Apparel Retailer Stocks Q2 In Review: Children's Place (NASDAQ:PLCE) Vs Peers

As apparel retailer stocks’ Q2 earnings season wraps, let's dig into this quarter's best and worst performers, including Children's Place (NASDAQ:PLCE) and its peers.

Apparel sales are not driven so much by personal need but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 10 apparel retailer stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 1.9%, while on average next quarter revenue guidance was 1.53% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth, but apparel retailer stocks held their ground better than others, with the share prices up 4.8% since the previous earnings results, on average.

Children's Place (NASDAQ:PLCE)

Offering sizes up to young teens, The Children’s Place (NASDAQ:PLCE) is a specialty retailer that sells its own brands of kid’s apparel and accessories.

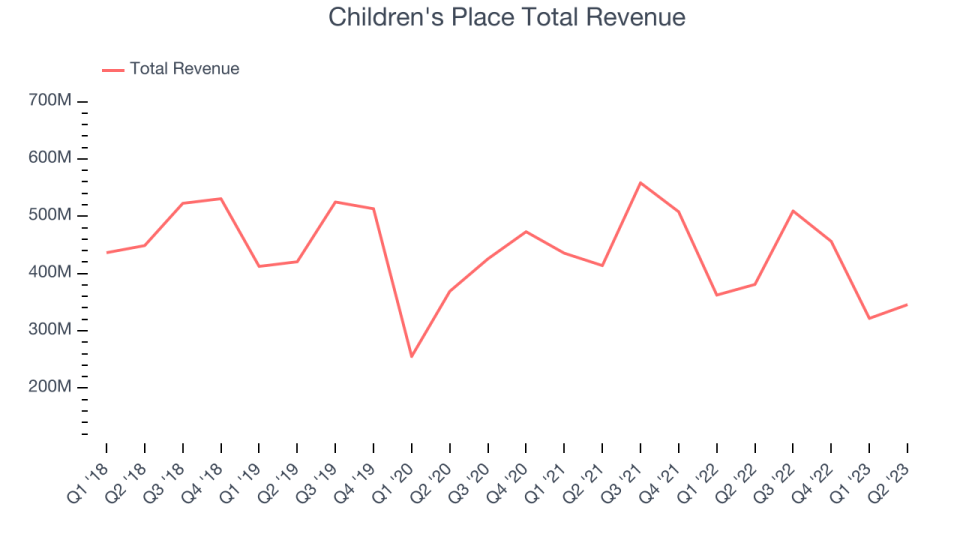

Children's Place reported revenues of $345.6 million, down 9.26% year on year, in line with analyst expectations. It was a strong quarter, with the company lifting its revenue guidance for the next quarter.

Children's Place scored the highest full year guidance raise of the whole group. The stock is down 9.5% since the results and currently trades at $24.

Read our full report on Children's Place here, it's free.

Best Q2: Abercrombie and Fitch (NYSE:ANF)

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE:ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

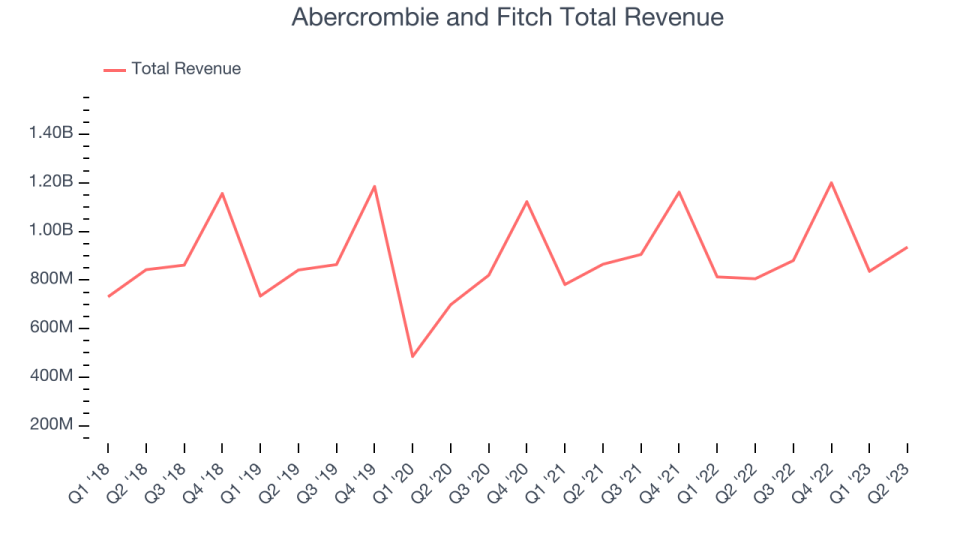

Abercrombie and Fitch reported revenues of $935.3 million, up 16.2% year on year, beating analyst expectations by 10.8%. It was a strong quarter for the company, with revenue and EPS exceeding expectations, driven by impressive sales growth at Abercrombie brands and a huge operating margin increase. On top of that, the company raised its full-year revenue guidance from 3% growth all the way up to 10% while changing its operating margin estimate from 5.5% to 8.5%.

Abercrombie and Fitch pulled off the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is up 50% since the results and currently trades at $61.75.

Is now the time to buy Abercrombie and Fitch? Access our full analysis of the earnings results here, it's free.

Chico's (NYSE:CHS)

With a style that ranges from casual to dressy, Chico’s FAS (NYSE:CHS) is a women’s apparel and accessories retailer that operates multiple brands.

Chico's reported revenues of $545.1 million, down 2.43% year on year, missing analyst expectations by 1.76%. It was a weak quarter for the company, with a miss of analysts' revenue estimates. The major negative was that the company reduced its full year revenue and EPS guidance. Next quarter's revenue and EPS guidance are also below expectations.

Chico's had the weakest performance against analyst estimates among the peers. The stock is up 45.5% since the results and currently trades at $7.45.

Read our full, actionable report on Chico's here, it's free.

Zumiez (NASDAQ:ZUMZ)

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ:ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Zumiez reported revenues of $194.4 million, down 11.6% year on year, beating analyst expectations by 2.25%. It was a weak quarter for the company, with revenue guidance for the next quarter below Wall Street's expectations. Management called out "continued headwinds facing consumer discretionary spending combined with a heightened promotional marketplace".

The stock is down 11.5% since the results and currently trades at $16.5.

Read our full, actionable report on Zumiez here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned