Here's Why Virtu Financial Is Down 14% Today

What happened

Shares of market-making and high-frequency trading firm Virtu Financial (NASDAQ: VIRT) are deep in the red today after the company reported second-quarter earnings. Obviously, the numbers just weren't what investors had been looking for, as the stock is off by more than 14% as of 10:45 a.m. EDT on Friday.

Specifically, analysts had been expecting earnings of $0.40 per share, but results fell $0.09 short of that mark. Alarmingly, the earnings miss happened despite a big revenue beat. The company's $328 million in revenue was roughly 20% higher than estimates called for.

Image source: Getty Images.

So what

Management said that market conditions in the second quarter were more challenging for the business than the first quarter. According to CEO Douglas Cifu:

Our second quarter results reflect an operating environment for our core wholesale market making operation that was markedly worse than the robust conditions we saw in the first quarter. In addition to declining volatility we saw reduced retail participation in the market.

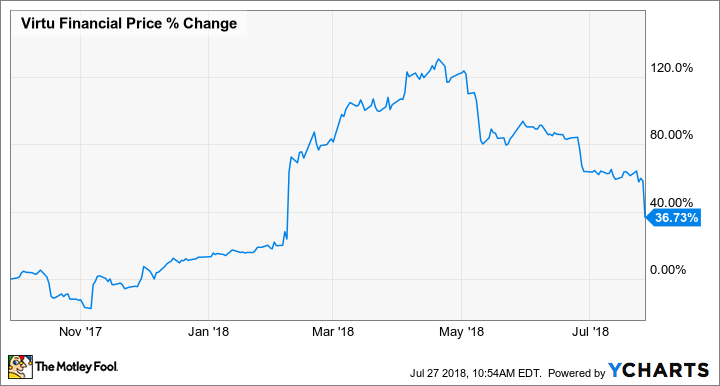

Another factor that could be adding to the downward move is that investor expectations have been high due to previous results. In fact, some of the company's recent results had been far stronger than expected, which makes this miss even more surprising. Before today's drop, Virtu had been up by 40% for 2018, so this could be some profit-taking from investors after a disappointing report.

Now what

One key point for Virtu investors to know is that post-earnings volatility is par for the course. Just look at the big spikes (both up and down) that seem to occur in the stock's price every three months:

The bottom line: Revenue from market making and trading activity is notoriously difficult to predict. This quarter, analysts got it wrong.

More From The Motley Fool

Matthew Frankel has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.