Apogee (APOG) Q2 Earnings Top Estimates, FY24 EPS View Rises

Apogee Enterprises, Inc. APOG reported record adjusted earnings per share (EPS) of $1.36 for second-quarter fiscal 2024 (ended Aug 26, 2023), surpassing the Zacks Consensus Estimate of $1.01 per share. The bottom line increased 28.3% from the prior-year quarter.

Including one-time items, earnings in the quarter under review were $1.52 per share compared with the $1.68 reported in the prior-year quarter.

Apogee generated revenues of $353.7 million in the quarter under review, down 5% from the year-ago quarter. This was mainly due to lower volumes in the Architectural Services and Architectural Framing Systems segments, which was partially offset by solid growth in the Architectural Glass segment. The top-line figure missed the Zacks Consensus Estimate of $367 million.

Operational Update

Cost of sales in the fiscal second quarter moved down 10.1% from the prior-year quarter to $258.3 million. The gross profit increased 12.3% from the prior-year quarter to $95.4 million. The gross margin expanded to 27.0% in the quarter under review from the prior-year quarter's 22.8%.

Selling, general and administrative (SG&A) expenses moved up 3.7% from the prior-year quarter to $54.8 million. The operating income rose 26.4% from the year-earlier quarter to $40.6 million. The operating margin in the reported quarter was 11.5% compared with the prior-year quarter's 8.6%.

Apogee Enterprises, Inc. Price, Consensus and EPS Surprise

Apogee Enterprises, Inc. price-consensus-eps-surprise-chart | Apogee Enterprises, Inc. Quote

Segmental Performance

In the fiscal second quarter, revenues in the Architectural Framing Systems segment were down 8.1% from the prior-year quarter to $159 million. We predicted the segment’s quarterly revenues to be $171 million. The segment's adjusted operating profit was $21 million compared with the year-ago quarter's $20.5 million. Our prediction for the segment’s operating profit was $19 million.

Revenues in the Architectural Glass segment improved 21.6% from the prior-year quarter to $94 million. Our prediction for the segment’s revenues was $85 million. The segment reported operating income of $17 million, up from $6.5 million in the second quarter of fiscal 2023. We predicted an adjusted operating income of $10 million for the quarter.

Revenues in the Architectural Services segment fell 17.5% from the prior-year quarter to $88 million. Our model estimated the segment’s revenues to be $100 million. The segment's operating profit declined 35.9% from the prior-year quarter to $3.5 million. We expected the operating profit to be $9 million.

Revenues in the Large-Scale Optical Technologies segment were down 6% from the prior-year quarter to $24 million. We projected revenues of $25 million for the quarter. The segment posted an operating profit of $5 million in the fiscal second quarter compared with the prior-year quarter's $6 million. Our estimate for the segment’s operating profit was $5.8 million.

Backlog

The Architectural Services segment's backlog came in at $674 million at the end of the second quarter of fiscal 2024 compared with $709 million at the end of the first quarter. The backlog in the Architectural Framing segment amounted to $197 million, down from $221 million at the end of first-quarter fiscal 2024.

Financial Position

Apogee had cash and cash equivalents of $18 million at the end of second-quarter fiscal 2024 compared with $20 million at the end of fiscal 2023. Cash provided by operating activities was $41.3 million in the quarter compared with the prior-year quarter’s $27.8 million.

Long-term debt was $145.7 million at the end of second-quarter fiscal 2024 compared with $169.8 million at the end of fiscal 2023.

Apogee returned $22.3 million in cash to its shareholders in the first half of fiscal 2024 through dividend payments and share repurchases.

FY24 Guidance

Apogee expects fiscal 2024 adjusted EPS between $4.35 and $4.65, up from the previously disclosed $4.15-$4.45. The company anticipates flat to modestly declining revenues from that reported in fiscal 2023. Management projects capital expenditure between $50 million and $60 million for fiscal 2024, and a long-term average tax rate of 24.5%.

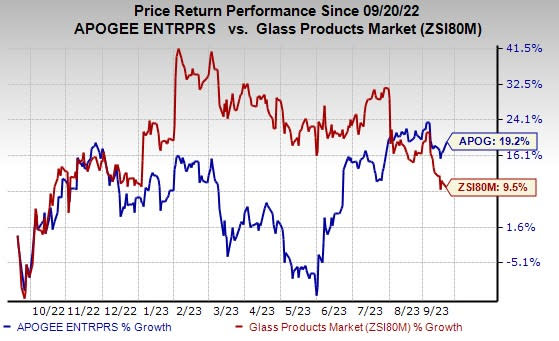

Price Performance

Shares of Apogee have gained 19.2% in the past year compared with the industry's growth of 9.5%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Apogee currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Industrial Products sector are Caterpillar Inc. CAT, Astec Industries, Inc. ASTE and Eaton Corporation plc. ETN. CAT and ASTE sport a Zacks Rank #1 (Strong Buy), and ETN has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved north by 11.4% in the past 60 days. Its shares gained 51.6% in the last year.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares gained 22.8% in the last year.

The Zacks Consensus Estimate for Eaton’s 2023 earnings per share is pegged at $8.80. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 3%. Shares of ETN rallied 68.8% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Apogee Enterprises, Inc. (APOG) : Free Stock Analysis Report