AON & Cover Whale Partner to Improve Trucking Insurance Access

Aon plc AON recently announced its partnership with Cover Whale to expand trucking insurance offerings. Cover Whale Insurance Solutions is a provider of commercial trucking insurance and a growing insurtech. CoverWallet is AON’s digital insurance platform for small business owners seeking insurance policies.

This move bodes well for AON’s insurance brokerage business which experienced an organic revenue growth of 5% year over year in the second quarter. More commissions earned will increase the company’s top line in the future. This collaboration will benefit from Cover Whale’s trucking insurance capacity and CoverWallet’s expertise in the distribution of policies. Trucking customers will benefit from more insurance policies, advanced telematics and proprietary binding and quoting technology offered by Cover Whale. This will aid AON in catering to this underserved segment in the insurance market.

Cover Wallet is expected to improve Cover Whale’s visibility and help expand the reach of its insurance policies to more drivers and fleets in the United States. Truckers will be able to get customizable coverage quickly and increase their earnings. They can find policies designed for their industry within one platform. AON aims to provide innovative solutions to help them make better decisions regarding their insurance coverage.

This partnership marks the first step toward achieving the goal of technological innovation and better customer-centric services. The company aims to deliver mid-single-digit or higher organic revenue growth for 2023. Moves like this should lend a hand in achieving its long-term growth objectives. Moreover, catering to the underserved market will help the company win and retain more customers.

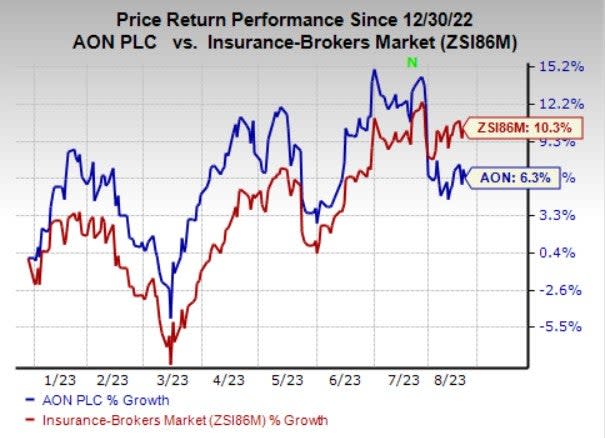

Price Performance

Shares of Aon have gained 6.3% year to date compared with the industry’s rise of 10.3%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Aon currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Brokerage Insurance space are Brown & Brown, Inc. BRO, Ryan Specialty Holdings, Inc. RYAN and Marsh & McLennan Companies MMC. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Brown & Brown 2023 and 2024 earnings per share (EPS) is pegged at $2.69 and $2.94, indicating a year-over-year increase of 18% and 9.3%, respectively. In the year-to-date period, BRO has gained 25.1%.

BRO beat estimates in three of the last four quarters and missed once, the average being 4%.

Ryan Specialty has a decent track record of beating earnings estimates in two of the last four quarters, meeting once and missing the other time, the average being 2.4%. In the year-to-date period, RYAN has gained 7.2%.

The Zacks Consensus Estimate for Ryan Specialty 2023 and 2024 EPS is pegged at $1.39 and $1.68, indicating a year-over-year increase of 20.9% for each year.

Marsh & McLennan Companies’ bottom line outpaced estimates in each of the trailing four quarters, the average being 3.4%. The Zacks Consensus Estimate for MMC’s 2023 earnings indicates a 12.6% rise, while the same for revenues suggests 7.8% growth from the respective prior-year reported figures. The consensus mark for MMC’s 2023 earnings has moved 0.1% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ryan Specialty Holdings Inc. (RYAN) : Free Stock Analysis Report