Apparel Retailer Stocks Q3 Recap: Benchmarking Abercrombie and Fitch (NYSE:ANF)

Earnings results often give us a good indication of what direction a company will take in the months ahead. With Q3 now behind us, let’s have a look at Abercrombie and Fitch (NYSE:ANF) and its peers.

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 9 apparel retailer stocks we track reported a strong Q3; on average, revenues beat analyst consensus estimates by 3.4% while next quarter's revenue guidance was 3.4% above consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but apparel retailer stocks held their ground better than others, with the share prices up 11.1% on average since the previous earnings results.

Abercrombie and Fitch (NYSE:ANF)

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE:ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

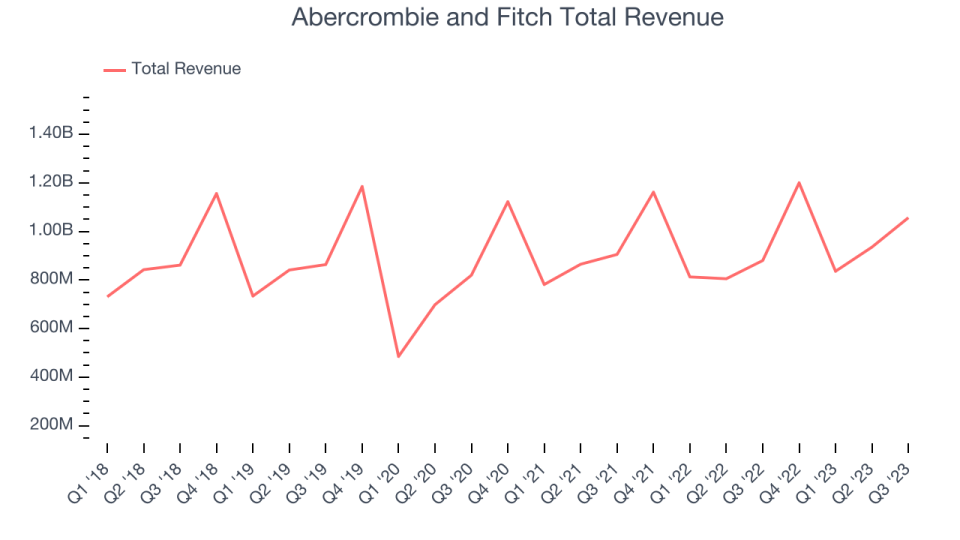

Abercrombie and Fitch reported revenues of $1.06 billion, up 20% year on year, topping analyst expectations by 7.7%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings and revenue estimates.

Fran Horowitz, Chief Executive Officer, said, “Our strong third quarter results, with net sales and operating margin well-exceeding our expectations, speak to the power of our playbook working globally across our brand portfolio. Net sales growth of 20% accelerated from the second quarter and was once again led by Abercrombie brands with exceptional growth of 30%. At Hollister brands, we had a solid back to school season, delivering 11% net sales growth for the quarter as our assortment and brand evolution is resonating with our teen customer. With strong product acceptance and tightly-controlled inventories across brands, we delivered gross profit rate expansion of 570 basis points to last year in addition to global sales growth. Operationally, we made investments in technology, marketing and our people while delivering strong year-over-year operating leverage resulting in an operating margin of 13.1% for the quarter.

Abercrombie and Fitch achieved the fastest revenue growth of the whole group. The stock is up 45.7% since the results and currently trades at $105.32.

Is now the time to buy Abercrombie and Fitch? Access our full analysis of the earnings results here, it's free.

Best Q3: Gap (NYSE:GPS)

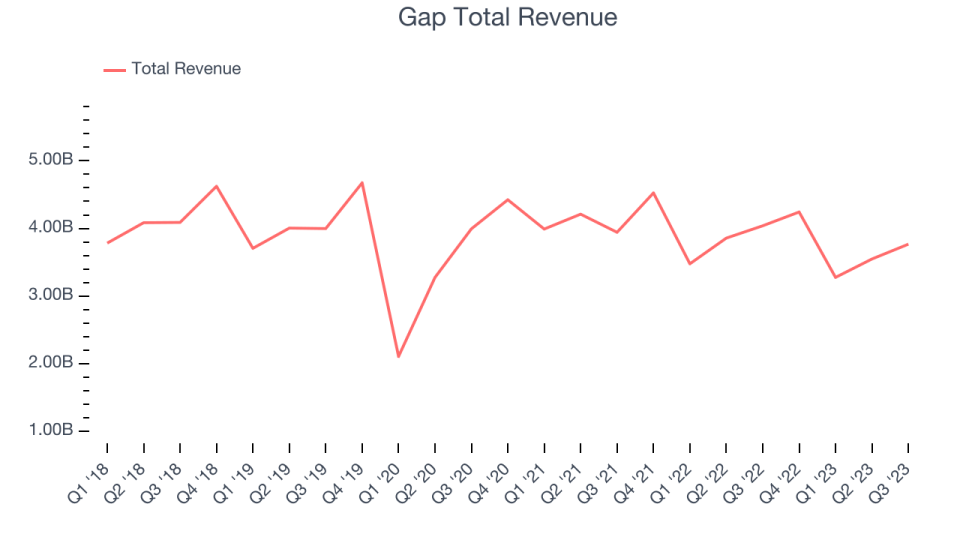

Operating under The Gap, Old Navy, Banana Republic, and Athleta brands, The Gap (NYSE:GPS) is an apparel and accessories retailer that sells its own brand of casual clothing to men, women, and children.

Gap reported revenues of $3.77 billion, down 6.7% year on year, outperforming analyst expectations by 4.4%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 41.4% since the results and currently trades at $19.32.

Is now the time to buy Gap? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Victoria's Secret (NYSE:VSCO)

Spun off from L Brands in 2020, Victoria’s Secret (NYSE:VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Victoria's Secret reported revenues of $1.27 billion, down 4% year on year, falling short of analyst expectations by 0.4%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year.

The stock is up 11.8% since the results and currently trades at $26.36.

Read our full analysis of Victoria's Secret's results here.

Children's Place (NASDAQ:PLCE)

Offering sizes up to young teens, The Children’s Place (NASDAQ:PLCE) is a specialty retailer that sells its own brands of kid’s apparel and accessories.

Children's Place reported revenues of $480.2 million, down 5.7% year on year, surpassing analyst expectations by 3.4%. It was a slower quarter for the company, with underwhelming earnings guidance for the full year.

Children's Place had the weakest full-year guidance update among its peers. The stock is down 19.6% since the results and currently trades at $23.

Read our full, actionable report on Children's Place here, it's free.

American Eagle (NYSE:AEO)

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

American Eagle reported revenues of $1.30 billion, up 4.9% year on year, surpassing analyst expectations by 1.6%. It was a mixed quarter for the company, with revenue exceeding estimates, driven by better-than-expected same-store store sales growth at both American Eagle and Aerie. On the other hand, its gross margin and operating income guidance for the full year, despite being raised, missed analysts' expectations.

The stock is up 3.8% since the results and currently trades at $20.5.

Read our full, actionable report on American Eagle here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned