APi Group Corp (APG) Announces Record Financial Results and Strategic Initiatives

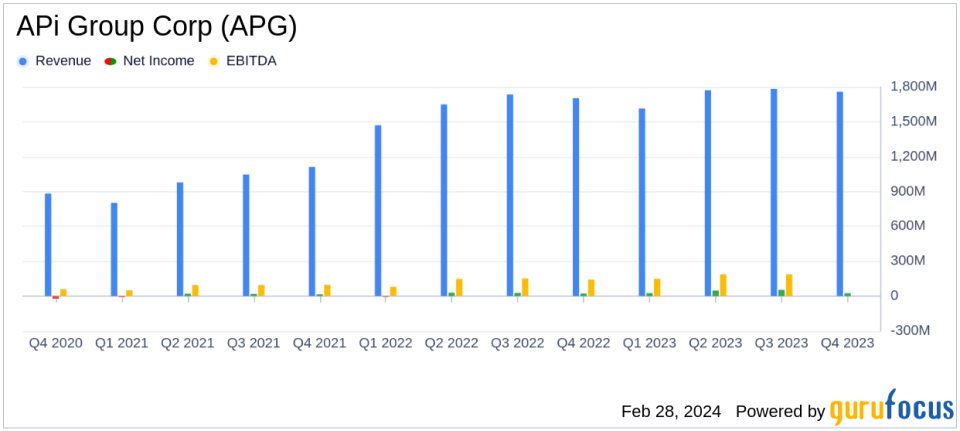

Net Revenues: Achieved record full year net revenues of $6.9 billion, a 5.6% increase year-over-year.

Net Income: Reported net income soared by 109.6% to $153 million for the full year.

Adjusted EBITDA: Grew by 16.2% to a record $782 million for the full year.

Adjusted Free Cash Flow Conversion: Reached 69% for the full year, with a net leverage ratio of 2.3x at year-end.

Share Repurchase Program: Announced a new $1 billion share repurchase program.

Series B Preferred Stock: Agreement to retire all outstanding Series B Preferred Stock from Blackstone and Viking.

On February 28, 2024, APi Group Corp (NYSE:APG) released its 8-K filing, detailing a year of record financial results and strategic advancements. APi Group Corp, a leading provider of safety services and specialty services, has reported significant growth in both its operating segments. The company's Safety Services segment, which includes integrated occupancy systems such as fire protection solutions, HVAC, and entry systems, and its Specialty Services segment, which focuses on infrastructure services and specialized industrial plant services, have both contributed to this year's success.

Financial Performance and Challenges

APi Group Corp's performance in 2023 was marked by a robust increase in net revenues, which reached $6.9 billion, representing approximately 6% reported growth and 5.5% organic growth. The company's net income grew by an impressive 110% to $153 million, while adjusted EBITDA increased by 16.2% to $782 million. This performance underscores the company's ability to grow and scale effectively, even in an evolving macroeconomic environment. However, challenges such as supply chain constraints, inflationary pressures, and geopolitical tensions could pose risks to future performance.

Financial Achievements and Industry Significance

The record financial achievements of APi Group Corp are particularly significant in the construction industry, where managing costs and maintaining growth are critical. The company's adjusted free cash flow conversion of 69% and a year-end net leverage ratio of 2.3x demonstrate strong financial health and operational efficiency. These metrics are vital for APi Group Corp as they provide the financial flexibility to pursue strategic initiatives, such as mergers and acquisitions, and to return value to shareholders through repurchase programs.

Key Financial Metrics

APi Group Corp's financial strength is further evidenced by its gross profit, which increased by 13.2% to $1.94 billion, and gross margin, which improved by 190 basis points to 28.0%. The company's operating income also saw a significant rise, with the Safety Services segment reporting a 54.7% increase to $396 million and the Specialty Services segment reporting an 11.3% increase to $108 million. These improvements in profitability metrics are crucial for APi Group Corp, as they reflect the company's ability to manage costs and enhance its service offerings effectively.

"2023 was a year of record financial results for APi. Our global team of 29,000 leaders delivered record net revenues, record adjusted EBITDA margins, and record adjusted free cash flow in an evolving macro environment," said Russ Becker, APis President and Chief Executive Officer.

Analysis of Company's Performance

APi Group Corp's strategic initiatives, including the retirement of Series B Preferred Stock and the announcement of a $1 billion share repurchase program, align with its goal of simplifying the capital structure and driving shareholder value. The company's focus on organic growth, margin expansion, and free cash flow generation positions it well for continued success in 2024. APi Group Corp's commitment to its "13/60/80" targets, which aim for adjusted EBITDA margins of 13% or more by 2025, reflects a clear strategy for sustainable growth.

For more detailed information on APi Group Corp's financial results and strategic initiatives, investors and interested parties are encouraged to review the full 8-K filing.

APi Group Corp's strong financial performance and strategic direction make it a company to watch for value investors and those interested in the construction industry's growth potential. Stay tuned to GuruFocus.com for further analysis and updates on APi Group Corp and other key players in the market.

Explore the complete 8-K earnings release (here) from APi Group Corp for further details.

This article first appeared on GuruFocus.