AppFolio Inc (APPF) Reports Strong Revenue Growth and Profitability in Q4 and Fiscal Year 2023

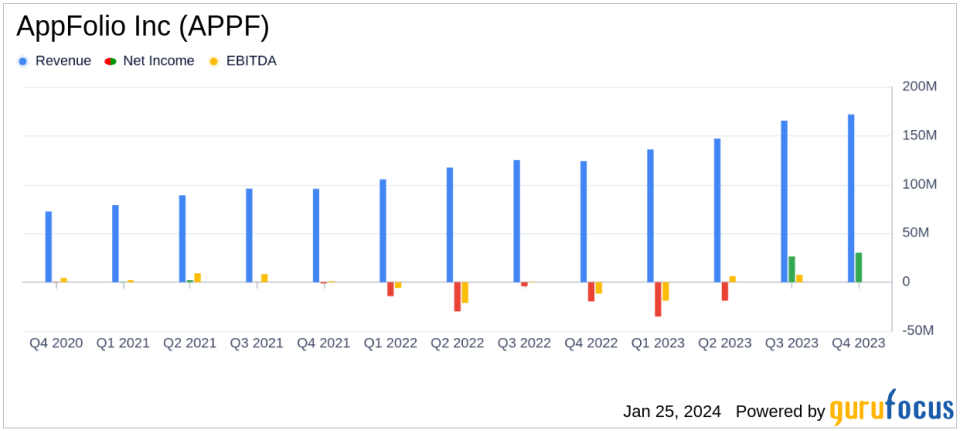

Revenue Growth: Q4 revenue surged by 39% year-over-year to $171.8 million, with full-year revenue up by 31% to $620.4 million.

Profitability: GAAP operating income for Q4 stood at $28.2 million, a significant turnaround from the previous year's operating loss.

Non-GAAP Measures: Non-GAAP operating income reached $41.8 million in Q4 and $75.8 million for the full year, reflecting strong operational efficiency.

Free Cash Flow: Non-GAAP free cash flow for Q4 was $34.3 million, demonstrating robust cash generation capabilities.

Units Under Management: Total units under management grew by 13% year-over-year to 8.2 million.

Financial Outlook: For fiscal year 2024, revenue is expected to be between $755 million and $765 million, with a non-GAAP operating margin of 21% to 23%.

On January 25, 2024, AppFolio Inc (NASDAQ:APPF) released its 8-K filing, announcing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, a leading provider of cloud-based software solutions for the property management and legal industries, reported a significant increase in revenue and profitability, highlighting the success of its strategic focus on innovation and customer-centric growth.

AppFolio's President and CEO, Shane Trigg, expressed satisfaction with the company's performance, attributing the success to disciplined investments and a commitment to delivering industry-leading innovation. The company's financial achievements are particularly noteworthy in the software industry, where recurring revenue and cash flow are critical indicators of long-term viability and growth potential.

Financial Performance Analysis

The company's revenue growth is a testament to the scalability of its software solutions and the increasing demand in the property management sector. The 39% year-over-year increase in Q4 revenue to $171.8 million, and the 31% increase for the full fiscal year to $620.4 million, underscore the company's ability to attract and retain customers. The growth in total units under management to 8.2 million also indicates a solid expansion of AppFolio's market presence.

Profitability has seen a remarkable improvement, with GAAP operating income for Q4 at $28.2 million, compared to the prior year's operating loss of $20.0 million. This shift to profitability is a clear indicator of effective cost management and operational efficiency. Non-GAAP operating income, which excludes certain non-cash expenses and one-time costs, provides an even more impressive picture of the company's financial health, with Q4 figures reaching $41.8 million, or 24.3% of revenue.

Free cash flow, an important metric for assessing the liquidity and financial flexibility of a company, was reported at $34.3 million for Q4 on a non-GAAP basis. This represents a substantial increase from the $1.3 million reported in the same quarter of the previous year and reflects the company's strong cash generation capabilities.

Looking ahead, AppFolio's financial outlook for fiscal year 2024 is optimistic, with projected revenue between $755 million and $765 million and an expected non-GAAP operating margin of 21% to 23%. This forward-looking guidance suggests that the company anticipates continued growth and profitability.

Key Financial Metrics and Tables

AppFolio's balance sheet remains solid, with cash and cash equivalents of $49.5 million and total assets of $408.9 million as of December 31, 2023. The company's financial stability is further evidenced by its stockholders' equity of $297.3 million.

Here is a summary of the key financial metrics from the income statement:

Financial Metrics | Q4 2023 | Q4 2022 | FY 2023 | FY 2022 |

|---|---|---|---|---|

Revenue | $171.8M | $124.1M | $620.4M | $471.9M |

GAAP Operating Income | $28.2M | ($20.0M) | $1.0M | ($72.4M) |

Non-GAAP Operating Income | $41.8M | ($3.4M) | $75.8M | ($2.7M) |

Non-GAAP Free Cash Flow | $34.3M | $1.3M | $73.6M | $4.1M |

AppFolio's earnings report reflects a company that is successfully navigating the competitive landscape of cloud-based software solutions. The strong revenue growth, improved profitability, and robust free cash flow highlight the company's operational excellence and strategic focus. With a positive outlook for the coming fiscal year, AppFolio appears well-positioned to continue its growth trajectory and deliver value to its customers and investors.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from AppFolio Inc for further details.

This article first appeared on GuruFocus.