Anheuser-Busch (NYSE:BUD) Misses Q4 Sales Targets

Beer powerhouse Anheuser-Busch InBev (NYSE:BUD) fell short of analysts' expectations in Q4 FY2023, with revenue down 1.3% year on year to $14.47 billion. It made a GAAP profit of $0.82 per share, down from its profit of $1.41 per share in the same quarter last year.

Is now the time to buy Anheuser-Busch? Find out by accessing our full research report, it's free.

Anheuser-Busch (BUD) Q4 FY2023 Highlights:

Revenue: $14.47 billion vs analyst estimates of $15.63 billion (7.4% miss)

EPS: $0.82 vs analyst expectations of $0.89 (7.8% miss)

Gross Margin (GAAP): 53.9%, down from 54.6% in the same quarter last year

Organic Revenue was up 6.2% year on year

Sales Volumes were down 2.6% year on year

Market Capitalization: $114.4 billion

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Anheuser-Busch is one of the most widely recognized consumer staples companies in the world. Its influence over consumers gives it extremely high negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don't have).

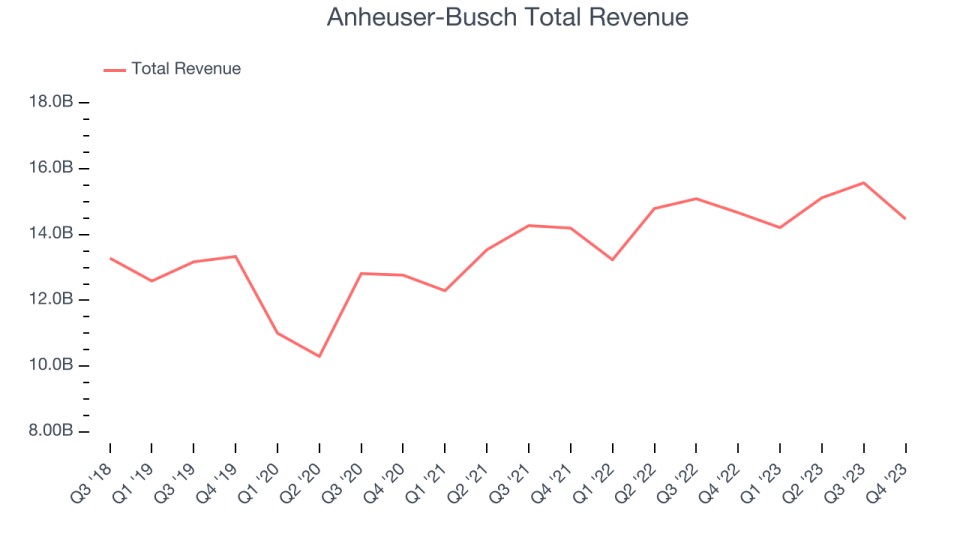

As you can see below, the company's annualized revenue growth rate of 8.2% over the last three years was decent despite selling a similar number of units each year. We'll explore what this means in the "Volume Growth" section.

This quarter, Anheuser-Busch missed Wall Street's estimates and reported a rather uninspiring 1.3% year-on-year revenue decline, generating $14.47 billion in revenue. Looking ahead, Wall Street expects sales to grow 6.8% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Anheuser-Busch generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

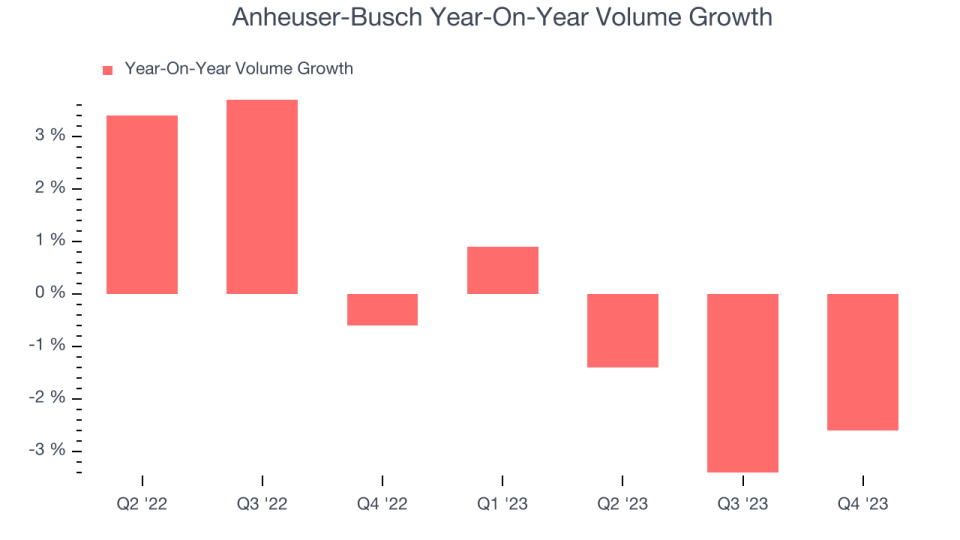

Over the last two years, Anheuser-Busch's quarterly sales volumes have, on average, stayed about the same. This stability is normal as the quantity demanded for consumer staples products typically doesn't see much volatility. The company's flat volumes also indicate its average organic revenue growth of 9.3% was generated from price increases.

In Anheuser-Busch's Q4 2023, sales volumes dropped 2.6% year on year. This result was a further deceleration from the 0.6% year-on-year decline it posted 12 months ago, showing the business is struggling to push its products.

Key Takeaways from Anheuser-Busch's Q4 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed analysts' expectations and its operating margin missed Wall Street's estimates. Overall, this was a mediocre quarter for Anheuser-Busch. The company is down 1.8% on the results and currently trades at $61.3 per share.

Anheuser-Busch may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.