Antero Resources Corp (AR) Reports Fourth Quarter 2023 Results and Provides 2024 Outlook

Net Production: Averaged 3.4 Bcfe/d in Q4 2023, with 190 MBbl/d of liquids.

Realized Prices: Natural gas price before hedging was $2.72 per Mcf, a $0.16 per Mcf discount to NYMEX Henry Hub.

Capital Expenditures: Drilling and completion capital expenditures were $164 million in Q4 2023.

Proved Reserves: Increased to 18.1 Tcfe at year-end 2023, up 2% from the prior year.

2024 Guidance: Drilling and completion capital budget set at $650 to $700 million, with net production expected to average between 3.3 and 3.4 Bcfe/d.

Free Cash Flow: $90 million in Q4 2023 before changes in working capital.

Leverage to NGL Prices: NGL prices up over 15%, boosting the 2024 outlook.

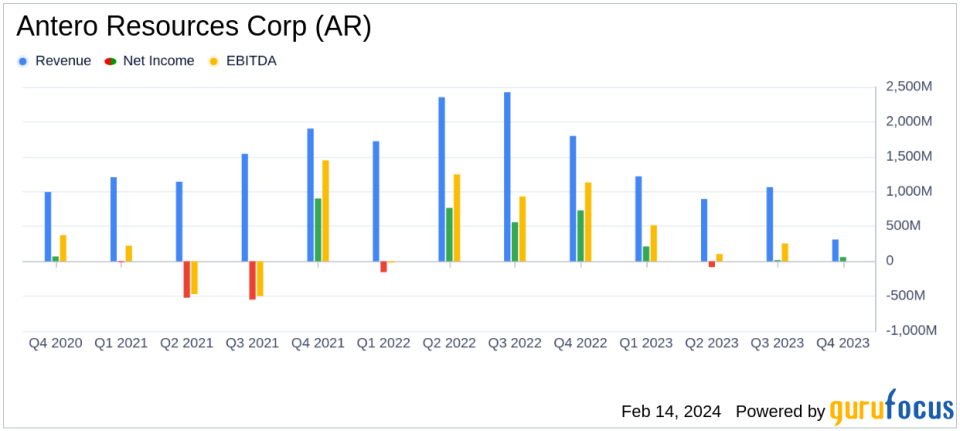

On February 14, 2024, Antero Resources Corp (NYSE:AR) released its 8-K filing, announcing its fourth quarter 2023 financial and operating results, year-end 2023 estimated proved reserves, and 2024 guidance. The Denver-based company, which specializes in the exploration and production of natural gas and natural gas liquids, reported a year-end reserve of 17.8 trillion cubic feet of natural gas equivalent and an average daily production of 3,205 million cubic feet of equivalent in 2022.

Financial and Operational Performance

Antero Resources highlighted significant capital efficiency improvements throughout 2023, with faster cycle times in its development program leading to a reduction in maintenance capital for 2024. Chairman and CEO Paul Rady emphasized the company's readiness to meet the demand surge expected from the second wave of LNG export facility buildouts. CFO Michael Kennedy pointed out that the capital efficiency gains and a lower base decline rate have led to a nearly 30% reduction in the total maintenance capital budget for 2024 compared to the previous year.

2024 Guidance and Capital Budget

Antero Resources' 2024 drilling and completion capital budget is projected to be between $650 to $700 million, with net production expected to average between 3.3 and 3.4 Bcfe/d. The company plans to focus on its organic leasing program to extend its premium drilling locations in the Marcellus liquids-rich fairway. The land capital guidance is set at $75 million to $100 million, down 41% from the prior year.

Free Cash Flow and Capital Investment

During the fourth quarter of 2023, Antero Resources generated $90 million in Free Cash Flow before changes in working capital. The company's drilling and completion capital expenditures for the quarter were $164 million, with an additional $14 million invested in land.

Year-End Proved Reserves and Production Highlights

Antero Resources' estimated proved reserves increased to 18.1 Tcfe at the end of 2023, with proved developed reserves growing by 3% over the prior year. The company placed 14 Marcellus wells and 7 Utica wells to sales during the fourth quarter, with an average lateral length of 15,500 feet.

The company's average realized natural gas price before hedging was $2.72 per Mcf, and its average realized C3+ NGL price was $37.72 per barrel. All-in cash expense decreased by 6% compared to the fourth quarter of 2022, due to lower production tax and transportation expense.

Market Position and Outlook

Antero Resources is well-positioned to benefit from the anticipated demand increase in natural gas due to its extensive firm transportation portfolio. The company's focus on capital efficiency and reduced maintenance capital is expected to generate significant free cash flow in 2024, despite a challenging natural gas strip.

For a detailed analysis of Antero Resources Corp's financial statements and further commentary on the company's performance, please refer to the full 8-K filing.

For more information and updates on Antero Resources Corp (NYSE:AR) and other value investing opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Antero Resources Corp for further details.

This article first appeared on GuruFocus.