Apellis (APLS) Updates on Safety Concerns for Syfovre

Apellis Pharmaceuticals APLS issued an update regarding the injection kits associated with Syfovre (pegcetacoplan injection), as well as the occurrence of rare cases of retinal vasculitis in real-world treatment with Syfovre. Shares of the company were up on Tuesday in after market following the update.

Syfovre was approved for the treatment of geographic atrophy (GA) secondary to age-related macular degeneration (AMD) by the FDA on Feb 17, 2023.

In July, Apellis received six reports of retinal vasculitis (or inflammation) following treatment with Syfovre. The company examined these cases along with the American Society of Retina Specialists' (ASRS) Research and Safety in Therapeutics (ReST). These events occurred between seven and 13 days after the initial administration of the drug with no specific lots implicated.

Apellis partnered with ReST and has been closely monitoring and investigating the occurrences of retinal vasculitis. The company updated the number of confirmed adverse events to eight (five occlusive and three non-occlusive). Two of these events followed injections in April, three in May and three in June.

The most recent confirmed event (occlusive) occurred on Jun 20, based on an analysis of adverse events reported to the company. All these events occurred after the initial administration of Syfovre.

To date, the company has distributed more than 100,000 vials of Syfovrefor both commercial use and administration in clinical studies. Per the company, the events of retinal vasculitis remain extremely rare, occurring atan estimated rate of 0.01% per injection, or approximately 1 in 10,000 injections.Per the company, approximately 78,000 vials of Syfovre have been distributed since approval. In addition, there were no instances of retinal vasculitis reported during the clinical studies, which involved more than 23,000 injections.

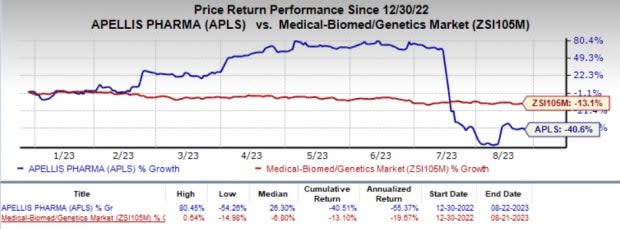

Shares of Apellis have plunged 40.6% year to date compared with the industry’s 13.1% decline.

Image Source: Zacks Investment Research

During the comprehensive investigation, Apellis discovered structural variation in 19-gauge x 1½ inch filter needles in some injection kits. These filter needles play a crucial role in withdrawing medication from vials during the preparation of injection procedures. However, we note that no definitive causal relationship has been established between these structural variations in the filter needle and occurrence of rare events of retinal vasculitis in the real world.

However, as a precautionary measure, Apellis recommends healthcare practitioners to not use injection kits containing the 19-gauge filter needle and switch to kits equipped with the 18-gauge filter needle, which are already in distribution.

The company is seeking to launch Syfovre in additional geographies. A regulatory application seeking approval of pegcetacoplan for the same indication as in the United States is currently under review in Europe and several other countries. A decision regarding the same from the European Medicines Agency is expected in early 2024, while those from regulatory bodies in other countries are expected in the first half of 2024.

The successful approval and launch in additional geographies will add an incremental stream of revenues to APLS. Syfovre generated revenues of almost $85.7 million in the first half of 2023.

Apellis Pharmaceuticals, Inc. Price and Consensus

Apellis Pharmaceuticals, Inc. price-consensus-chart | Apellis Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Apellis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same industry are Emergent Biosolutions EBS, Annovis Bio ANVS and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for Emergent Biosolutions has narrowed from a loss of $1.42 per share to a loss of $1.35 for 2023. The bottom-line estimate has gone down from $1.79 to $1.06 for 2024 during the same time frame. Shares of the company have lost 62.1% year to date.

EBS’ earnings missed estimates in each of the trailing four quarters, delivering an average negative surprise of 577.88%.

In the past 90 days, the Zacks Consensus Estimate for Annovis Bio has narrowed from a loss of $4.89 per share to a loss of $4.38 for 2023. The bottom-line estimate has narrowed from a loss of $3.18 to $2.77 for 2024 during the same time frame. Shares of the company have lost 4.0% year to date.

ANVS’ earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 13.40%.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings has gone up from 66 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 64 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 56.1% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report