Applied Industrial (AIT) Q1 Earnings Beat, FY24 View Upbeat

Applied Industrial Technologies AIT reported first-quarter fiscal 2024 (ended Sep 30, 2023) earnings of $2.39 per share, which surpassed the Zacks Consensus Estimate of $2.07. The bottom line jumped 21.3% year over year.

Net sales of $1,095.2 million outperformed the consensus estimate of $1,091.1 million. The top line inched up 3.1% year over year. Acquisitions boosted the top line by 1.1%, while foreign-currency translation had a positive impact of 0.2%. Organic sales increased 3.4%.

Segmental Discussion

The Service Center-Based Distribution segment’s revenues, which contributed 68.2% to net revenues, totaled $746.53 million in the quarter under review. On a year-over-year basis, the segment’s revenues increased 4%. Our estimate for segmental revenues was $729.3 million. Organic sales grew 3.1%. Foreign currency translation increased sales by 0.3%, while acquisitions boosted sales by 0.6%. Segmental revenues were driven by benefits from sales process initiatives, solid growth across national strategic accounts and benefits from cross-selling actions.

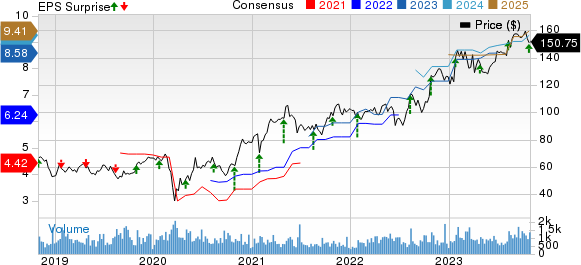

Applied Industrial Technologies, Inc. Price, Consensus and EPS Surprise

Applied Industrial Technologies, Inc. price-consensus-eps-surprise-chart | Applied Industrial Technologies, Inc. Quote

The Engineered Solutions segment’s revenues (formerly Fluid Power & Flow Control segment), which contributed 31.8% to net revenues, totaled $348.7 million in the reported quarter. On a year-over-year basis, the segment’s revenues increased 1.2%. Our estimate for the Engineered Solutions segment’s revenues in the fiscal first quarter was $355.6 million. Acquisitions boosted the top line by 2.2%. Organic sales decreased 1% due to one less working day, reduced activity across the technology sector and ongoing supply-chain constraints.

Margin Profile

In the reported quarter, Applied Industrial’s cost of sales increased 1.9% year over year to $770.11 million. Gross profit in the quarter increased 6% year over year to $325.08 million, while the gross margin increased to 30% from 29% in the year-ago quarter. Selling, distribution and administrative expenses (including depreciation) climbed 2.1% year over year to $204.4 million. EBITDA was $133.36 million, reflecting an increase of 12.3%.

Balance Sheet & Cash Flow

At the end of fiscal 2024, Applied Industrial had cash and cash equivalents of $360.42 million compared with $344.04 million at the end of fiscal 2023. Long-term debt was $596.9 million, flat compared to fiscal 2023.

At the end of the reported quarter, Applied Industrial generated net cash of $66.21 million from operating activities, reflecting an increase of more than 100% from the year-ago period. Capital expenditures totaled $4.34 million, down 21.9% year over year. Free cash flow in the fiscal first quarter surged more than 200% year over year to $61.87 million.

In the first quarter of fiscal 2024, Applied Industrial rewarded shareholders with dividends of $13.55 million, up 3.4% year over year.

Dividend Update

Applied Industrial’s board approved a quarterly cash dividend of 35 cents per share, payable to shareholders on Nov 30, of record as of Nov 15.

Fiscal 2024 Guidance

For fiscal 2024, Applied Industrial, carrying a Zacks Rank #2 (Buy), anticipates earnings of $9.25-$9.80 per share compared with $8.80-$9.55 expected earlier. The mid-point of the guided range — $9.53 — lies above the Zacks Consensus Estimate of $9.26. The company predicts sales to increase 1-4% year over year compared with 0-4% anticipated earlier. AIT expects organic sales to inch up 0-3%. The company expects EBITDA margin of 12-12.3% for fiscal 2024. Previously, the same was expected in the range of 11.9-12.1%. The guidance includes the effect of a slowdown in end markets and ongoing inflationary and supply-chain headwinds. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Performance of Other Industrial Companies

Cimpress plc CMPR reported first-quarter fiscal 2024 (ended Sep 30, 2023) adjusted earnings of 17 cents per share, which surpassed the Zacks Consensus Estimate of a loss of 34 cents per share. The company incurred a loss of 97 cents per share in the year-ago quarter.

Cimpress’ total revenues of $757.3 million missed the Zack Consensus Estimate of $771 million. The top line increased 7.7% year over year, driven by growth across most of its businesses.

Stanley Black & Decker SWK reported third-quarter 2023 adjusted earnings (excluding $1.02 from non-recurring items) of $1.05 per share, which beat the Zacks Consensus Estimate of 84 cents. The bottom line jumped 38.2% year over year due to lower costs.

Stanley Black’s net sales of $3,953.9 million missed the Zacks Consensus Estimate of $4,019.3 million. The top line also declined 4% year over year due to weakness in the Tools & Outdoor segment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Cimpress plc (CMPR) : Free Stock Analysis Report