What's in the Offing for Huntsman (HUN) in Q3 Earnings?

Huntsman Corporation HUN is set to release third-quarter 2018 results before the opening bell on Oct 30.

Huntsman saw its profits surge more than three-fold year over year to $623 million or $1.71 per share in second-quarter 2018. Adjusted earnings of $1.01 per share for the quarter topped the Zacks Consensus Estimate of 87 cents.

Revenues went up around 17% year over year to $2,404 million, also beating the Zacks Consensus Estimate of $2,276 million. The results were driven by strong performance across the company's businesses.

Huntsman has outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering a positive average earnings surprise of 22.5%.

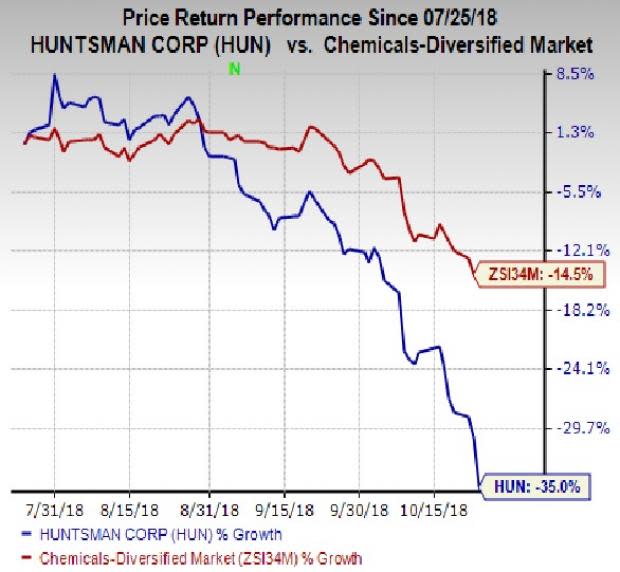

The company’s shares have lost around 35% over the past three months, underperforming the industry's decline of 14.5%.

Let's see how things are shaping up for this announcement.

Factors to Watch For

Huntsman, in its second-quarter call, stated that growth in its Polyurethanes business continues on the back of good supply and demand fundamentals. The company remains focused on executing opportunities in its downstream businesses while creating shareholder value.

Revenues for Huntsman for the third quarter is projected to rise roughly 3.2% year over year as the Zacks Consensus Estimate for the quarter is currently pegged at $2,239 million.

Revenues from Huntsman’s Polyurethanes segment is anticipated to witness a 6.9% rise year over year as the Zacks Consensus Estimate for the third quarter is pegged at $1,280 million.

Performance Products unit’s revenues are expected to increase 6% year over year as the Zacks Consensus Estimate for the third quarter is $531 million.

Revenues for the Advanced Materials segment are projected to rise 6.8% from the year-ago quarter as the Zacks Consensus Estimate for the third quarter stands at $281 million.

Moreover, the Textile Effects segment is expected to witness a 5.2% rise in revenues year over year as the Zacks Consensus Estimate is pegged at $203 million for the third quarter.

Huntsman remains committed to grow its downstream specialty and formulation businesses and is witnessing solid growth in these businesses. The company is seeing strong demand for MDI (methylene diphenyl diisocyanate) and the momentum is likely to continue in the third quarter. Substitution of MDI for less effective materials will remain a key driving factor. Huntsman expects its MDI Urethanes business to witness good volume growth year over year in the third quarter.

Moreover, Huntsman, earlier this year, acquired Demilec from an affiliate of Sun Capital Partners, Inc., for $350 million. Demilec is a leading manufacturer and distributor of spray polyurethane foam (SPF) insulation systems in North America. The acquisition is expected to contribute to volume growth in the third quarter.

Strength in derivatives businesses and favorable trends across key end-markets are also likely to support volume and margin growth in the Performance Products segment in the to-be-reported quarter. Moreover, growth in the specialty business is expected to drive results in the Advanced Materials unit. Growth in specialty and differentiated products and favorable global textile demand fundamentals should also support margins in the Textile Effects business.

However, Huntsman faces headwind from higher raw material costs as witnessed in the last reported quarter across some of its segments. Higher feedstock costs, partly due to stricter environmental policy in China, are expected to put some pressure on margins across Advanced Materials and Textile Effects segments in the third quarter.

Huntsman Corporation Price and EPS Surprise

Huntsman Corporation Price and EPS Surprise | Huntsman Corporation Quote

Earnings Whispers

Our proven model does not conclusively show that Huntsman is likely to beat the Zacks Consensus Estimate this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below:

Earnings ESP: Earnings ESP for Huntsman is currently pegged at -4.38%. This is because the Most Accurate Estimate stands at 80 cents while the Zacks Consensus Estimate is pegged at 84 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Huntsman currently carries a Zacks Rank #3, which when combined with a negative ESP, makes surprise prediction difficult.

Note that we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

CF Industries Holdings, Inc. CF has an Earnings ESP of +8.33% and carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Domtar Corporation UFS has an Earnings ESP of +1.32% and carries a Zacks Rank #2.

Arconic Inc. ARNC has an Earnings ESP of +6.42% and carries a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntsman Corporation (HUN) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Arconic Inc. (ARNC) : Free Stock Analysis Report

Domtar Corporation (UFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.