Applied Industrial (AIT) Gains 2% Since Q1 Earnings Release

Applied Industrial Technologies AIT shares have gained 2.4% since its first-quarter fiscal 2023 (ended Sep 30, 2022) earnings release on Oct 27. Better-than-expected results and an improved fiscal 2023 outlook seem to have pleased investors.

The company reported first-quarter fiscal 2023 earnings of $1.97 per share, beating the Zacks Consensus Estimate of $1.64. The bottom line jumped approximately 45% year over year. Net sales of $1,062.4 million also outperformed the Zacks Consensus Estimate of $987 million. The top line jumped 19.2% year over year.

Simultaneously, Applied Industrial improved its earnings and sales forecast for fiscal 2023. The company expects earnings of $6.90-$7.55 per share compared with $6.65-$7.30 anticipated earlier. The mid-point of the guided range — $7.23 — lies below the Zacks Consensus Estimate of $7.52. The company anticipates sales to increase 5-9% for fiscal 2023, compared with a rise of 3-7% estimated earlier.

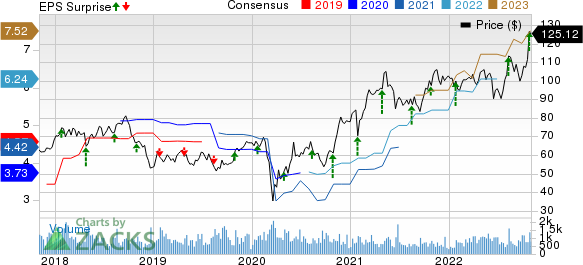

Applied Industrial Technologies, Inc. Price, Consensus and EPS Surprise

Applied Industrial Technologies, Inc. price-consensus-eps-surprise-chart | Applied Industrial Technologies, Inc. Quote

Coming back to the fiscal first-quarter performance, results benefited from 19.4% growth in organic sales and 0.2% gain from acquisitions. The increase was partially offset by an adverse impact of 0.5% from foreign currency translation.

Segmental Discussion

Service Center-Based Distribution’s revenues totaled $717.99 million, which contributed 67.6% to net revenues in the quarter under review. On a year-over-year basis, the segment’s revenues increased 19.5%. Organic sales grew 20.3%. Foreign currency translation had a negative impact of 0.8%. Segmental revenues were driven by benefits from break-fix MRO activity, sales process initiatives, pricing actions and investments across the U.S. manufacturing sector. Growth was strong across the food & beverage, mining, metals, pulp & paper, energy, aggregates, lumber & wood and transportation end markets.

Engineered Solutions’ (formerly Fluid Power & Flow Control segment) revenues totaled $344.4 million, which contributed 32.4% to net revenues in the reported quarter. On a year-over-year basis, the segment’s revenues increased 18.4%. Organic sales ascended 17.8%, owing to growth across mining, metals, agriculture, chemicals, technology, food & beverage, and machinery end markets. Acquisitions contributed 0.6% to segmental revenues.

Margin Profile

In the reported quarter, Applied Industrial’s cost of sales increased 18.7% year over year to $755.62 million. Gross profit in the quarter grew 20.1% year over year to $306.78 million, while gross margin increased 30 basis points (bps) to 28.9%. Selling, distribution and administrative expenses (including depreciation) climbed 10.8% year over year to $200.25 million. EBITDA was $118.71 million, reflecting an increase of 34.2%.

Balance Sheet & Cash Flow

At the end of first-quarter fiscal 2023, Applied Industrial had cash and cash equivalents of $147.58 million compared with $184.47 million at the end of fiscal 2022. Long-term debt was $649.2 million, nearly flat on a sequential basis.

At the end of the reported quarter, Applied Industrial generated net cash of $25.94 million from operating activities, reflecting a decrease of 46.7% from the year-ago quarter. Capital expenditures totaled $5.55 million, up 53.4% year over year. Free cash flow in the reported quarter decreased 54.7% to $20.39 million.

In the fiscal first quarter, Applied Industrial rewarded its shareholders with a dividend payout of $13.1 million, up 3.1% year over year.

Fiscal 2023 Guidance

Applied Industrial expects organic sales to increase 6-10% in the ongoing fiscal year. EBITDA margin is predicted to be 10.9-11.2% compared with 10.8-11.1% anticipated earlier.

Dividend Update

Applied Industrial’s board approved a quarterly cash dividend of 34 cents per share, payable to shareholders on Nov 30, of record as of Nov 15.

Zacks Rank & Other Key Picks

Applied Industrial currently sports a Zacks Rank #1 (Strong Buy).

Some other companies from the Industrial Products sector worth considering are as follows:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks.

Enerpac Tool has an estimated earnings growth rate of 44.6% for the current fiscal year. The company’s shares have rallied 23.2% in the past three months.

iRobot Corporation IRBT presently has a Zacks Rank of 2 (Buy). IRBT’s earnings surprise in the last four quarters was 59.1%, on average.

iRobot has an estimated earnings growth rate of 36.6% for the current year. The stock has gained 10.9% in the past three months.

Reliance Steel & Aluminum Co. RS presently carries a Zacks Rank of 2. Its earnings surprise in the last four quarters was 13.6%, on average.

Reliance Steel has an estimated earnings growth rate of 29.7% for the current year. The stock has appreciated 7.2% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

iRobot Corporation (IRBT) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research