Apple's (AAPL) Q4 Earnings Beat Estimates, Revenues Fall Y/Y

Apple AAPL reported fourth-quarter fiscal 2023 earnings of $1.46 per share, which beat the Zacks Consensus Estimate by 5.04% and increased 13.2% year over year.

Net sales decreased 0.7% year over year to $89.498 billion, which beat the Zacks Consensus Estimate by 0.52%. Unfavorable forex hurt revenues by almost 200 basis points (bps).

iPhone sales increased 2.8% from the year-ago quarter to $43.805 billion and accounted for 48.9% of total sales. iPhone sales missed the Zacks Consensus Estimate by 0.97%.

Services revenues grew 16.3% from the year-ago quarter to $22.31 billion and accounted for 24.9% of sales. The figure also beat the consensus mark by 4.53%.

Apple now has more than 1 billion paid subscribers across its Services portfolio, nearly double what it had three years ago.

Both transacting accounts and paid accounts grew double-digits year over year in the reported quarter.

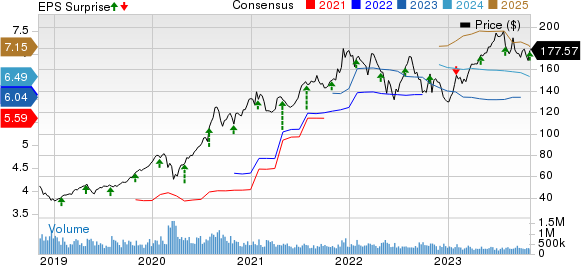

Apple Inc. Price, Consensus and EPS Surprise

Apple Inc. price-consensus-eps-surprise-chart | Apple Inc. Quote

Top Line Details

America’s sales increased 0.8% year over year to $40.115 billion and accounted for 44.8% of total sales. The figure beat the Zacks Consensus Estimate by 5.45%.

Europe generated $22.463 billion in sales, down 1.5% on a year-over-year basis. The region accounted for 25.1% of total sales. Europe’s sales beat the consensus mark by 1.11%.

Greater China sales decreased 2.5% from the year-ago quarter to $15.084 billion, accounting for 16.9% of total sales. The figure lagged the Zacks Consensus Estimate by 13.03%.

Rest of the Asia Pacific generated sales of $6.331 billion, down 0.7% year over year. The region accounted for 7.1% of total sales. The figure beat the consensus mark by 4.8%.

Japan’s sales of $5.505 billion decreased 3.4% year over year, accounting for 6.2% of total sales. The figure lagged the consensus mark by 0.32%.

Top-Line Details

Product sales (75.1% of sales) decreased 5.3% year over year to $67.184 billion. Non-iPhone revenues (iPad, Mac and Wearables) decreased 17.5% on a combined basis.

iPad sales of $6.443 billion declined 10.2% year over year and accounted for 7.2% of total sales. The figure beat the Zacks Consensus Estimate by 10.04%.

Mac sales of $7.61 billion decreased 33.8% from the year-ago quarter and accounted for 8.5% of total sales. The figure lagged the Zacks Consensus Estimate by 8.1%.

Wearables, Home and Accessories sales decreased 3.4% year over year to $9.322 billion and accounted for 10.4% of total sales. The figure beat the consensus mark by 1.05%.

Apple Watch’s adoption rate continues to grow rapidly. More than two-thirds of the customers who purchased the Apple Watch during the reported quarter were first-time customers.

Operating Details

Gross margin of 45.2% expanded 290 bps on a year-over-year basis.

Moreover, the gross margin expanded 70 bps sequentially due to cost savings and a favorable mix shift toward services.

Products’ gross margin expanded 120 bps sequentially to 36.6%. Services’ gross margin was 70.9%, up 40 bps sequentially.

Operating expenses rose 1.9% year over year to $13.46 billion due to higher research & development expenses, which increased 8.1% year over year. Selling, general & administrative expenses decreased 4.5% year over year.

Operating margin expanded 250 bps on a year-over-year basis to 30.1%.

Balance Sheet

As of Sep 30, 2023, cash & marketable securities were $162.099 billion compared with $167.08 billion as of Jun 30, 2023.

Term debt, as of Sep 30, 2023, was $105.103 billion, down from $105.29 billion as of Jun 30, 2023.

Apple returned nearly $25 billion in the reported quarter through dividend payouts ($3.8 billion) and share repurchases ($15.5 billion).

Guidance

Apple expects the December quarter’s (first-quarter fiscal 2024) revenues to be similar to that of the year-ago quarter’s figure.

Apple expects iPhone’s year-over-year revenues to grow on an absolute basis. Revenues for Mac are expected to significantly accelerate compared with the September quarter’s reported figure.

It expects the year-over-year revenue growth for both iPad and Wearables, Home and Accessories to decelerate significantly from the September quarter due to a different timing of product launches.

For the Services segment, Apple expects average revenues per week to grow at a similar strong double-digit rate as it did during the September quarter.

Gross margin is expected between 45% and 46% in the first quarter of fiscal 2024. Operating expenses are expected between $14.4 billion and $14.6 billion.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

NetEase NTES, NVIDIA NVDA and Model N MODN are some better-ranked stocks that investors can consider in the broader Zacks Computer & Technology sector, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NetEase shares have gained 51.1% year to date. NTES is set to report its third-quarter 2023 results on Nov 16.

NVIDIA shares have returned 197.5% year to date. NVDA is set to report its third-quarter fiscal 2024 results on Nov 21.

Model N shares have declined 39.2% year to date. MODN is set to report its fourth-quarter fiscal 2023 results on Nov 9.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report