Apogee (APOG) to Report Q2 Earnings: What's in the Cards?

Apogee Enterprises, Inc. APOG is slated to release second-quarter fiscal 2024 results on Sept 19, before the opening bell.

Which Way Are Estimates Headed?

The Zacks Consensus Estimate for Apogee’s earnings per share is pegged at $1.01 for the fiscal second quarter, suggesting a fall of 4.7% from the prior-year quarter's reported figure. The consensus estimate has been unchanged over the past 60 days. The same for revenues is pegged at $366.5 million, indicating a 1.5% year-over-year decline.

Apogee Enterprises, Inc. Price and EPS Surprise

Apogee Enterprises, Inc. price-eps-surprise | Apogee Enterprises, Inc. Quote

Let’s see how things are shaping up for this announcement.

Factors at Play

Apogee’s fiscal second-quarter performance is likely to have benefited from the ongoing momentum in the Architectural Glass segment witnessed over the past three quarters. The impacts of improved pricing and product mix (reflecting the company’s strategic shift toward more premium products) are likely to get reflected in the segment’s top-line results in the quarter under review. Our model predicts the segment’s revenues to increase 9.7% year over year to $84.9 million.

The segment is also likely to have registered productivity gains from its Lean program. These gains, along with higher pricing, are expected to have helped offset inflation. We expect the segment’s adjusted operating income to grow 51.8% from the prior-year figure to $9.8 million.

The Architectural Framing Systems segment is expected to reflect gains from pricing actions and the benefits of completed restructuring and cost-saving actions. However, inflationary pressures, supply-chain disruptions and labor constraints are expected to have negatively impacted the segment’s performance.

We expect the segment’s quarterly revenues to be $171 million, suggesting a dip of 1% from the year-ago reported figure. Our model predicts Architectural Framing Systems’ adjusted operating income to be $18.8 million, indicating a year-over-year decline of 8.4%.

The Architectural Services segment's revenues are pegged at $100 million, indicating a year-over-year decline of 6.1%. The segment’s results will likely reflect the impacts of lower volumes from project executions. We predict the segment’s adjusted operating income to grow 55.9% year over year to $8.6 million.

The Large-Scale Optical segment’s results are likely to reflect lower volumes and customer inventory destocking. We predict net sales of $25.3 million, suggesting year-over-year growth of 0.5%. Our model predicts the segment's adjusted operating income to fall 2.7% to $5.8 million.

Earnings Whispers

Our proven model doesn’t conclusively predict an earnings beat for Apogee this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Apogee is 0.00%.

Zacks Rank: Apogee currently carries a Zacks Rank of 4 (Sell).

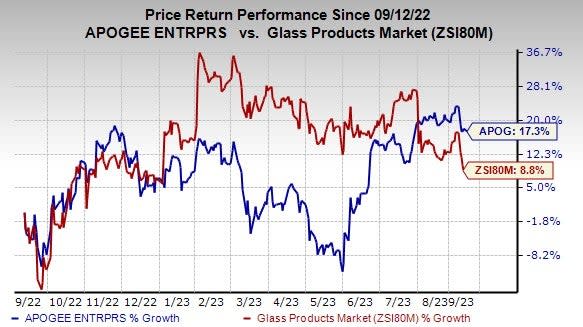

Price Performance

The company’s shares have gained 17.3% in the past year compared with the industry’s 8.8% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks that have the right combination of elements to post an earnings beat this quarter.

Cadre Holdings, Inc. CDRE is expected to release its third-quarter 2023 results on Nov 9. It has an Earnings ESP of +0.31% and sports a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for third-quarter earnings is pegged at 22 cents per share, suggesting growth of 69.2% from the prior-year quarter’s reported figure. It has a trailing four-quarter average surprise of 16.1%.

Eaton Corporation plc ETN, expected to release earnings on Nov 7, has an Earnings ESP of +0.65%.

The consensus estimate for Eaton’s earnings for the third quarter is pegged at $2.33 per share. ETN currently carries a Zacks Rank of 2. It has a trailing four-quarter average surprise of 3%

Deere & Company DE, expected to release earnings on Nov 22, has an Earnings ESP of +0.20% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Deere’s fiscal fourth-quarter earnings is pegged at $7.55 per share, suggesting a year-over-year improvement of 1.5%. It has a trailing four-quarter average surprise of 15.4%

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Apogee Enterprises, Inc. (APOG) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report