Apple (AAPL) Rumored to Bring Tap to Pay on iPhone to Brazil

Apple AAPL is reportedly testing the Tap to Pay on iPhone feature in Brazil. Per a latest 9TO5Mac article, some users of the Brazil payments platform, InfinitePay, received “early access to Tap to Pay on iPhone through the InfinitePay app.”

Tap To Pay on iPhone was first introduced in the United States in 2022. The feature is currently supported by Square, payment platform Adyen, Stripe, GoDaddy and Clover. Chase, North American Bancard and Worldpay are the upcoming partners.

In April, Apple launched Tap to Pay on iPhone in Taiwan, which is supported by CTBC Bank, TapPay and Taipei Fubon Bank. In May, Apple expanded its footprint by launching the feature in Australia.

Apple recently expanded Tap to Pay on iPhone in the U.K. This capability enables millions of merchants, ranging from small enterprises to large retailers, to seamlessly and securely accept payments through Apple Pay, contactless credit and debit cards, and other digital wallets using only their iPhone as a payment terminal and a partner-enabled iOS app.

Several payment platforms and app developers in the U.K. are integrating Tap to Pay on iPhone into their iOS apps, offering it as a payment acceptance option for their business customers. Revolut and Tyl by NatWest are among the first payment platforms to adopt this feature, with others, such as Adyen, Dojo, myPOS, Stripe, SumUp, Viva Wallet, Worldline and Zettle by PayPal PYPL, following suit soon. Notably, Apple Store locations in the U.K. will roll out Tap to Pay on iPhone in the coming weeks.

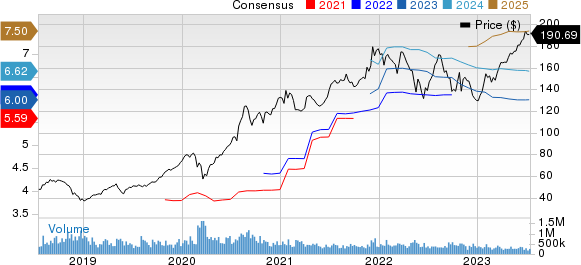

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Apple is collaborating with leading payment platforms and app developers to ensure the widespread adoption of Tap to Pay on iPhone. This feature is compatible with contactless credit and debit cards from major payment networks like American Express, Mastercard and Visa.

Apple's Tap to Pay Expansion to Aid Prospects

Apple shares have returned 46.8%, outperforming the Zacks Computer & Technology sector’s growth of 40.5%. The company has been benefiting from the steady shipment of iPhone 14 and 14 Plus, as well as expanding its footprint in emerging markets.

Apple’s business primarily consists of its flagship iPhone. The company’s expanding install base is expected to boost the adoption of the Tap To Pay feature. It is also expanding Apple Pay to Central America countries, including Guatemala, El Salvador and Panama. AAPL is also reportedly expanding Apple Pay to Vietnam soon.

Expanding support is driving the adoption of Apple Pay, which is now available in more than 80 countries. In April, PayPal announced support for Apple Pay as a checkout option for small businesses.

Growing subscriber base and improving customer engagement are tailwinds for the services business. Apple is expanding service offerings with the new features and enhancements in its upcoming iOS 17, iPadOS 17, macOS Sonoma, watchOS 10 and tvOS 17. Expanding content on Apple TV+ bodes well for Apple.

The Services portfolio currently has more than 975 million paid subscribers and accounted for 22% of sales in the fiscal second quarter. Services revenues increased 5.5% from the year-ago quarter to $20.77 billion.

For the fiscal third quarter, Services’ revenue growth is expected to be similar to the March-end quarter’s reported figure. Apple expects services to be negatively impacted by challenging macroeconomic conditions, as well as weakness in digital advertising and mobile gaming.

The Zacks Consensus Estimate for third-quarter fiscal 2023 revenues for the Services segment is pegged at $20.79 billion, indicating 6.05% year-over-year growth.

This Zacks Rank #3 (Hold) company expects the June-end quarter’s (fiscal third) year-over-year revenue growth to be similar to that reported in the March-end quarter due to unfavorable forex.

The Zacks Consensus Estimate for Apple’s fiscal third-quarter earnings has increased by a couple of cents to $1.20 per share over the past 30 days. The consensus estimate for revenues is pegged at $81.11 billion, indicating a 2.23% year-over-year decline.

Stocks to Consider

Cadence Design Systems CDNS and Salesforce CRM are better-ranked stocks in the broader sector, sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Cadence Design Systems and Salesforce have returned 73% and 49.9%, respectively, on a year-to-date basis.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report