Appian Corp (APPN) Reports Significant Reduction in Operating and Net Losses for Q4 and Full ...

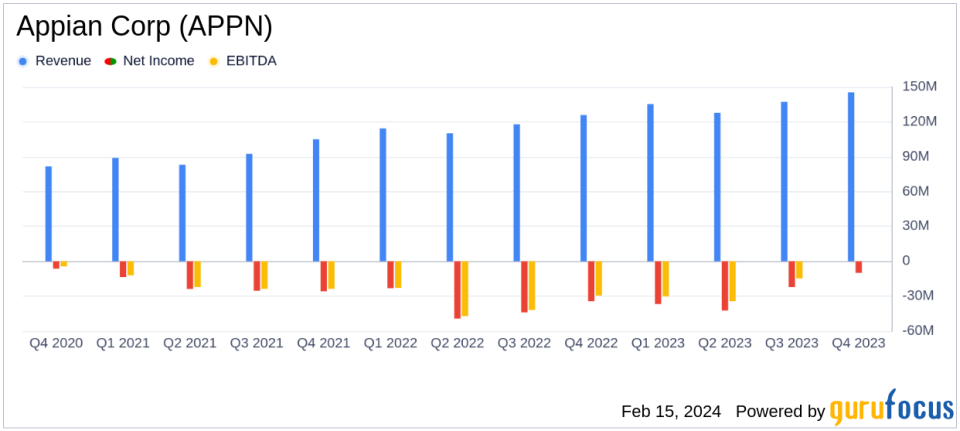

Cloud Subscription Revenue: Q4 increased by 26% to $83.1 million; full year up 29% to $304.5 million.

Total Revenue: Q4 saw a 16% increase to $145.3 million; full year rose by 17% to $545.4 million.

Operating Loss: Q4 GAAP operating loss narrowed to $(16.8) million; full year loss reduced to $(108.0) million.

Net Loss: Q4 GAAP net loss improved to $(10.0) million; full year loss decreased to $(111.4) million.

Adjusted EBITDA: Q4 turned positive at $1.0 million; full year loss lessened to $(44.8) million.

Cash Position: Ended the year with $159.0 million in cash, cash equivalents, and investments.

On February 15, 2024, Appian Corp (NASDAQ:APPN) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year ended December 31, 2023. The company, a leader in low-code enterprise platform-as-a-service, has reported a substantial increase in cloud subscription revenue and a significant reduction in operating and net losses, marking a year of strong financial performance and operational efficiency.

Appian's platform, known for its comprehensive automation capabilities including case management, robotic process automation, and artificial intelligence, has seen a growing demand for its cloud-based solutions, reflected in the 29% year-over-year increase in full-year cloud subscription revenue. This growth is a testament to the company's robust subscription model and its strategic focus on cloud-based offerings.

Financial Performance and Challenges

The fourth quarter saw cloud subscription revenue climb to $83.1 million, a 26% increase from the same period in the previous year. Total revenue for the quarter reached $145.3 million, marking a 16% year-over-year rise. Despite a 9% decrease in professional services revenue, the company's total subscriptions revenue, which includes cloud subscriptions, on-premises term license subscriptions, and maintenance and support, grew by 24% to $115.8 million.

Appian's operating loss for the fourth quarter was significantly reduced to $(16.8) million from $(40.6) million in Q4 2022. The full-year operating loss also saw improvement, shrinking to $(108.0) million from $(145.0) million in the previous year. These reductions in losses highlight Appian's enhanced operational efficiency and cost management.

Net loss for the fourth quarter was $(10.0) million, a notable improvement from $(34.4) million in Q4 2022. The full-year net loss followed a similar trend, decreasing to $(111.4) million from $(150.9) million in the prior year. The company's adjusted EBITDA turned positive in Q4 at $1.0 million, compared to a loss of $(24.8) million in the same quarter of the previous year, indicating a stronger operational performance.

Appian delivered our plan in 2023 and reached two milestones. Full year revenue exceeded half a billion dollars, and we achieved the highest quarterly gross margin in our public history, said Matt Calkins, CEO & Founder.

Financial Outlook and Investor Relations

Looking ahead, Appian provided guidance for the first quarter and full year of 2024, projecting continued growth in cloud subscription revenue and total revenue. The company anticipates a cloud subscription revenue between $84.0 million and $86.0 million for Q1 2024, and between $364.0 million and $366.0 million for the full year. Total revenue is expected to reach between $148.0 million and $150.0 million in Q1, and between $615.0 million and $617.0 million for the full year.

Appian will host a conference call to discuss the financial results and business outlook, and has announced an Investor Day on April 16, 2024, near Washington DC, to provide further insights into the company's strategy and operations.

For value investors and potential GuruFocus.com members, Appian's strong performance in cloud subscription revenue and the significant reduction in losses are indicators of the company's growing market presence and operational efficiency. The positive adjusted EBITDA and the company's optimistic outlook for 2024 suggest a promising trajectory for Appian's financial health and continued innovation in the software industry.

For a detailed analysis of Appian's financials and future prospects, visit GuruFocus.com, where we provide in-depth research and expert insights to help you make informed investment decisions.

Explore the complete 8-K earnings release (here) from Appian Corp for further details.

This article first appeared on GuruFocus.