Antero Midstream Corp (AM) Announces Q4 Earnings and Launches $500 Million Share Repurchase Program

Net Income: Reported $100 million for Q4 2023, a 24% per share increase year-over-year.

Adjusted EBITDA: Increased by 10% to $254 million in Q4 2023 compared to the prior year quarter.

Free Cash Flow: Free Cash Flow after dividends saw a 500% increase to $48 million in Q4 2023.

2024 Guidance: Expects Net Income of $405 to $445 million and Adjusted EBITDA of $1,020 to $1,060 million.

Share Repurchase Program: Authorized a $500 million program, representing about 9% of market capitalization.

Capital Expenditures: Forecasted at $150 to $170 million for 2024, a 14% decrease from 2023.

On February 14, 2024, Antero Midstream Corp (NYSE:AM) released its 8-K filing, detailing its financial and operational results for the fourth quarter of 2023 and providing guidance for 2024. The company, a key player in midstream energy infrastructure services in the Appalachian Basin, also announced a significant $500 million share repurchase program.

Financial Highlights and Performance

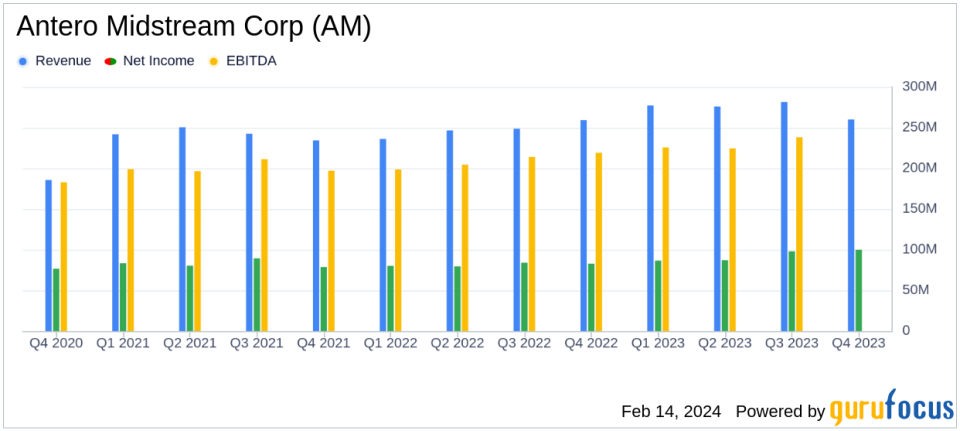

Antero Midstream reported a robust quarter with a 24% increase in Net Income per share compared to the same quarter in the previous year, reaching $100 million or $0.21 per diluted share. Adjusted EBITDA also saw a healthy 10% increase to $254 million, reflecting the company's operational efficiency and throughput growth. The company's Free Cash Flow after dividends experienced a significant surge, increasing by 500% to $48 million for the quarter.

The company's financial achievements are particularly noteworthy in the context of the Oil & Gas industry, where efficient capital allocation and operational excellence are critical for generating shareholder value. Antero Midstream's focus on high-return, high-visibility capital projects has been a cornerstone of its strategy, as evidenced by the 18% Return on Invested Capital in 2023.

Operational Updates and 2024 Outlook

Operationally, Antero Midstream connected 21 wells to its gathering system and serviced 15 well completions with its water delivery systems in Q4 2023. Looking ahead, the company has provided guidance for 2024, forecasting Net Income of $405 to $445 million and Adjusted EBITDA of $1,020 to $1,060 million. This guidance reflects a 5% increase in Adjusted EBITDA at the midpoint, driven by the expiration of a low pressure gathering fee rebate program and inflation adjustments to fixed fees.

Antero Midstream's capital budget for 2024 is set at $150 to $170 million, marking a 14% decrease from 2023. The company plans to focus its capital expenditures primarily in the Marcellus Shale liquids-rich midstream corridor, with a significant portion of the budget allocated to gathering and compression infrastructure.

Strategic Share Repurchase Program

The newly authorized $500 million share repurchase program underscores Antero Midstream's commitment to returning value to shareholders. The program is designed to be flexible, allowing the company to repurchase shares opportunistically, and is expected to complement the stable dividend policy currently in place.

Financial Statements and Tables

The earnings release includes detailed financial statements, such as the Consolidated Balance Sheets, Consolidated Statements of Operations and Comprehensive Income, Selected Operating Data, and Consolidated Statements of Cash Flows. These documents provide a comprehensive view of the company's financial position as of December 31, 2023.

Antero Midstream's financial and operational achievements in Q4 2023, coupled with its strategic outlook for 2024 and proactive shareholder return initiatives, position the company as a compelling investment opportunity for value investors interested in the midstream oil and gas sector.

For more detailed information on Antero Midstream's financial results and operational updates, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Antero Midstream Corp for further details.

This article first appeared on GuruFocus.