ANSYS (NASDAQ:ANSS) Surprises With Q4 Sales

Engineering simulation software provider Ansys (NASDAQ:ANSS) reported Q4 FY2023 results beating Wall Street analysts' expectations , with revenue up 16% year on year to $805.1 million. It made a non-GAAP profit of $3.94 per share, improving from its profit of $3.09 per share in the same quarter last year.

Is now the time to buy ANSYS? Find out by accessing our full research report, it's free.

ANSYS (ANSS) Q4 FY2023 Highlights:

Revenue: $805.1 million vs analyst estimates of $795.9 million (1.2% beat)

EPS (non-GAAP): $3.94 vs analyst estimates of $3.70 (6.5% beat)

Gross Margin (GAAP): 91.3%, down from 93.7% in the same quarter last year

Market Capitalization: $28.85 billion

ANSS acquired by Synopsys (NASDAQ:SNPS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

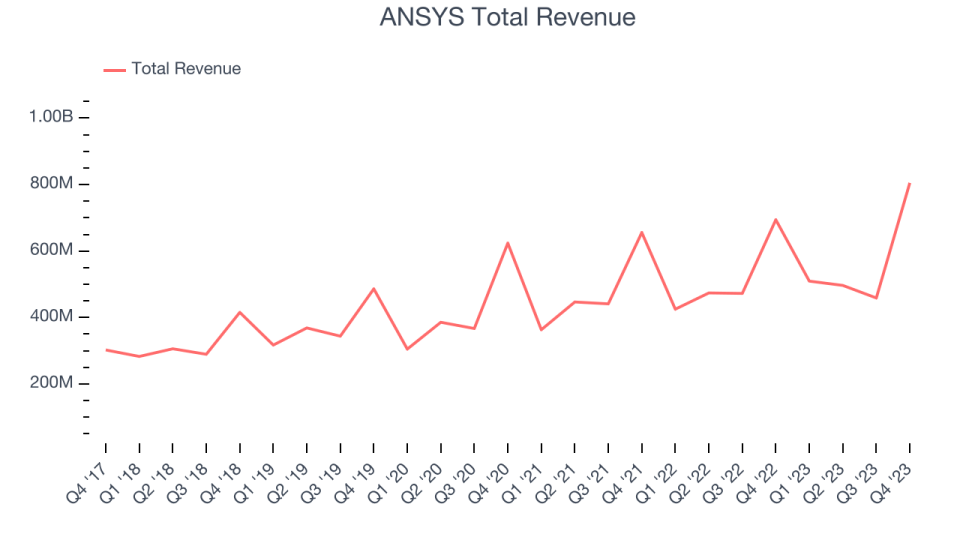

As you can see below, ANSYS's revenue growth has been unremarkable over the last two years, growing from $655.7 million in Q4 FY2021 to $805.1 million this quarter.

This quarter, ANSYS's quarterly revenue was up 16% year on year, above the company's historical trend. On top of that, its revenue increased $346.3 million quarter on quarter, a strong improvement from the $37.8 million decrease in Q3 2023. This is a sign of acceleration of growth and very nice to see indeed.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. ANSYS's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 91.3% in Q4.

That means that for every $1 in revenue the company had $0.91 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, ANSYS's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Key Takeaways from ANSYS's Q4 Results

It was good to see ANSYS slightly improve its gross margin this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. Zooming out, we think this was a decent quarter, showing that the company is staying on target. The stock is flat after reporting and currently trades at $328 per share.