Apparel and Footwear Retail Stocks Q3 Results: Benchmarking Burlington (NYSE:BURL)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Burlington (NYSE:BURL), and the best and worst performers in the apparel and footwear retail group.

Apparel and footwear was once a category thought to be relatively safe from major e-commerce penetration because of the need to try on, touch, and feel products, but the category is now meaningfully transacted online. Everyone still needs clothes and shoes to go outside unless they want some curious (or horrified) looks. But this ongoing digitization is forcing apparel and footwear retailers–that once only had brick-and-mortar stores–to respond with omnichannel offerings. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stagnate, so the evolution of clothing and shoes sellers marches on.

The 18 apparel and footwear retail stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 1.8% while next quarter's revenue guidance was 2.1% above consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but apparel and footwear retail stocks held their ground better than others, with the share prices up 7.3% on average since the previous earnings results.

Burlington (NYSE:BURL)

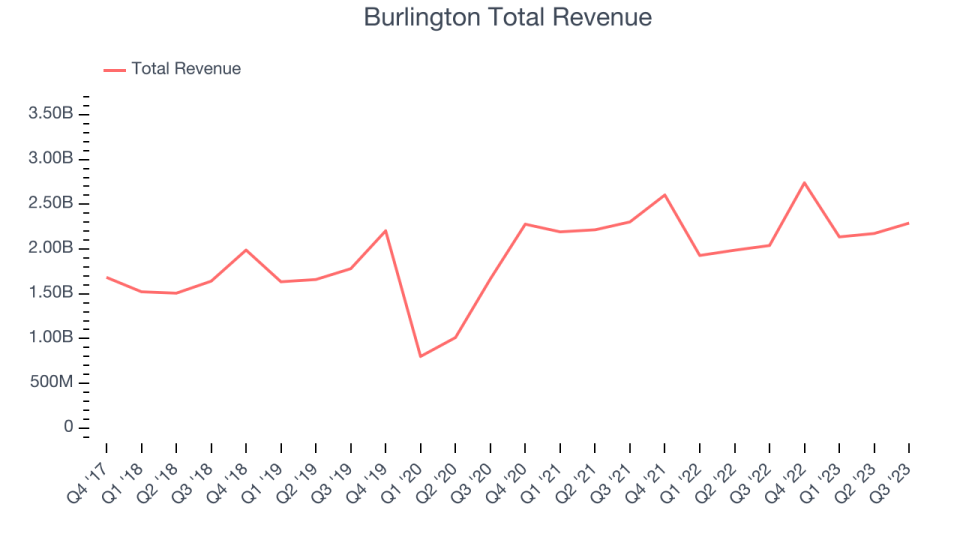

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE:BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Burlington reported revenues of $2.29 billion, up 12.2% year on year, falling short of analyst expectations by 0.3%. It was a slower quarter for the company, with underwhelming earnings guidance for the next quarter and the full year.

Michael O’Sullivan, CEO, stated, “We were pleased with our performance during the third quarter. We had a strong trend in August and September, and this drove 6% comparable store sales growth for the full quarter despite the negative impact of unseasonably warm weather in October. This trend together with strong merchandise margins delivered earnings at the high end of expectations.”

The stock is up 43.1% since the results and currently trades at $195.71.

Read our full report on Burlington here, it's free.

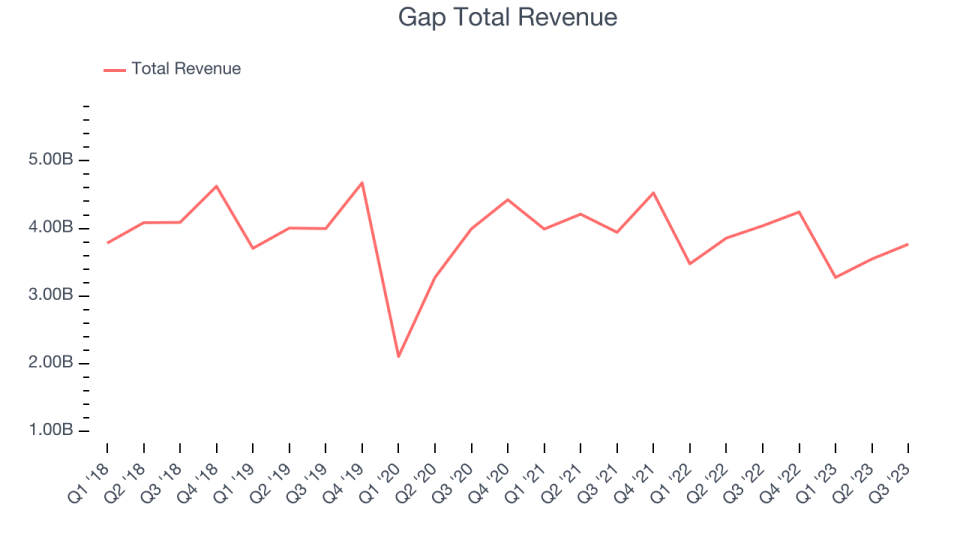

Best Q3: Gap (NYSE:GPS)

Operating under The Gap, Old Navy, Banana Republic, and Athleta brands, The Gap (NYSE:GPS) is an apparel and accessories retailer that sells its own brand of casual clothing to men, women, and children.

Gap reported revenues of $3.77 billion, down 6.7% year on year, outperforming analyst expectations by 4.4%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 35.7% since the results and currently trades at $18.53.

Is now the time to buy Gap? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Designer Brands (NYSE:DBI)

Founded in 1969 as a shoe importer and distributor, Designer Brands (NYSE:DBI) is an American discount retailer focused on footwear and accessories.

Designer Brands reported revenues of $786.3 million, down 9.1% year on year, falling short of analyst expectations by 4.4%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year.

Designer Brands had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 35.5% since the results and currently trades at $8.26.

Read our full analysis of Designer Brands's results here.

Children's Place (NASDAQ:PLCE)

Offering sizes up to young teens, The Children’s Place (NASDAQ:PLCE) is a specialty retailer that sells its own brands of kid’s apparel and accessories.

Children's Place reported revenues of $480.2 million, down 5.7% year on year, surpassing analyst expectations by 3.4%. It was a slower quarter for the company, with underwhelming earnings guidance for the full year.

The stock is down 23.4% since the results and currently trades at $21.92.

Read our full, actionable report on Children's Place here, it's free.

Foot Locker (NYSE:FL)

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE:FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

Foot Locker reported revenues of $1.99 billion, down 8.6% year on year, surpassing analyst expectations by 1.6%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates and optimistic earnings guidance for the full year.

The stock is up 10.7% since the results and currently trades at $26.4.

Read our full, actionable report on Foot Locker here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned