Antero (AR) Q2 Earnings Miss Estimates on Lower Gas Price

Antero Resources Corporation AR reported second-quarter 2023 adjusted loss of 28 cents per share, which missed the Zacks Consensus Estimate of a loss of 27 cents. The figure declined significantly from the year-ago quarter’s reported earnings of $1.69 per share.

Total quarterly revenues of $953 million missed the Zacks Consensus Estimate of $970 million. Also, the top line decreased significantly from the year-ago quarter’s $2202 million.

Such weak quarterly results can be primarily attributed to a substantial decline in natural-gas-equivalent price realization.

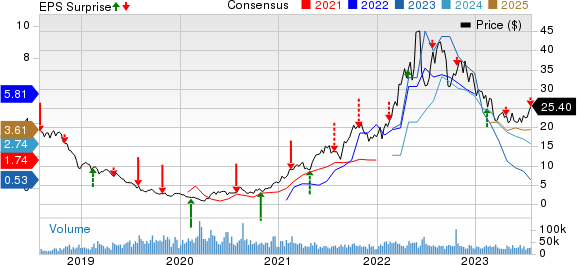

Antero Resources Corporation Price, Consensus and EPS Surprise

Antero Resources Corporation price-consensus-eps-surprise-chart | Antero Resources Corporation Quote

Overall Production

Total production through the second quarter was 309 billion cubic feet equivalent (Bcfe), up 5% from 294 Bcfe a year ago. The reported figure came in higher than our estimate of 295 Bcfe. Natural gas production (accounting for 66% of the total output) totaled 204 Bcf, higher than our estimate of 197 Bcf.

Oil production in the reported quarter amounted to 971 thousand barrels (MBbls), up 7% from 906 MBbls in the year-ago period. Our estimate for the same was pinned at 920 MBbls.

AR reported production of 6,414 MBbls of C2 Ethane, up 59% from 4,025 MBbls in the year-ago quarter. The company’s output of 10,175 MBbls of C3+ NGLs was slightly higher than 10,156 MBbls a year ago.

Realized Prices (Excluding Derivative Settlements)

Weighted natural-gas-equivalent price realization in the quarter was $2.89 per thousand cubic feet equivalent (Mcfe), lower than the year-ago quarter’s figure of $8.00. Our estimate for the same was pegged at $2.74 Mcfe. Realized prices for natural gas declined 72% to $2.14 per Mcf from $7.67 a year ago. The figure was also lower than our estimate of $2.42 per Mcf.

The company’s oil price realization in the quarter was $59.69 per barrel (Bbl), down 39% from $98.49 a year ago. The figure was also lower than our estimate of $63.35 per Bbl. The realized price for C3+ NGLs declined to $34.16 per Bbl from $60.28. The realized price for C2 Ethane decreased 65% to $7.82 per Bbl from $22.42 a year ago. The figure was lower than our estimate of $15.47 per Bbl.

Operating Expenses

Total operating expenses decreased to $1,042.2 million from $1,140.2 million in the year-ago period.

Average lease operating cost was 9 cents per Mcfe. The gathering and compression costs decreased 11% to 68 cents per Mcfe.

Transportation expenses declined 16% from the prior-year quarter’s level to 61 cents per Mcfe, while processing costs increased 13% year over year to 85 cents per Mcfe.

Capex & Financials

In the second quarter, Antero spent $247 million on drilling and completion operations. As of Jun 30, 2023, it had no cash and cash equivalents. It had long-term debt of $1.5 billion as of the same date.

Guidance

For 2023, Antero raised its guidance for net daily natural gas-equivalent production by 3%. It now expects the same in the range of 3.35-3.4 Bcfe/d. The company also projected a decline in realized natural gas price premium to NYMEX Henry Hub by $0.05 per Mcf to $0.00-$0.10 per Mcf.

Zacks Rank & Stocks to Consider

Currently, Antero carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the energy space are Evolution Petroleum Corporation EPM, Murphy USA Inc. MUSA and MPLX LP MPLX. While EPM sports a Zacks Rank #1 (Strong Buy), both MUSA and MPLX carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Through its ownership interests in onshore oil and natural gas properties in the United States, Evolution Petroleum is touted as a key independent energy player.

Murphy USA serves 1.6 million customers daily and owns a dedicated line space on the Colonial Pipeline. MUSA operates stations close to Walmart supercenters and is a low-cost, high-volume fuel seller. This enables the company to attract significantly more transactions than its peers.

MPLX generates stable fee-based revenues from diverse midstream energy assets via long-term contracts and is least exposed to commodity price fluctuations. The partnership is well positioned to capitalize on the growing demand for fresh midstream assets in order to support increasing volumes of crude oil, natural gas and NGLs in the prolific shale plays in the United States.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report