Application Software Segment Aids Roper (ROP) Amid Cost Woes

Roper Technologies, Inc. ROP is well-poised to gain from strength across each of its segments. Its Application Software segment is benefiting from strength across its Deltek, Vertafore, Strata, Frontline and Aderant businesses. Continued SaaS strength, sustained momentum in the SMB channel and the private sector solutions are aiding Deltek. The acquisition of Replicon (August 2023) has been supporting Deltek’s growth by boosting its SaaS solutions portfolio.

Growing adoption and cross-selling of SaaS solutions and continued GenAI innovation are aiding Aderant’s growth. The MGA systems acquisition and strength across core P&C business are fueling Vertafore's growth. The Strata business is gaining from its leading decision support and financial planning solutions. Strong customer renewal season is aiding the Frontline business. Roper expects organic revenues to increase in mid-single digits for the Application Software segment in the fourth quarter of 2023.

Strength in the DAT & Loadlink businesses, excellent bookings in the iPipeline business, strength across the Foundry business and solid alternate site healthcare businesses (MHA, SHP & SoftWriters) are fostering the growth of the Network Software segment. ROP expects low-single-digit organic revenue growth for the segment in the fourth quarter of 2023.

The solid performance of the Neptune business due to continued demand for ultrasonic meters and increasing adoption of meter data management software is fostering the growth of the Tech-enabled Products segment. Solid performance of Verathon business due to strength across single-use BFlex & GlideScope offerings and continued BladderScan demand bodes well for the segment. The company expects low-double-digit organic growth for the segment in the fourth quarter of 2023.

Roper is steadily strengthening its business through acquisitions. In August 2023, the company acquired cloud-based performance management and data solutions provider, Syntellis Performance Solutions. The acquired entity will be integrated into Roper’s Strata Decision Technology business, which is part of the Application Software segment. Syntellis is expected to contribute approximately $185 million and $85 million to Roper’s revenues and EBITDA in 2024, respectively, including planned cost synergies.

In October 2022, the company acquired Frontline Education for $3.7 billion. The acquisition builds on Roper’s Horizon software business (which it acquired in 2008), expanding its presence in the K-12 education market, and is expected to contribute approximately $370 million to Roper’s revenues and $175 million to its EBITDA in 2023. Acquisitions boosted sales by 9% in the third quarter.

The company continues to increase shareholders’ value through dividend payments and share buybacks. In the first nine months of 2023, ROP rewarded its shareholders with a dividend payment of $118.7 million, up 11.1% year over year. In November 2023, the company hiked its dividend by 10%.

However, escalating costs and expenses have been a concern for ROP over time. In the first nine months of 2023, the cost of sales increased 16.1% year over year, while selling, general and administrative expenses climbed 15.9%. Raw material cost inflation is pushing up the cost of sales. Escalating costs, if not controlled, may impede the company’s bottom line.

Given Roper’s extensive presence across international markets, its operations are subject to risks associated with unfavorable movement in foreign currencies and geopolitical issues. In the first nine months of 2023, movement in foreign currency translation decreased sales by $8 million.

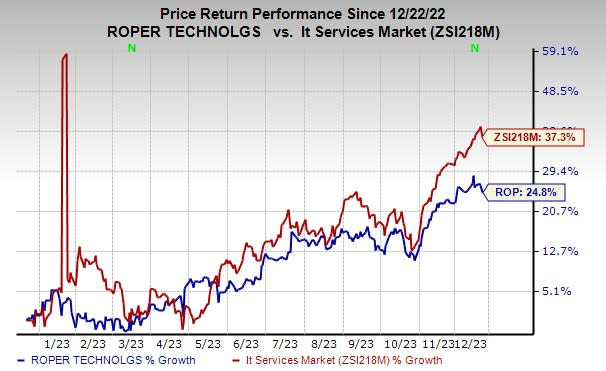

In the past year, this Zacks Rank #3 (Hold) company's stock gained 24.8% compared with the industry’s 39.8% increase.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked companies from the Computer and Technology sector are discussed below:

Arista Networks, Inc. ANET presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ANET delivered a trailing four-quarter average earnings surprise of 12%. In the past 60 days, the Zacks Consensus Estimate for Arista Networks’ 2023 earnings has increased 6.2%. The stock has risen 93.7% in the past year.

AppFolio, Inc. APPF presently carries a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 81.6%.

The consensus estimate for APPF’s 2023 earnings has increased 45% in the past 60 days. Shares of AppFolio have surged 64.6% in the past year.

Arlo Technologies, Inc. ARLO currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 70.9%.

In the past 60 days, the consensus estimate for Arlo Technologies’ 2023 earnings has improved 8.7%. The stock has risen 168.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

AppFolio, Inc. (APPF) : Free Stock Analysis Report

Arlo Technologies, Inc. (ARLO) : Free Stock Analysis Report