Apellis' (APLS) Empaveli Injector Gets FDA Nod for PNH

Apellis Pharmaceuticals APLS announced that its Empaveli (pegcetacoplan) Injector was approved by the FDA as a single use, on-body device to enhance self-administration. The drug was approved for paroxysmal nocturnal hemoglobinuria (PNH) by the FDA in 2021.

Empaveli is also approved in Europe under the brand name Aspaveli for the treatment of adult patients with PNH.

The injector aims to provide patients with greater mobility and convenience in managing PNH. The Empaveli Injector is the first of its kind, offering a high-volume (20ml), subcutaneous on-body drug delivery system that can simplify the process of self-administration.

PNH is a rareand life-threatening blood disorder, associated with abnormally low hemoglobin levels since the disease destroys red blood cells. The disorder leads to anemia, fatigue and increased susceptibility to infections.

Since its launch, Empaveli continues to be one of the growth drivers for Apellis. The drug generated revenues of almost $42.7 million in the first half of 2023.

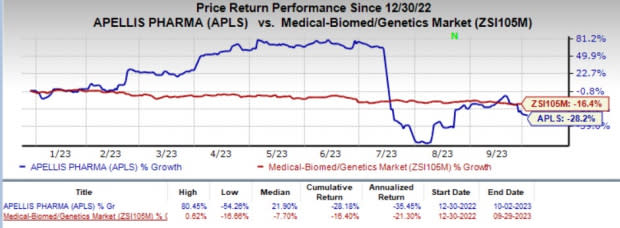

APLS’ shares have lost 28.2% year to date compared with the industry's 16.4% decline.

Image Source: Zacks Investment Research

The other drug in the company’s portfolio is Syfovre, the first and only approved treatment for geographic atrophy secondary to age-related macular degeneration. The drug is witnessing a robust initial uptake since its launch in March 2023 in the United States.

However, the drug is facing some safety concerns. The company received reports of retinal vasculitis (or inflammation) following treatment with the injection in July.

Apellis, along with the American Society of Retina Specialists' Research and Safety in Therapeutics (ReST), examined the reported cases. These events occurred between seven and 13 days after the initial administration of the drug, with no specific lots implicated.

APLS partnered with ReST and has been closely monitoring and investigating the occurrences of retinal vasculitis. It updated the number of confirmed adverse events to eight (five occlusive and three non-occlusive). Two of these events followed injections in April, three in May and three in June. All these events occurred after the initial administration of Syfovre.

Last month, Apellis announced its plans to start a comprehensive corporate restructuring policy to strengthen growth of its two key products — Empaveli and Syfovre — and curb cash burn. To achieve these objectives, Apellis will reduce its existing workforce by about 25% (around 225 employees), which is expected to result in up to $300 million in total cost savings through 2024.

Apellis Pharmaceuticals, Inc. Price and Consensus

Apellis Pharmaceuticals, Inc. price-consensus-chart | Apellis Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Buy).

Some better-ranked stocks in the same industry are Anika Therapeutics ANIK, Annovis Bio ANVS and Corcept Therapeutics CORT. While Anika Therapeutics currently sports a Zacks Rank #1 (Strong Buy), both Annovis Bio and Corcept Therapeutics carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 90 days, the Zacks Consensus Estimate forAnika Therapeutics has narrowed from a loss of $1.41 per share to a loss of $1.24 for 2023. The bottom-line estimate has widened from a loss of 79 cents to a loss of 82 cents for 2024 during the same time frame. Shares of the company have lost 36.8% year to date.

ANIK’s earnings beat estimates in one of the trailing four quarters and missed the mark in the remaining three, delivering an average negative surprise of 32.12%.

In the past 90 days, the Zacks Consensus Estimate for Annovis Bio has narrowed from a loss of $4.89 per share to a loss of $4.38 for 2023. The bottom-line estimate has narrowed from a loss of $3.18 to a loss of $2.77 for 2024 during the same time frame. Shares of the company have lost 32.2% year to date.

ANVS’ earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 13.40%.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings has gone up from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 29.4% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Anika Therapeutics Inc. (ANIK) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report