Applied Genetic Technologies' (NASDAQ:AGTC) Shareholders Are Down 70% On Their Shares

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

It is doubtless a positive to see that the Applied Genetic Technologies Corporation (NASDAQ:AGTC) share price has gained some 37% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In that time the share price has delivered a rude shock to holders, who find themselves down 70% after a long stretch. So we're hesitant to put much weight behind the short term increase. But it could be that the fall was overdone.

View our latest analysis for Applied Genetic Technologies

We don't think Applied Genetic Technologies' revenue of US$2,859,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Applied Genetic Technologies comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Some Applied Genetic Technologies investors have already had a taste of the bitterness stocks like this can leave in the mouth.

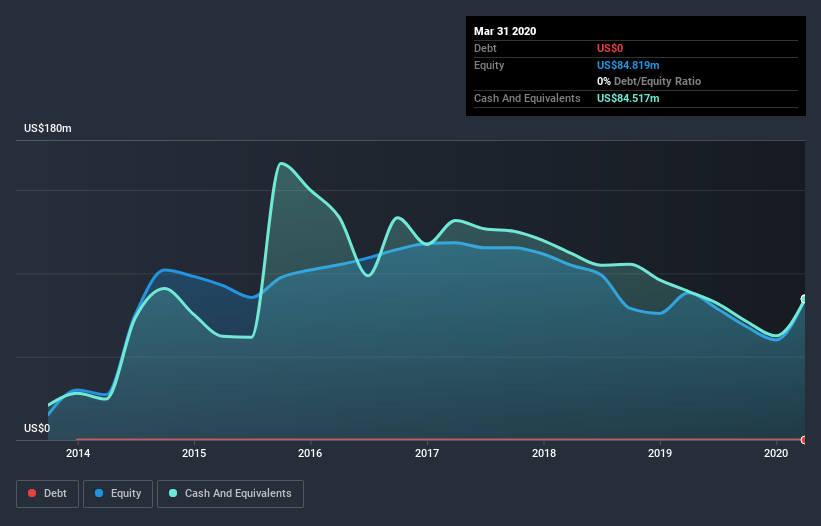

When it last reported its balance sheet in March 2020, Applied Genetic Technologies had cash in excess of all liabilities of US$64m. While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. We'd venture that shareholders are concerned about the need for more capital, because the share price has dropped 11% per year, over 5 years. The image below shows how Applied Genetic Technologies' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

It's nice to see that Applied Genetic Technologies shareholders have received a total shareholder return of 49% over the last year. That certainly beats the loss of about 11% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Applied Genetic Technologies is showing 4 warning signs in our investment analysis , you should know about...

But note: Applied Genetic Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.