Antero (AR) Q3 Earnings Beat Estimates, Revenues Fall Y/Y

Antero Resources Corporation AR reported third-quarter 2023 adjusted earnings of 8 cents per share, which beat the Zacks Consensus Estimate of a loss of 2 cents. However, the bottom line declined significantly from the year-ago quarter’s level of $1.63.

Total quarterly revenues of $1,126 million missed the Zacks Consensus Estimate of $1,136 million. Also, the top line decreased significantly from the year-ago quarter’s figure of $2,065 million.

The better-than-expected quarterly earnings can be primarily attributed to higher volumes, driven by strong well performance and lower operating expenses. However, a substantial decline in commodity price realization offset the positives.

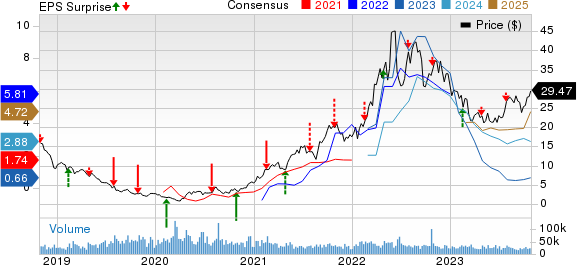

Antero Resources Corporation Price, Consensus and EPS Surprise

Antero Resources Corporation price-consensus-eps-surprise-chart | Antero Resources Corporation Quote

Overall Production

Total production through the third quarter was 320 billion cubic feet equivalent (Bcfe), up 9% from 294 Bcfe recorded a year ago. The reported figure came in higher than our estimate of 311 Bcfe. Natural gas production (accounting for 65% of the total output) totaled 208 Bcf, higher than our estimate of 207 Bcf.

Oil production in the quarter amounted to 918 thousand barrels (MBbls), up 14% from 804 MBbls registered in the year-ago period.

AR reported production of 6,696 MBbls of C2 Ethane, up 34% from 5,010 MBbls recorded a year ago. Our estimate for the same was pinned at 6,685 MBbls. The company’s output of 10,977 MBbls of C3+ NGLs was 10% higher than 9,950 MBbls reported in the year-ago period. The figure also came in higher than our estimate of 10,381 MBbls.

Realized Prices (Excluding Derivative Settlements)

Weighted natural-gas-equivalent price realization in the quarter was $3.32 per thousand cubic feet equivalent (Mcfe), lower than the year-ago quarter’s figure of $8.23. Our estimate for the same was pegged at $3.08 Mcfe. Realized prices for natural gas declined 71% to $2.48 per Mcf from $8.69 recorded a year ago. The figure was also lower than our estimate of $2.82 per Mcf.

The company’s oil price realization in the quarter was $68.22 per barrel (Bbl), down 18% from $83.41 registered a year ago. The figure was also lower than our estimate of $69.92 per Bbl. The realized price for C3+ NGLs declined to $36.81 per Bbl from $50.61. The realized price for C2 Ethane decreased 50% to $11.73 per Bbl from $23.40 recorded a year ago. The figure was lower than our estimate of $15.45 per Bbl.

Operating Expenses

Total operating expenses decreased to $1,070.4 million from $1,290.5 million reported in the year-ago period. Our estimate for the same was pinned at $1,028.3 million.

However, the average lease operating cost was 10 cents per Mcfe, up 11% from 9 cents recorded in the year-ago period. The gathering and compression costs decreased 16% year over year to 68 cents per Mcfe.

Transportation expenses declined 25% from the prior-year quarter’s level to 60 cents per Mcfe, while processing costs increased 1% to 83 cents per Mcfe during the same time frame.

Capex & Financials

In the third quarter, Antero spent $231 million on drilling and completion operations. As of Sep 30, 2023, it had no cash and cash equivalents. It had a long-term debt of $1.61 billion as of the same date.

Guidance

For 2023, Antero raised its projection for net daily natural gas-equivalent production to the range of 3.39-3.41 Bcfe/d. The company also anticipated a decline in realized natural gas price to flat to NYMEX Henry Hub. It decreased the high end of its cash production expense guidance by $0.05 per Mcfe to $2.35-$2.40. The company also lowered the projected net marketing expense to a range of $0.05-$0.07 per Mcfe.

Zacks Rank & Stocks to Consider

Currently, Antero carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy sector are Liberty Energy Inc. LBRT and Matador Resources Company MTDR, both currently sporting a Zacks Rank #1 (Strong Buy), and APA Corporation APA carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty reported third-quarter 2023 earnings of 85 cents per share, which beat the Zacks Consensus Estimate of 74 cents. The Denver-CO-based oil and gas equipment company’s outperformance reflects the impacts of strong execution and increased service pricing.

Liberty’s board of directors announced a cash dividend of 7 cents per common share, payable on Dec 20, 2023, to stockholders of record as of Dec 6, 2023. The dividend increased 40% from the previous quarter’s level.

Matador Resources reported third-quarter 2023 adjusted earnings of $1.86 per share, which beat the Zacks Consensus Estimate of $1.59. MTDR’s milestone led to better-than-expected third-quarter results, with the highest-ever total production averaging more than 135,000 barrels of oil and natural gas equivalent per day.

For the fourth quarter of 2023, MTDR expects an average daily oil equivalent production of 145,000 BOE. The recent guidance indicates a 2% upward revision from the previously mentioned 143,000 BOE/D.

APA released supplemental information regarding its financial and operational results for the third quarter of 2023. The company anticipates its quarterly total adjusted production and adjusted oil production to be in the upper half of its guidance range. This can be mainly attributed to strong Permian oil and U.K. North Sea volumes.

The company expects its adjusted production and adjusted oil production figures to fall within the upper half of its guided range. It anticipates adjusted production of 337-339 Mboe/d and adjusted oil production of 159-161 Mboe/d. APA is scheduled to release third-quarter results on Nov 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

APA Corporation (APA) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report