Announcing: IMImobile (LON:IMO) Stock Increased An Energizing 150% In The Last Five Years

IMImobile PLC (LON:IMO) shareholders might be concerned after seeing the share price drop 22% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. In fact, the share price is 150% higher today. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now.

See our latest analysis for IMImobile

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

IMImobile has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. So we might find other metrics can better explain the share price movements.

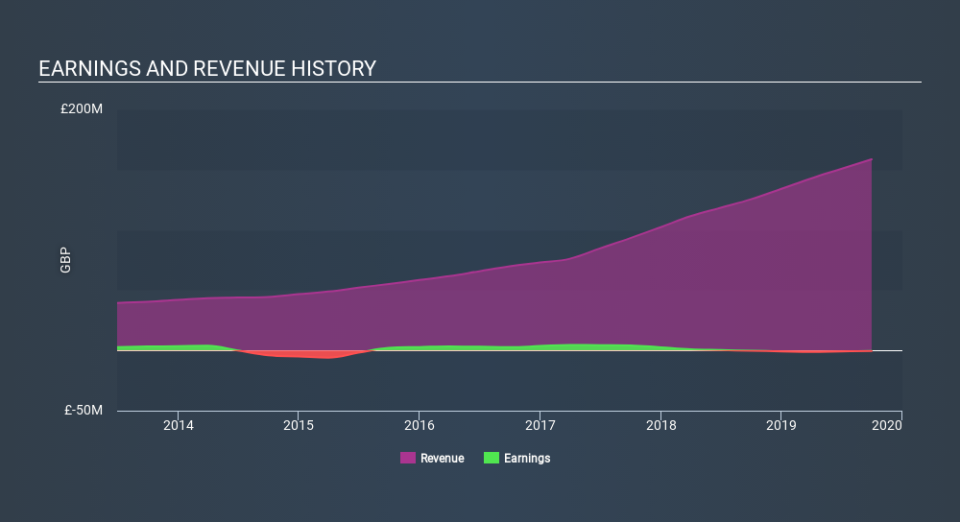

On the other hand, IMImobile's revenue is growing nicely, at a compound rate of 26% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling IMImobile stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that IMImobile has rewarded shareholders with a total shareholder return of 3.0% in the last twelve months. However, that falls short of the 20% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for IMImobile (1 shouldn't be ignored) that you should be aware of.

Of course IMImobile may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.