Appian (NASDAQ:APPN) Exceeds Q4 Expectations, Stock Jumps 10.9%

Low code software development platform provider Appian (Nasdaq: APPN) beat analysts' expectations in Q4 FY2023, with revenue up 15.5% year on year to $145.3 million. The company expects next quarter's revenue to be around $149 million, in line with analysts' estimates. It made a non-GAAP profit of $0.06 per share, improving from its loss of $0.28 per share in the same quarter last year.

Is now the time to buy Appian? Find out by accessing our full research report, it's free.

Appian (APPN) Q4 FY2023 Highlights:

Revenue: $145.3 million vs analyst estimates of $140.7 million (3.2% beat)

EPS (non-GAAP): $0.06 vs analyst estimates of -$0.24 ($0.30 beat)

Revenue Guidance for Q1 2024 is $149 million at the midpoint, roughly in line with what analysts were expecting

Management's revenue guidance for the upcoming financial year 2024 is $616 million at the midpoint, in line with analyst expectations and implying 13% growth (vs 16.6% in FY2023)

Free Cash Flow was -$9.60 million compared to -$65.47 million in the previous quarter

Net Revenue Retention Rate: 119%, in line with the previous quarter

Gross Margin (GAAP): 76.4%, up from 72% in the same quarter last year

Market Capitalization: $2.44 billion

“Appian delivered our plan in 2023 and reached two milestones. Full year revenue exceeded half a billion dollars, and we achieved the highest quarterly gross margin in our public history,” said Matt Calkins, CEO & Founder.

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

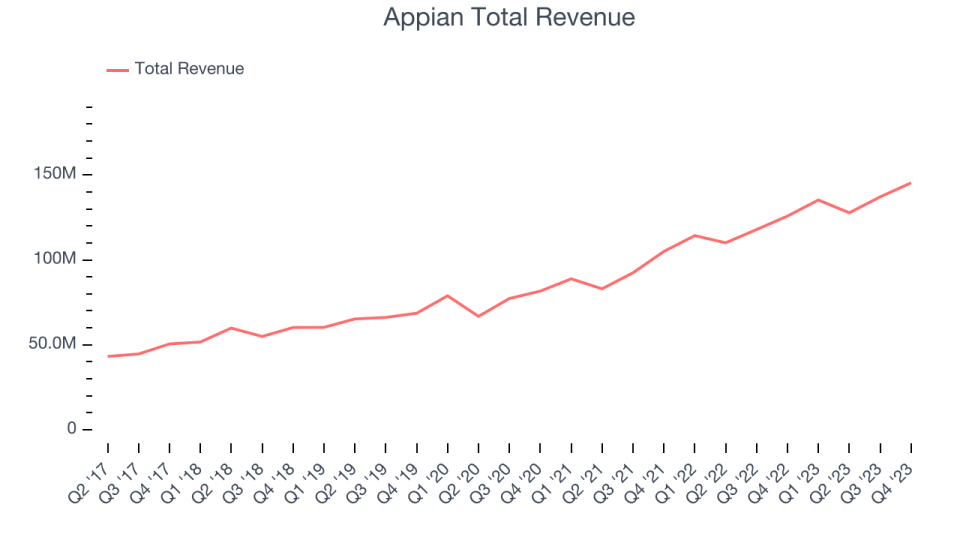

As you can see below, Appian's revenue growth has been strong over the last two years, growing from $105 million in Q4 FY2021 to $145.3 million this quarter.

This quarter, Appian's quarterly revenue was once again up 15.5% year on year. However, its growth did slow down a little compared to last quarter as the company increased revenue by $8.23 million in Q4 compared to $9.38 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Appian is expecting revenue to grow 10.2% year on year to $149 million, slowing down from the 18.4% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $616 million at the midpoint, growing 13% year on year compared to the 16.5% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Appian's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 119% in Q4. This means that even if Appian didn't win any new customers over the last 12 months, it would've grown its revenue by 19%.

Significantly up from the last quarter, Appian has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Appian's Q4 Results

We were glad to see Appian's revenue outperform Wall Street's estimates along with solid revenue retention. Gross margin also improved, and cash burn improved from previous quarters. Guidance for next quarter and the full year were relatively in line with expectations, with full year adjusted EBITDA guidance actually better than Wall Street estimates, suggesting better profitability. Zooming out, we think this was a solid quarter, showing that the company is staying on track. The stock is up 10.9% after reporting and currently trades at $36.93 per share.

So should you invest in Appian right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.