Applied Industrial Technologies Inc (AIT) Posts Modest Sales Growth and Strong Earnings in Q2 ...

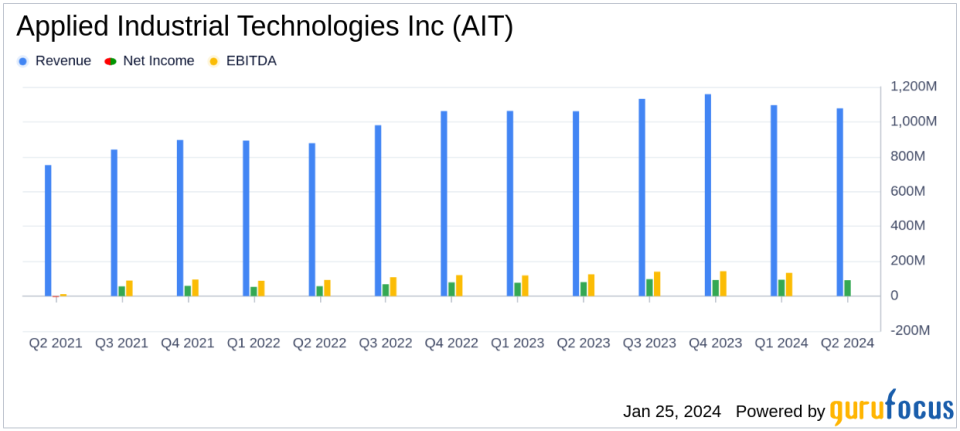

Net Sales: $1.1 billion, a 1.6% increase year-over-year (YoY).

Net Income: $91.2 million, translating to $2.32 per share.

Adjusted Net Income: $88.2 million, or $2.24 per share, up 9.3% YoY.

EBITDA: $130.8 million, a 4.2% increase YoY.

Operating Cash Flow: $101.8 million with Free Cash Flow of $96.2 million.

Quarterly Dividend: Increased by 6% to $0.37 per share.

Fiscal 2024 Guidance: Adjusted EPS of $9.35 to $9.70, with sales growth of 1% to 3%.

On January 25, 2024, Applied Industrial Technologies Inc (NYSE:AIT) released its 8-K filing, announcing the financial results for the second quarter of fiscal year 2024. AIT, a leading distributor and technical solutions provider of industrial motion, fluid power, flow control, automation technologies, and related maintenance supplies, reported a slight increase in net sales to $1.1 billion, up 1.6% YoY, though on an organic basis, sales saw a marginal decline of 0.1%. The company operates primarily in North America, Australia, and New Zealand, serving both the maintenance, repair, and operations market and the original equipment manufacturing industry.

The company's net income for the quarter was a robust $91.2 million, or $2.32 per share, with an adjusted net income of $88.2 million, or $2.24 per share, marking a 9.3% increase YoY. EBITDA also saw a healthy rise of 4.2% to $130.8 million. These figures reflect the company's operational execution and cost control measures, as well as a normalization of LIFO expense, which was $3.4 million pre-tax for the quarter.

AIT's President & Chief Executive Officer, Neil A. Schrimsher, commented on the results, stating:

"Im encouraged by our second quarter results considering normalization of industrywide end-market activity. Organic sales exceeded our expectations and held steady relative to prior-year levels, despite facing our most difficult comparison of the year, and slower technology sector activity as noted last quarter."

He also highlighted the company's strong cash flow generation and its strategic positioning to capitalize on a multi-year secular growth cycle in North America.

Financial Performance and Outlook

AIT's financial achievements in the quarter are significant, particularly in the context of the industrial distribution industry. The company's ability to maintain gross margin and EBITDA margin expansion is indicative of its strong market position and operational efficiency. The updated fiscal 2024 guidance reflects a cautious but positive outlook, with adjusted EPS projections slightly narrowed to $9.35 to $9.70 and sales growth expectations adjusted to 1% to 3%.

The company's balance sheet remains solid, with cash and cash equivalents of $412.9 million as of December 31, 2023. AIT's commitment to returning value to shareholders is evident in the 6% increase in its quarterly dividend, marking the 15th increase since 2010.

Applied Industrial Technologies Inc (NYSE:AIT) continues to navigate the challenges of the current economic environment, including supply chain issues and inflationary pressures. However, the company's updated guidance and strong Q2 performance suggest confidence in its ability to adapt and thrive amidst these challenges.

For more detailed information on AIT's financial performance, including income statements and balance sheets, investors and interested parties are encouraged to review the full 8-K filing.

AIT's commitment to growth and value creation positions it as a noteworthy company for value investors and those seeking exposure to the industrial distribution sector. Stay tuned to GuruFocus.com for further analysis and updates on Applied Industrial Technologies Inc and other key players in the industry.

Explore the complete 8-K earnings release (here) from Applied Industrial Technologies Inc for further details.

This article first appeared on GuruFocus.