Applied UV: A Pertinent Acquisition Move

Disinfection technology player Applied UV Inc. (NASDAQ:AUVI) has been one of my favorite microcaps. The company has an interesting story as it started off as a marriage between a furnishings company, Munn Works, and a proprietary surface disinfection technology, SteriLumen. The management team was able to make the most out of the Covid-19 pandemic and went on to establish key partnerships with some of the largest hotel chains in the world, where it was able to sell its UV-based furnishings such as drains and mirrors. The company has had a very interesting journey so far, including a promising set of recent updates and acquisitions that could bring back some momentum to the stock.

Business recap

Applied UV may have started as a surface disinfection technology expert with a focus on the hospitality industry, but it went on to diversify both its product offerings as well as its client base. Today, the company has clients among military facilities, museums, hospitals, wineries, schools, manufacturing companies and home users. Its first major product diversification move came in the form of the acquisition of the rights to produce and sell the Airocide air purification technology from Akida Holdings. Given the fact that Airocide had been developed with the purpose of catering to NASA, Applied UV was able to attract a fair share of high-profile clientele, including the Boston Red Sox. The company has further strengthened its position in this space through a couple of new acquisitions.

Acquisition of KES Science and JJS Technologies

Applied UV recently went on to close on the acquisition of the assets of privately-held Kennesaw, Georgia-based KES Science & Technology Inc. and JJS Technologies LLC through its fully-owned subsidiary, SteriLumen. The acquisition gives Applied UV the rights to produce and distribute all of its patented air disinfection and purification tools around the world. The consideration for the acquisition was a mix of $4.3 million in cash and 300,000 of Applied UVs common stock, but it involved the acquisition of only the asset base of the ywo companies. This acquisition is complementary to the Airocide air purification systems as well as the SteriLumen surface disinfection systems and provides the company with a client base in sectors such as cannabis, food distribution and the post-harvest markets. The impact of the acquisition on the companys top and bottom lines is yet to be seen.

Key developments

One of the biggest developments in Applied UV recently was the appointment of James Alecxih as CEO and as a board member on Dec. 8. He replaced Keyoumars Saeed, who served as Applied UVs CEO since its inception in early 2020.

Alecxih is a veteran of the biotech and health care industry and was formerly the president at ViveBio Scientific. With a new CEO at the helm, Applied UV looks all set to further expand its client base. Earlier this month, the company announced the installation of its Airocide air purification systems at a prestigious biomedical facility in Thailand. This was a major development and did result in a temporary spike in the companys stock price as its Thai distributor, Sithiporn Associates, confirmed the deployment of Airocide units at the Armed Forces Research Institute of Medical Sciences (AFRIMS) in Bangkok. It is believed that the photocatalytic oxidation technology within Airocide is ideal for a biomedical research facility like AFRIMS to help create cleaner and safer environments for visitors and staff. It also happens to be used by the U.S. Army's Walter Reed Army Institute of Research, where there is rigorous research being carried out on diseases related to infectious pathogens. Apart from Applied UVs successful business-to-business strategy, it is also making an attempt to sell its disinfection offerings directly to consumers online, priced at around $900. All these developments do point toward significant expected revenue growth in the future.

Improving financial performance

Applied UVs revenue has already started gaining momentum and its recent quarterly results for the third quarter was an excellent example of this progress. The companys net revenue increased by a staggering 127.6% to nearly $3.6 million, up from around $1.6 million in the prior-year quarter. The increase in revenue was despite the fact that like most industrial players, the company also suffered from various supply chain and transportation issues in key markets resulting in order fulfillment delays. The companys net loss of $1.08 million for the quarter was a 49% improvement as compared to the loss reported in the second quarter. Applied UV has a positive gross margin of nearly 30% and with the rapid expansion of distribution and revenues, it is only a matter of time before the company reaches its operating break-even.

Key takeaways

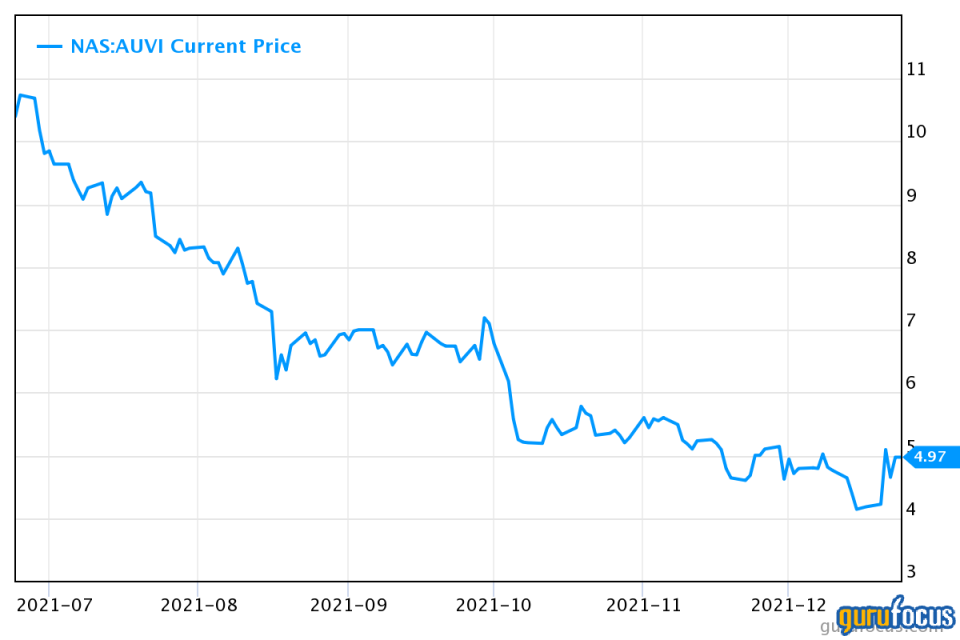

Every major spike in Applied UVs stock price has always been followed by a heavy amount of profit-taking, which may not always be justified. The same goes for the recent selloff as well, which came after the companys stock spiked on the AFRIMS installations announcement. Interestingly, President Max Munn has recently purchased 10,000 shares of the stock this week, which shows how confident the management team is of the stock price rising. Applied UV is trading at a price-to-book ratio of 1.78 and at an enterprise value-to-revenue multiple of around 4.5. Its current value indicates to me that the market is not pricing in the future growth potential. Overall, I am extremely bullish on Applied UV and believe the company could be an excellent pick for microcap investors with a high risk appetite.

This article first appeared on GuruFocus.