Apexigen (APGN) to Get Acquired by Pyxis Oncology, Stock Up

Apexigen APGN announced its definitive agreement to be acquired by Pyxis Oncology PYXS, a company focused on developing innovative solutions for challenging cancers.

The acquisition will be an all-stock transaction, under which Pyxis Oncology will take over Apexigen for an implied value of $0.64 APGN per share. This will amount to a total enterprise value of approximately $16 million. The acquisition is expected to close by mid-2023.

Shares of Apexigen surged almost 45% following the news. The same plunged 15% year to date compared with the industry’s 7.4% decline.

Image Source: Zacks Investment Research

APGN specializes in developing innovative antibody therapies for oncology with the use of its proprietary antibody platform, APXiMAB. Its lead product candidate, sotigalimab, is in a phase II study, and being developed for various cancer indications. The candidate is a humanized agonist antibody that targets and activates CD40 to stimulate an anti-tumor immune response.

Sotigalimab is currently being evaluated in an investigator-initiated phase II study in combination with doxorubicin dedifferentiated liposarcoma, a rare subtype of liposarcoma. It is also undergoing a phase II trial in combination with nivolumab in patients with PD-(L)1 blockade refractory melanoma.

Apexigen has discovered several preclinical and research-stage antibodies using its APXiMAB platform. It has out-licensed the antibody platform to advance candidates in clinical studies for different cancer indications.

Four such antibodies are currently under clinical development by Apexigen’s licensees. The first of these, Novartis’ NVO Beovu (brolucizumab-dbll) product, received FDA approval in 2019 for the treatment of neovascular (wet), age-related macular degeneration and diabetic macular edema.

Pyxis Oncology, through its strategic acquisition of Apexigen, aims at positioning itself as a leader in antibody-drug conjugate (ADC) innovation. It will do so by combining its flexible antibody conjugation technology ADC toolkit (acquired from Pfizer) with Apexigen's expertise in humanized antibody generation. PYXS has a robust portfolio in discovering and developing therapies for various cancer indications.

For each share of Apexigen, Pyxis Oncology will issue 0.1725 shares of its common stock, par value $0.001 per share, for a total enterprise value of approximately $16 million.

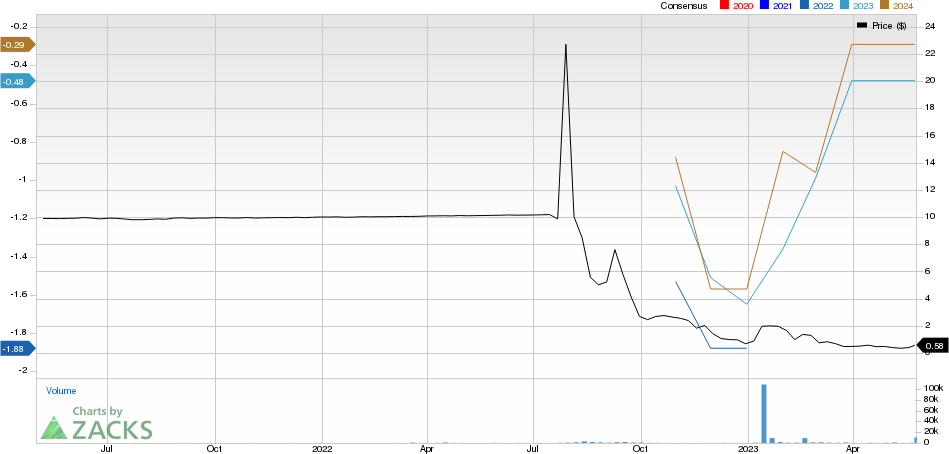

Apexigen, Inc. Price and Consensus

Apexigen, Inc. price-consensus-chart | Apexigen, Inc. Quote

Zacks Rank and Stock to Consider

Currently, Apexigen carries a Zacks Rank #3 (Hold).

A better-ranked stock in the same sector is ADMA Biologics ADMA, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Loss per estimates for ADMA have narrowed from 19 cents to 9 cents for 2023 in the past 60 days. Shares of ADMA have risen 3.9% in the year-to-date period.

ADMA Biologics’ earnings beat estimates in three of the trailing four quarters and met the mark in one, delivering an average surprise of 19.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Pyxis Oncology, Inc. (PYXS) : Free Stock Analysis Report

Apexigen, Inc. (APGN) : Free Stock Analysis Report