Ansys Inc (ANSS) Reports Solid Q4 and Full-Year 2023 Financial Growth Amid Pending Acquisition ...

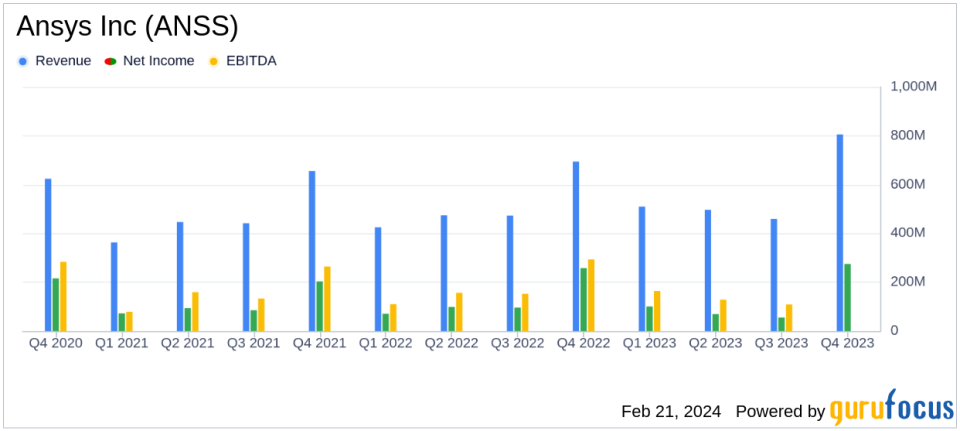

Q4 Revenue: $805.1 million, a 16% increase year-over-year.

Full-Year Revenue: $2,269.9 million, up 10% from the previous year.

Q4 Earnings Per Share: GAAP EPS at $3.14 and non-GAAP EPS at $3.94.

Full-Year Earnings Per Share: GAAP EPS at $5.73 and non-GAAP EPS at $8.80.

Annual Contract Value (ACV): Q4 ACV at $955.2 million and full-year ACV at $2,300.5 million.

Operating Cash Flows: Q4 at $232.7 million and full-year at $717.1 million.

Deferred Revenue and Backlog: Totaled $1,472.6 million as of December 31, 2023.

Ansys Inc (NASDAQ:ANSS) released its 8-K filing on February 21, 2024, detailing robust financial results for both the fourth quarter and the full year of 2023. The engineering simulation software company, which employs over 4,000 individuals and serves a global customer base of more than 50,000, reported significant year-over-year revenue growth and increased earnings per share.

The company's performance reflects its strong market position and the increasing demand for simulation software across various industries, including aerospace, defense, and automotive. Ansys' comprehensive suite of software enables customers to simulate structural, fluids, semiconductor power, embedded software, optical, and electromagnetic properties, which is critical for innovation and development in these sectors.

Financial Performance Highlights

Ansys' fourth-quarter revenue reached $805.1 million, marking a 16% increase compared to the same period in the previous year. The full-year revenue also saw a significant rise to $2,269.9 million, a 10% growth from FY 2022. These results were mirrored in the company's earnings per share, with Q4 GAAP EPS climbing to $3.14 from $2.95 and non-GAAP EPS to $3.94 from $3.09 in the prior year's quarter. The full-year EPS figures followed suit, with GAAP EPS at $5.73, up from $5.99, and non-GAAP EPS at a strong $8.80, compared to $7.99 in FY 2022.

The Annual Contract Value, a key metric indicating the strength and trajectory of Ansys' business, showed robust growth with Q4 ACV at $955.2 million and full-year ACV at $2,300.5 million. These figures represent a 17% and 13% increase in reported currency for the respective periods. The company's operating cash flows were equally impressive, with Q4 generating $232.7 million and the full year accumulating $717.1 million.

Deferred revenue and backlog were reported at $1,472.6 million as of December 31, 2023, underscoring the company's solid financial position and future revenue potential.

Strategic Developments and Outlook

Notably, on January 15, 2024, Ansys entered into a definitive agreement with Synopsys, Inc., under which Synopsys will acquire Ansys. The transaction, valued at approximately $35.0 billion, is expected to close in the first half of 2025, subject to customary closing conditions and approvals. This strategic move is set to create a leader in silicon to systems design solutions, combining Synopsys' semiconductor electronic design automation expertise with Ansys' simulation portfolio.

Due to the pending transaction, Ansys has suspended its quarterly earnings conference calls and will no longer provide quarterly or annual guidance. However, the company expects FY 2024 ACV to grow in double digits, with the dollar value of ACV continuing to be highly skewed toward the fourth quarter.

While Ansys' financial achievements are noteworthy, the company faces challenges inherent in the highly competitive software industry, including the need to continuously innovate and adapt to changing technologies. Additionally, the pending acquisition by Synopsys introduces a level of uncertainty that may impact customer and investor sentiment.

Overall, Ansys' financial results demonstrate a strong performance in a dynamic market, positioning the company well for the anticipated merger and future growth opportunities.

For a more detailed breakdown of Ansys Inc (NASDAQ:ANSS)'s financial results and the full earnings release, please refer to the provided 8-K filing.

Explore the complete 8-K earnings release (here) from Ansys Inc for further details.

This article first appeared on GuruFocus.