Is Appian (APPN) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is Appian (NASDAQ:APPN). The stock, currently priced at 51.08, recorded a loss of 1.01% in a day and a 3-month increase of 5.32%. The stock's fair valuation is $80.2, as indicated by its GF Value.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

We believe the GF Value Line is the fair value that the stock should be traded at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Unwrapping the Potential Risks

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with Appian should not be ignored. These risks are primarily reflected through its low Piotroski F-score, Altman Z-score, and Beneish M-score. These indicators suggest that Appian, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

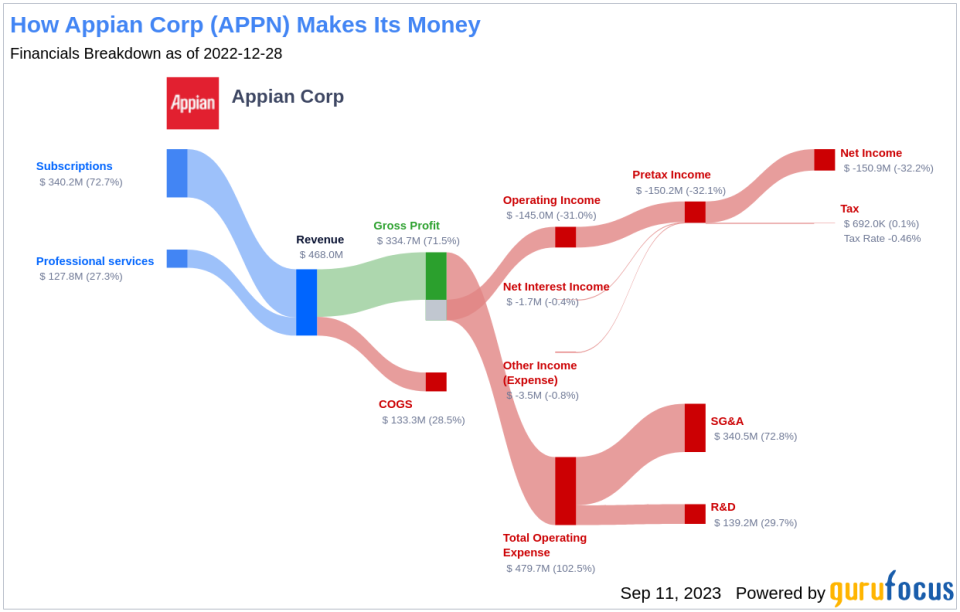

Appian Corp (NASDAQ:APPN): A Closer Look

Appian Corp provides a low-code software development platform as a service that enables organizations to rapidly develop powerful and unique applications. With its platform, organizations can rapidly and easily design, build and implement powerful, enterprise-grade custom applications through an intuitive, visual interface with little or no coding required. The company's customers use applications built on its low-code platform to launch new business lines, automate vital employee workflows, manage complex trading platforms, accelerate drug development and build procurement systems. The group generates a majority of its revenue from the domestic market. It serves various industries such as education; insurance; retail; telecom and media and others.

Conclusion: Navigating the Thin Line Between Value and Trap

While Appian (NASDAQ:APPN) might seem like an attractive investment option due to its current undervaluation, investors should tread carefully. The company's low Piotroski F-score, Altman Z-score, and Beneish M-score indicate potential risks that could turn this seemingly good value into a value trap. Therefore, it is crucial for investors to perform thorough due diligence before making an investment decision. Is Appian (NASDAQ:APPN) a hidden gem or a value trap waiting to ensnare unsuspecting investors? The answer lies in careful, comprehensive analysis.

This article first appeared on GuruFocus.