ANI Pharmaceuticals Inc (ANIP) Reports Strong Growth in Q4 and Full-Year 2023, Sets Positive ...

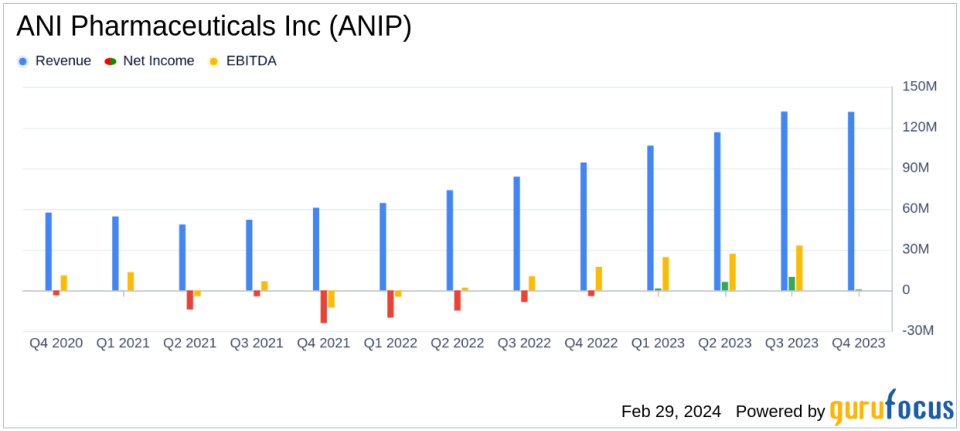

Net Revenues: ANI Pharmaceuticals Inc (NASDAQ:ANIP) reported a 39.7% increase in quarterly net revenues, reaching $131.7 million.

Net Income: The company achieved a net income of $0.7 million for common shareholders, with GAAP diluted earnings per share of $0.04.

Adjusted non-GAAP EBITDA: ANIP delivered $30.2 million in adjusted non-GAAP EBITDA, reflecting strong operational performance.

Rare Disease Segment Growth: The Rare Disease business saw a significant 137.3% increase in net revenues year-over-year, totaling $41.7 million for Q4.

Cash Flow: ANIP generated $119.0 million in cash from operating activities during the year, ending Q4 with $221.1 million in cash.

2024 Guidance: The company provided positive guidance for 2024, with net revenues expected to be between $520 million to $542 million, and adjusted non-GAAP earnings per share projected at $4.26 to $4.67.

On February 29, 2024, ANI Pharmaceuticals Inc (NASDAQ:ANIP) released its 8-K filing, announcing its financial results for the fourth quarter and the full year of 2023. ANI Pharmaceuticals, a biopharmaceutical company, develops, manufactures, and markets generic prescription pharmaceuticals, focusing on narcotics, oncolytic, hormones and steroids, and complex formulations. The company's growth is predominantly driven by its operations in the United States.

ANI Pharmaceuticals' fourth quarter performance highlighted a substantial year-over-year growth in net revenues, which rose to $131.7 million, a 39.7% increase. This growth was propelled by the company's Rare Disease business, which delivered a remarkable 137.3% increase in net revenues, amounting to $41.7 million for the quarter. The company's net income available to common shareholders reached $0.7 million, translating to a GAAP diluted earnings per share of $0.04. Additionally, the adjusted non-GAAP EBITDA stood at $30.2 million, with adjusted non-GAAP diluted earnings per share of $1.00.

The company's financial achievements are particularly significant in the context of the Drug Manufacturers industry, where ANI Pharmaceuticals has demonstrated its ability to grow its Rare Disease business rapidly. This segment's success is crucial as it represents a high-margin area with significant barriers to entry, providing a competitive edge and potential for sustained profitability.

Financial Highlights and Operational Performance

ANI Pharmaceuticals' generics business also concluded a successful year, with 11 new products launched and 20 new products filed, retaining the number two ranking in Competitive Generic Therapy approvals. The company's operational excellence and U.S.-based manufacturing capabilities have been instrumental in achieving these results, ensuring a stable supply of products to customers and contributing to market share gains.

For the full year of 2023, ANI Pharmaceuticals generated a total net revenue of $486.8 million. The company's liquidity position is strong, with $221.1 million in unrestricted cash and cash equivalents as of December 31, 2023. The company's net accounts receivable stood at $162.1 million, and the total outstanding debt was reported at $294.0 million (face value).

ANI Pharmaceuticals has issued guidance for 2024, with net revenues expected to range between $520 million to $542 million. The guidance also includes projected net revenues of $170 million to $180 million from Purified Cortrophin Gel, indicating a year-over-year growth of 52% to 61%. The adjusted non-GAAP EBITDA is forecasted to be between $135 million to $145 million, with adjusted non-GAAP earnings per share ranging from $4.26 to $4.67.

Management's Perspective

Nikhil Lalwani, President and CEO of ANI, expressed optimism about the company's trajectory, stating, "The fourth quarter capped off a record year for ANI, as we delivered record growth in annual net revenue and adjusted non-GAAP EBITDA. For our lead Rare Disease asset, Cortrophin Gel, new patient starts accelerated in Q4, and we posted the strongest sequential growth in net revenue to date."

ANI Pharmaceuticals' management is committed to leveraging its R&D capabilities, operational excellence, and manufacturing footprint to launch new products and address patient needs. The company's strong balance sheet is expected to provide the flexibility needed to expand the scope and scale of its Rare Disease business further.

For more detailed financial information and the full earnings report, please refer to ANI Pharmaceuticals' 8-K filing.

Investors and analysts are encouraged to follow the company's progress as it continues to serve patients and improve lives while delivering sustainable growth.

Explore the complete 8-K earnings release (here) from ANI Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.