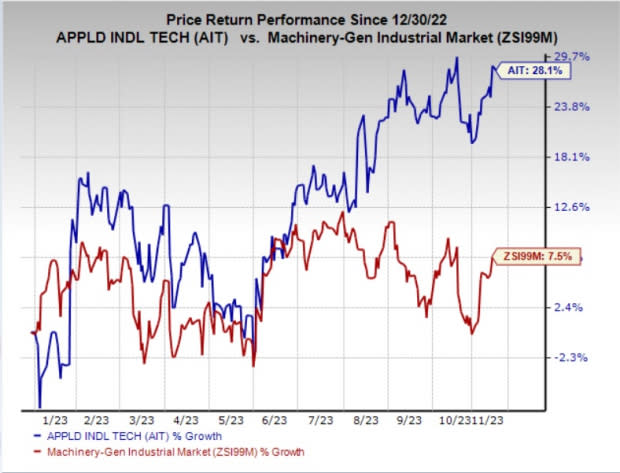

Applied Industrial (AIT) Up 28% YTD: Will the Uptrend Continue?

Shares of Applied Industrial Technologies AIT have rallied 28% in the year-to-date period, outperforming the industry’s 7.4% increase. This can be linked to strength across end markets, benefits of acquired assets and shareholder-friendly policies.

Image Source: Zacks Investment Research

Strength across the food and beverage, lumber and wood, mining, pulp and paper, energy, utilities and refining end markets are driving AIT’s growth. The Service Center Based Distribution segment is benefiting from growth in larger national accounts and fluid power aftermarket sales as well as benefits from sales force effectiveness initiatives. Sustained Maintenance, Repair, and Operations (MRO) activity and capex spending in process flow infrastructure are aiding the Engineered Solutions segment. Growth in off-highway mobile and industrial fluid power verticals, as well as higher margin process flow control products and solutions, augur well for the Engineered Solutions segment.

Successive acquisitions are contributing to Applied Industrial’s top-line growth. The acquisitions of Bearing Distributors and Cangro (September 2023) enhanced the company’s footprint and strategic growth initiatives across the U.S. Southeast and upper Northeast regions. The Advanced Motion Systems Inc. (April 2023) buyout expanded the company’s footprint in the upper Northeast region of the United States while helping to bolster relationships with leading suppliers.

Applied Industrial’s efforts to reward shareholders through dividends are encouraging. In the first quarter of fiscal 2024, Applied Industrial rewarded shareholders with dividends of $13.55 million, up 3.4% year over year. The company hiked its quarterly dividend rate by 2.9% in January 2023. In fiscal 2023, it paid out dividends worth $53.4 million, up 3.2% on a year-over-year basis.

Will the Momentum Continue?

Applied Industrial’s focus on pricing and cross-selling actions are expected to drive its growth. Focus on improving the product line, value-added services and initiatives to drive operational excellence and cost-saving efforts bolster the company’s growth prospects. The company’s investments in automation, Industrial Internet of Things (IIot), digital offerings and customer development initiatives augur well.

Zacks Rank & Other Stocks to Consider

Applied Industrial carries a Zacks Rank #2 (Buy).

Below, we discuss some other top-ranked stocks.

ITT ITT presently carries a Zacks Rank #2. The company pulled off a trailing four-quarter earnings surprise of 8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ITT has an estimated earnings growth rate of 16.2% and 10.9% for 2023 and 2024, respectively. Shares of the company have gained 27.1% in the year-to-date period.

A. O. Smith Corporation AOS presently carries a Zacks Rank #2. The company delivered a trailing four-quarter earnings surprise of 14%, on average.

A. O. Smith has an estimated earnings growth rate of 19.4% and 6.4% for 2023 and 2024, respectively. Shares of the company have gained 28.2% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report