Apartment Income REIT Corp (AIRC) Reports Mixed Results Amidst Growth and Repurchases

Net Income: Q4 net loss of $0.11 per share, full year net income down 26.5%.

Revenue Growth: Full year Same Store Revenue up 7.9%.

NOI and FCF: Net Operating Income (NOI) and Free Cash Flow (FCF) margins hit all-time highs.

Share Repurchases: 2.1 million shares repurchased in Q4; 13.4 million shares since year-end 2021.

2024 Guidance: Run-Rate FFO per share expected to increase by 0.8% at the midpoint.

Leverage and Liquidity: Year-end Net Leverage to Adjusted EBITDAre of approximately 6.0x, with $1.9 billion in available liquidity.

On February 8, 2024, Apartment Income REIT Corp (NYSE:AIRC) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, which owns a portfolio of 73 apartment communities with over 25,000 units, focuses on high-quality properties in key urban and suburban submarkets across the United States.

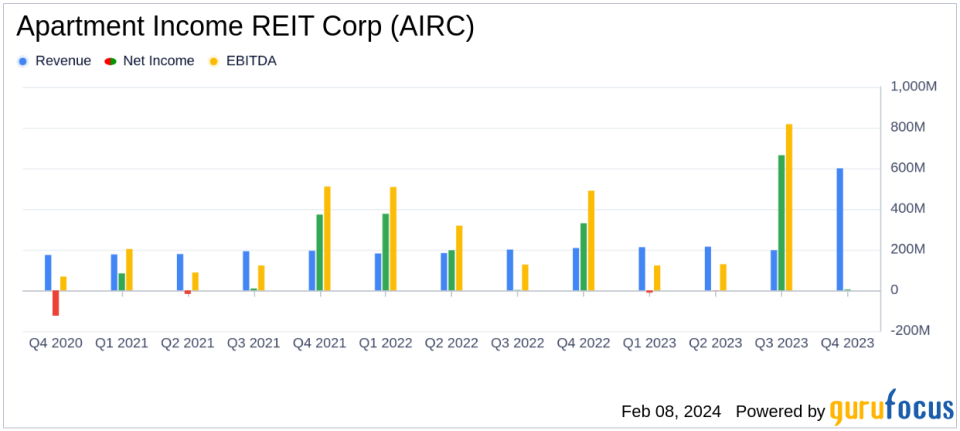

AIRC's full year performance showcased robust growth with Same Store Revenue, NOI, and FCF increasing by 7.9%, 9.3%, and 9.5%, respectively. However, the fourth quarter saw a net loss of $0.11 per share, a stark contrast to the $2.17 per share reported in the same quarter of the previous year. Despite this, the company's full year net income decreased by 26.5% compared to 2022.

Financial Achievements and Challenges

The company's financial achievements include a significant increase in NOI and FCF margins, which reached all-time highs, indicating efficient operations and strong underlying property performance. The full year Run-Rate FFO and AFFO per share also saw healthy increases of 7.8% and 7.7%, respectively. These achievements are particularly important for a REIT like AIRC, as they reflect the company's ability to generate sustainable cash flows from its real estate assets, a key metric for investors in the sector.

However, AIRC faced challenges in the fourth quarter, reporting a net loss which could signal potential issues. The net loss was primarily due to a significant variance in net income year-over-year. The company's CEO, Terry Considine, commented on the performance, stating:

AIR's operating performance in 2023 was excellent the highest in our peer group. We improved our portfolio with co-investment from two of the most respected global property investors. In 2024, we will continue to focus on driving predictable growth in recurring free cash flow attracting high quality residents, and retaining them with great service from productive and caring teammates. As ever, we expect to improve in operations, portfolio quality, operating scale, operating margins and quality of earnings, all with a safe balance sheet and a focus on higher free cash flow and NAV growth per share.

Key Financial Metrics

Important metrics from the Income Statement include a 4.6% increase in NAREIT Funds From Operations (FFO) for the full year, despite a 20.7% decrease in the fourth quarter. The Balance Sheet reflects a strong liquidity position with $1.9 billion available at year-end, and a Net Leverage to Adjusted EBITDAre of approximately 6.0x, indicating a solid financial structure.

The Cash Flow Statement highlights the company's commitment to returning value to shareholders through share repurchases, with $71 million spent on buybacks in the fourth quarter at an average price of $34.39 per share. This strategy not only reflects confidence in the company's value proposition but also serves to enhance shareholder value over time.

2024 Outlook and Analysis

Looking ahead to 2024, AIRC has provided guidance that includes a continued focus on steady growth in unlevered FCF, with a range of 2.0% to 5.6% expected Same Store NOI growth and 2.3% to 6.3% expected Same Store FCF growth. The company anticipates Run-Rate FFO per share to be between $2.33 and $2.43, reflecting a modest increase over the 2023 Run-Rate FFO per share of $2.36.

The company's performance in 2023, particularly the growth in NOI and FCF, positions it well for the coming year. However, the net loss in the fourth quarter and the modest guidance for 2024 suggest that there may be headwinds facing the company. Investors will be watching closely to see if AIRC can continue to drive growth and manage expenses effectively in a challenging economic environment.

For more detailed information on AIRC's financial performance and future outlook, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Apartment Income REIT Corp for further details.

This article first appeared on GuruFocus.