Angel Oak Mortgage REIT Inc CFO & Treasurer Brandon Filson Sells 24,371 Shares

In a notable insider transaction, CFO & Treasurer Brandon Filson of Angel Oak Mortgage REIT Inc (NYSE:AOMR) sold 24,371 shares of the company on November 21, 2023. This move has caught the attention of investors and analysts who closely monitor insider behaviors as indicators of a company's financial health and future performance.

Who is Brandon Filson?

Brandon Filson serves as the Chief Financial Officer and Treasurer of Angel Oak Mortgage REIT Inc. In his role, Filson is responsible for the company's financial operations, including accounting, treasury, financial planning, and risk management. His decisions and actions are critical to the financial stability and growth of the company. With a deep understanding of the company's financials, Filson's trading activities are often scrutinized for insights into the company's performance and outlook.

About Angel Oak Mortgage REIT Inc

Angel Oak Mortgage REIT Inc is a real estate investment trust focused on investing in and managing a diversified portfolio of residential mortgage assets. The company primarily targets investments in mortgage-backed securities and other mortgage-related assets in the United States housing market. Angel Oak Mortgage REIT Inc aims to provide attractive risk-adjusted returns to its shareholders through dividends and capital appreciation.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions, particularly those executed by high-ranking executives like CFOs, can provide valuable clues about a company's financial health and future prospects. In the case of Angel Oak Mortgage REIT Inc, the insider, Brandon Filson, has sold a significant number of shares, which could be interpreted in various ways by the market.

Over the past year, Filson has sold a total of 44,371 shares and has not made any purchases. This one-sided activity might suggest that the insider could perceive the stock as being fully valued or potentially overvalued at current prices, leading to a decision to realize gains or diversify personal holdings. However, without additional context, it is challenging to determine the exact motivation behind these sales.

On the day of the insider's recent sale, shares of Angel Oak Mortgage REIT Inc were trading at $9.85, giving the company a market cap of $249.403 million. The stock price on the day of the transaction can often influence the perception of the sale. If the stock was near all-time highs, the sale might be viewed as a top-ticking move. Conversely, if the stock was trading near lows, it could be seen as a lack of confidence in the company's ability to rebound.

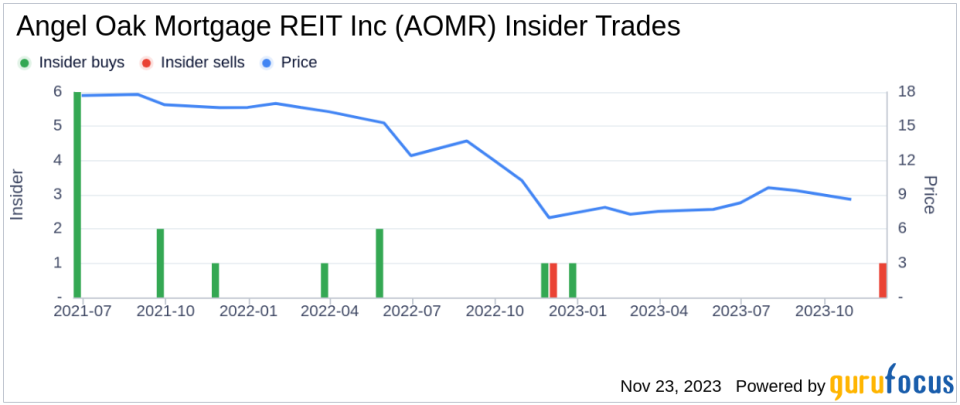

It is also important to consider the overall insider transaction history for Angel Oak Mortgage REIT Inc. Over the past year, there have been 2 insider buys and 2 insider sells. This balanced activity suggests that while some insiders are taking profits or reducing their positions, others may see value at current or lower prices.

When analyzing insider transactions, it is crucial to look at the broader context, including the company's performance, market conditions, and any recent news that may affect the stock. For instance, if the company had recently reported strong earnings or raised guidance, an insider sale might not carry as much negative weight.

Insider Trends

The insider transaction history can often reveal patterns or trends that are useful for investors. For Angel Oak Mortgage REIT Inc, the history over the past year shows a balance between insider buys and sells, which could indicate a neutral insider sentiment overall.

This image illustrates the recent insider trading activity for Angel Oak Mortgage REIT Inc. As investors, it is essential to consider these trends when evaluating the potential impact of insider transactions on stock price and investor sentiment.

Conclusion

Brandon Filson's recent sale of 24,371 shares of Angel Oak Mortgage REIT Inc is a significant insider transaction that warrants attention. While the reasons behind the sale are not publicly known, the action could be interpreted in various ways depending on the context and market conditions. Investors should consider the insider's history, the company's performance, and overall market trends when assessing the potential implications of this insider move.

As with any insider transaction, it is important not to jump to conclusions based solely on the sale itself. Instead, investors should use this information as one piece of a larger puzzle when constructing their investment thesis for Angel Oak Mortgage REIT Inc. Keeping an eye on future insider transactions and company developments will be crucial in understanding the full picture and making informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.