Anson Funds Management LP Acquires Shares in MEI Pharma Inc

Anson Funds Management LP (Trades, Portfolio), a prominent investment firm, recently added 864,188 shares of MEI Pharma Inc (NASDAQ:MEIP) to its portfolio. This article will delve into the details of this transaction, provide an overview of the guru and the traded company, and analyze the potential implications of this acquisition on the market.

Transaction Details

The transaction took place on September 22, 2023, with Anson Funds Management LP (Trades, Portfolio) acquiring shares of MEI Pharma Inc at a price of $6.85 per share. This addition resulted in a 5.89% change in the firm's holdings, impacting its portfolio by 0.06%. The firm now holds a total of 864,188 shares in MEI Pharma Inc, representing 1.02% of its portfolio and 12.98% of the company's total shares. This significant acquisition could potentially influence the market dynamics surrounding MEI Pharma Inc.

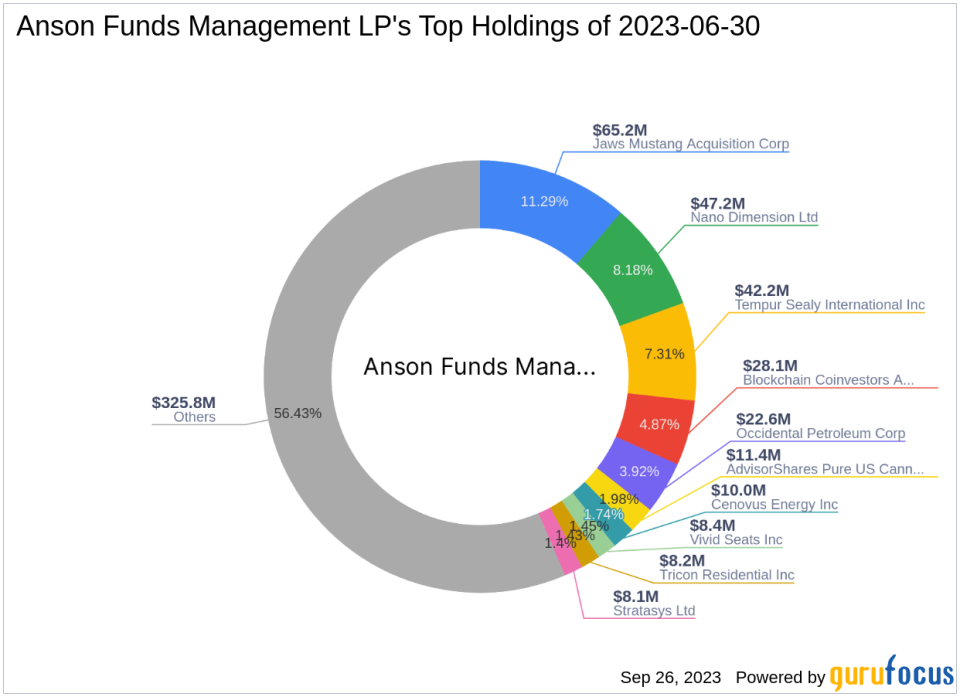

Profile of Anson Funds Management LP (Trades, Portfolio)

Anson Funds Management LP (Trades, Portfolio), located at 16000 Dallas Parkway, Dallas, TX, is a renowned investment firm with a diverse portfolio. The firm currently holds 143 stocks, with a total equity of $577 million. Its top holdings include Nano Dimension Ltd(NASDAQ:NNDM), Occidental Petroleum Corp(NYSE:OXY), Tempur Sealy International Inc(NYSE:TPX), Jaws Mustang Acquisition Corp(JMSM.WS), and Blockchain Coinvestors Acquisition Corp I(NASDAQ:BCSAW). The firm's primary sectors of investment are Financial Services and Technology. The acquisition of MEI Pharma Inc shares aligns with the firm's investment philosophy and could potentially enhance its portfolio diversity.

Overview of MEI Pharma Inc

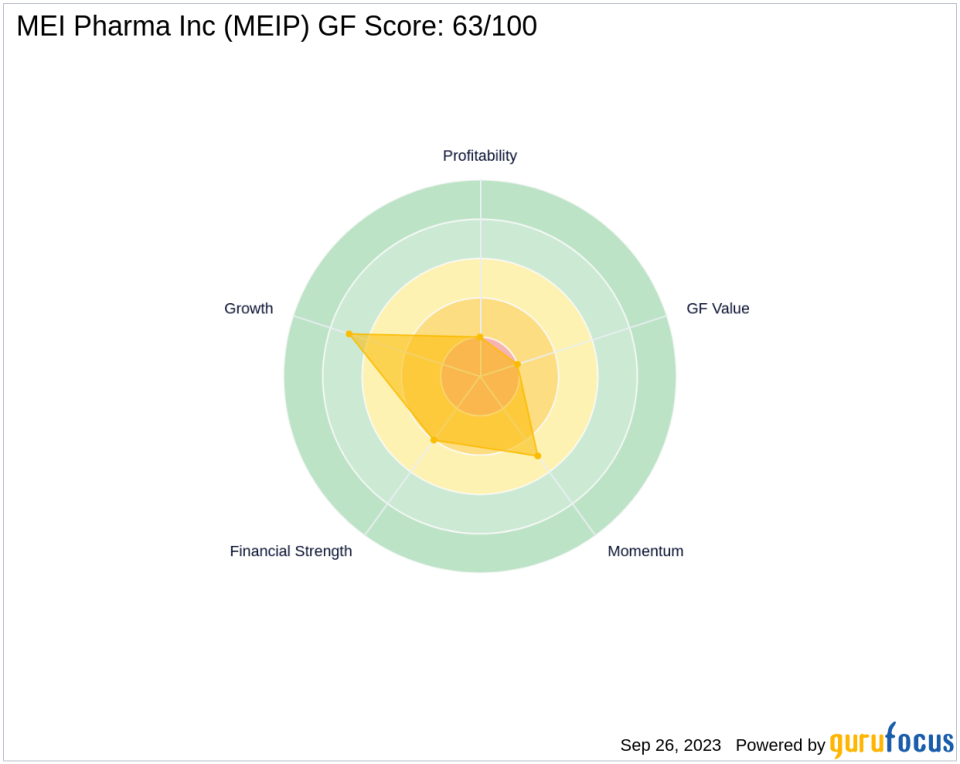

MEI Pharma Inc, a US-based company, is primarily engaged in the clinical development of novel therapies for cancer. The company's portfolio includes Pracinostat, Zandelisib, and ME-344, which are being developed for the treatment of various types of cancer. The company's market cap stands at $49.438 million, with a current stock price of $7.42. The company's GF Score is 63/100, indicating a moderate future performance potential.

Stock Performance and Valuation

MEI Pharma Inc's stock performance has been quite volatile. The company's PE percentage is currently at 0.00, indicating that the company is at a loss. The GF Valuation suggests that the stock could be a possible value trap, with a GF Value of 66.34 and a price to GF Value of 0.11. The stock has gained 8.32% since the transaction and has seen a year-to-date price change ratio of 46.64%. However, the stock's IPO percent stands at -99.92%, indicating a significant decrease since its Initial Public Offering in 2003.

Financial Health and Industry Position

MEI Pharma Inc's financial health is reflected in its Financial Strength rank of 4/10 and a Profitability Rank of 2/10. The company's cash to debt ratio is 8.58, ranking 745th in the biotechnology industry. The company's ROE and ROA stand at -78.82 and -23.16 respectively, with respective ranks of 990 and 597. Despite these figures, the company has seen a 3-year revenue growth of 68.60%, indicating potential growth prospects.

Stock Momentum and Predictability

MEI Pharma Inc's stock momentum is reflected in its RSI 5 day, RSI 9 day, and RSI 14 day figures of 87.07, 78.97, and 70.68 respectively. The company's momentum index for 6 - 1 month and 12 - 1 month stand at 32.29 and -23.55 respectively. However, the company's predictability rank is currently not available, indicating uncertainty in its future performance.

Conclusion

In conclusion, Anson Funds Management LP (Trades, Portfolio)'s acquisition of MEI Pharma Inc shares could potentially influence the market dynamics surrounding the company. Despite the company's current financial health and stock performance, its potential growth prospects and the guru's investment strategy could lead to positive outcomes. However, investors should exercise caution due to the company's potential as a value trap and its uncertain predictability rank.

This article first appeared on GuruFocus.