Anika (ANIK) to Report Q4 Earnings: What's in the Cards?

We expect investors to focus on the sales performance of Anika Therapeutics' ANIK Osteoarthritis Pain (OAP) Management, Joint Preservation and Restoration segments when it reports its fourth-quarter and full-year 2022 results.

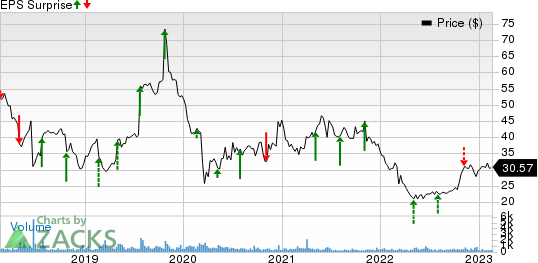

ANIK’s earnings surpassed estimates in two of the trailing three quarters and missed the mark on one occasion, the average three-quarter surprise being 12.58%. ANIK delivered a negative earnings surprise of 20.83% in the last reported quarter.

Anika Therapeutics Inc. Price and EPS Surprise

Anika Therapeutics Inc. price-eps-surprise | Anika Therapeutics Inc. Quote

Shares of Anika Therapeutics have risen 0.4% in 2022 against the industry’s decline of 7.4%.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for the quarter to be reported.

Factors to Note

The ongoing disruption in the macroeconomic environment have been impacting certain elected procedures and causing supply chain issues, thus hurting Anika’s overall business. It is yet to be seen if the trend improved in the fourth quarter.

Anika’s revenues are driven by the three segments, namely Osteoarthritis Pain (OAP) Management, Joint Preservation and Restoration and Non-Orthopedic.

In the fourth quarter, sales in the Joint Preservation and Restoration segment are likely to have risen, backed by improved procedural volumes. However, supply chain challenges may have limited Anika’s ability to meet the strong demand for its new X-Twist sports medicine product in the fourth quarter. Also, slower recovery in elective procedures that utilize Anika’s joint preservation products is likely to have affected sales in the Joint Preservation and Restoration segment.

Sales in the OAP management unit declined in the third quarter due to an unfavorable order timing, which we expect to have reversed in the fourth quarter and benefited revenues. Nonetheless, revenues in the OA Pain Management segment can vary significantly on a quarterly basis, based on ordering patterns by Anika’s partners and distributors.

International viscose sales have remained strong in the OAP management segment in the last three reported quarters of 2022. However, Anika has guided a decline in international sales in the fourth quarter. Meanwhile, new product introductions are likely to have continued to growth in the to-be-reported quarter.

The company is likely to have continued facing staffing shortages and disruptions in the global supply chain with COVID-19 causing back orders and delay in shipment to customers.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Anika Therapeutics this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Anika Therapeutics’ Earnings ESP is 0.00% as both the Most Accurate Estimate and Zacks Consensus Estimate stand at a loss of 22 cents per share.

Zacks Rank: Anika currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Syndax Pharmaceuticals SNDX has an Earnings ESP of +4.39% and a Zacks Rank #3.

Syndax Pharmaceuticals’ stock has surged 59.2% in the past year. Syndax Pharmaceuticals beat estimates in three of the last four quarters while meeting the mark on one occasion. Syndax Pharmaceuticals delivered an earnings surprise of 95.39%, on average, in the last four quarters. In the last reported quarter, SNDX reported an earnings surprise of 10.77%.

Allogene Therapeutics ALLO has an Earnings ESP of +25.7% and Zacks Rank #2.

Allogene Therapeutics stock has declined 22.6% in the past year. Earnings of ALLO beat estimates in all the last four quarters. Allogene witnessed a trailing four-quarter positive earnings surprise of 9.44%, on average. In the last reported quarter, ALLO reported an earnings surprise of 6.45%.

BeiGene BGNE has an Earnings ESP of +4.19% and Zacks Rank #2.

BeiGene shares have risen 9% in the past year. BGNE beat estimates in one of the last four quarters while missing the mark in the other three, delivering a negative earnings surprise of 21.98%, on average. In the last reported quarter, BGNE delivered a negative earnings surprise of 34.08%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Anika Therapeutics Inc. (ANIK) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

BeiGene, Ltd. (BGNE) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report