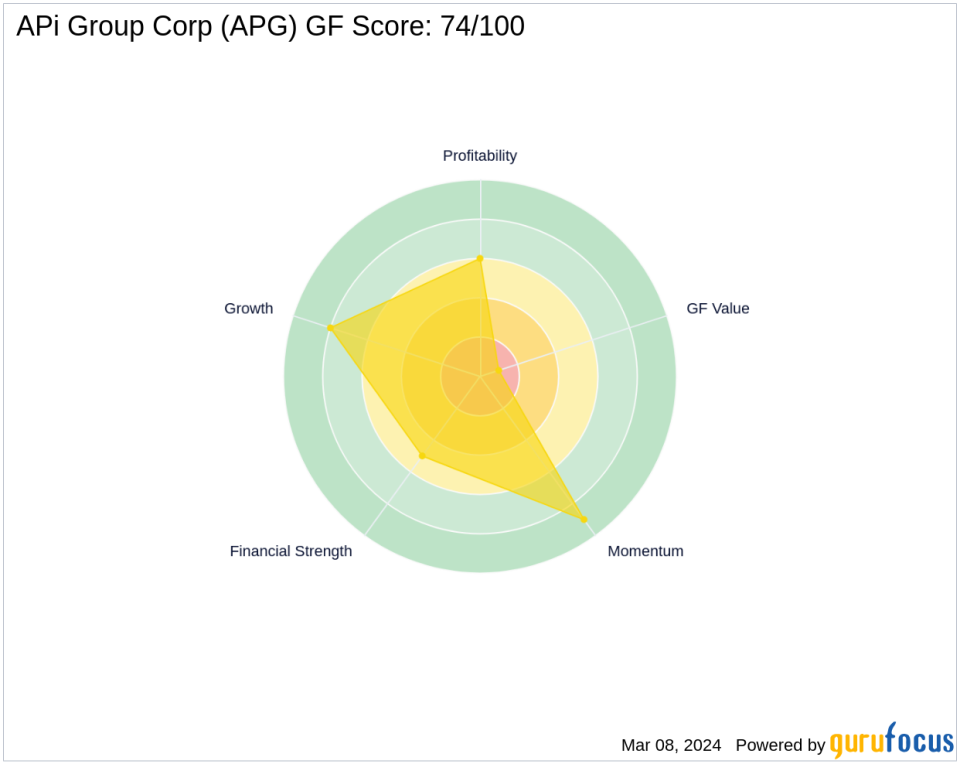

APi Group Corp's financial health and market performance present a mixed picture. The company's GF Score stands at 74/100, indicating a strong potential for future performance. However, its GF Value Rank is low at 1/10, reflecting its overvaluation status. APG's Growth Rank is high at 8/10, supported by a three-year EBITDA growth of 55.10%. The company's Profitability Rank and Financial Strength are moderate, with scores of 6/10 and 5/10, respectively. APG's Piotroski F-Score is a robust 8, indicating a healthy financial situation, but its Altman Z score of 2.22 suggests some financial distress risk.

Sector and Industry Analysis

Viking Global Investors has shown a preference for the Healthcare and Financial Services sectors, with APi Group Corp fitting into the firm's diverse portfolio as a part of the construction industry. The construction sector is currently experiencing growth, and APi Group Corp's position within it is strengthened by its specialized services and infrastructure solutions.

Other Notable Investors in APi Group Corp

Fisher Asset Management, LLC is currently the largest guru shareholder in APi Group Corp, while other notable investors include Joel Greenblatt (Trades, Portfolio). Their involvement in APG underscores the stock's appeal to value-oriented investment firms.

Conclusion

The reduction in APi Group Corp shares by Andreas Halvorsen (Trades, Portfolio)'s Viking Global Investors reflects a strategic portfolio adjustment. Despite the sale, APG remains a significant holding for the firm, aligning with its long-term, research-focused investment philosophy. APi Group Corp's strong market performance and growth prospects, coupled with its current overvaluation, will be key factors for investors to monitor moving forward.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.