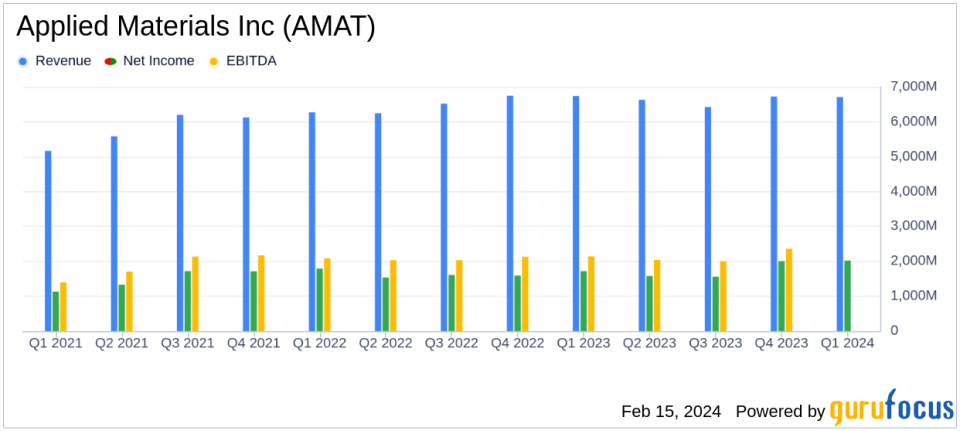

Applied Materials Inc (AMAT) Reports Stable Revenue and Increased Earnings in Q1 2024

Revenue: Reported at $6.71 billion, remaining flat year over year.

GAAP and Non-GAAP Operating Margins: GAAP operating margin increased slightly to 29.3%, while non-GAAP operating margin remained flat at 29.5% year over year.

Earnings Per Share (EPS): GAAP EPS rose by 19% to $2.41, and non-GAAP EPS increased by 5% to $2.13 year over year.

Cash Flow: Generated $2.33 billion in cash from operations, indicating strong cash-generating ability.

Capital Return: Distributed $966 million to shareholders through share repurchases and dividends.

Segment Performance: Semiconductor Systems revenue decreased, while Applied Global Services and Display and Adjacent Markets saw revenue growth.

On February 15, 2024, Applied Materials Inc (NASDAQ:AMAT), the world's largest semiconductor wafer fabrication equipment manufacturer, released its 8-K filing, detailing the financial results for the first quarter of fiscal year 2024. The company, known for its market share leadership in deposition and serving major chipmakers like TSMC, Intel, and Samsung, reported a steady performance amidst a challenging market environment.

Financial Performance Overview

Applied Materials Inc (NASDAQ:AMAT) maintained its revenue at $6.71 billion, consistent with the previous year. The company's GAAP operating margin saw a marginal increase to 29.3%, while non-GAAP operating margin stayed steady at 29.5%. Notably, GAAP EPS experienced a significant 19% increase to $2.41, and non-GAAP EPS also grew by 5% to $2.13 compared to the same quarter last year. This earnings growth is a testament to the company's ability to manage costs and enhance profitability in a flat revenue scenario.

The company's financial health is further underscored by the $2.33 billion generated from operations, showcasing its robust cash flow. Applied Materials Inc (NASDAQ:AMAT) also demonstrated its commitment to shareholder returns, distributing $966 million through share repurchases and dividends.

Segment Performance and Challenges

The Semiconductor Systems segment, which is a significant part of the company's business, saw a decrease in revenue from $5.162 billion to $4.909 billion year over year. However, the Applied Global Services and Display and Adjacent Markets segments reported increases in revenue, indicating a diversified strength across the company's portfolio.

Despite the stable overall performance, the flat revenue growth signals potential challenges in market demand and competition. The semiconductor industry is known for its cyclical nature, and Applied Materials Inc (NASDAQ:AMAT) must navigate these cycles effectively to maintain and grow its market position.

Importance of Financial Achievements

The increase in EPS is particularly significant for Applied Materials Inc (NASDAQ:AMAT) as it reflects the company's efficiency in converting revenue into profit, an essential metric for investors. Operating margin improvements suggest the company's ability to control costs relative to its net sales, which is crucial in a competitive industry like semiconductors where pricing pressures are common.

These financial achievements are important as they demonstrate the company's operational excellence and ability to deliver value to shareholders, even when revenue growth is not present. They also provide the company with a solid foundation to invest in new technologies and maintain its leadership in the semiconductor equipment market.

Looking Ahead

For the second quarter of fiscal 2024, Applied Materials Inc (NASDAQ:AMAT) expects net revenue to be approximately $6.50 billion, with non-GAAP diluted EPS projected to be in the range of $1.79 to $2.15. This outlook reflects the company's cautious optimism in the face of ongoing industry and economic uncertainties.

President and CEO Gary Dickerson expressed confidence in the company's direction, stating,

Applied Materials delivered strong results in the first quarter of fiscal 2024 and has outperformed our markets for the fifth consecutive year,"

and highlighted the company's strategic position to capitalize on semiconductor technology inflections critical to AI and IoT in the coming years.

As Applied Materials Inc (NASDAQ:AMAT) continues to navigate the dynamic semiconductor landscape, its ability to maintain financial stability and invest in future growth will be key to sustaining its market leadership and delivering long-term shareholder value.

Explore the complete 8-K earnings release (here) from Applied Materials Inc for further details.

This article first appeared on GuruFocus.