Announcing: Takung Art (NYSEMKT:TKAT) Stock Soared An Exciting 747% In The Last Year

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, Takung Art Co., Ltd. (NYSEMKT:TKAT) has generated a beautiful 747% return in just a single year. Also pleasing for shareholders was the 571% gain in the last three months. Also impressive, the stock is up 307% over three years, making long term shareholders happy, too.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Takung Art

Takung Art wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Takung Art saw its revenue grow by 71%. That's stonking growth even when compared to other loss-making stocks. But the share price has really rocketed in response gaining 747% as previously mentioned. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

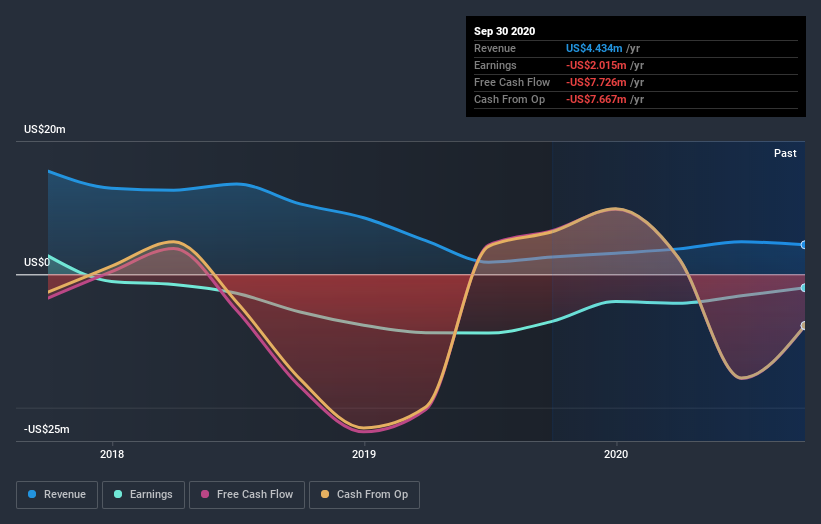

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Takung Art stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Takung Art has rewarded shareholders with a total shareholder return of 747% in the last twelve months. That's better than the annualised return of 18% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Takung Art is showing 5 warning signs in our investment analysis , and 2 of those are potentially serious...

We will like Takung Art better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.