April Growth Opportunities – Espial Group And More

Looking to enhance your portfolio with high-growth, financially-robust stocks, but not sure where you should even begin? Stocks such as Espial Group and Aurinia Pharmaceuticals are deemed to be superior in terms of how much they’re expected to earn and return to shareholders, according to analysts. Below I’ve put together a list of great potential investments for you to consider adding to your portfolio if growth is a dimension you would like to firm up.

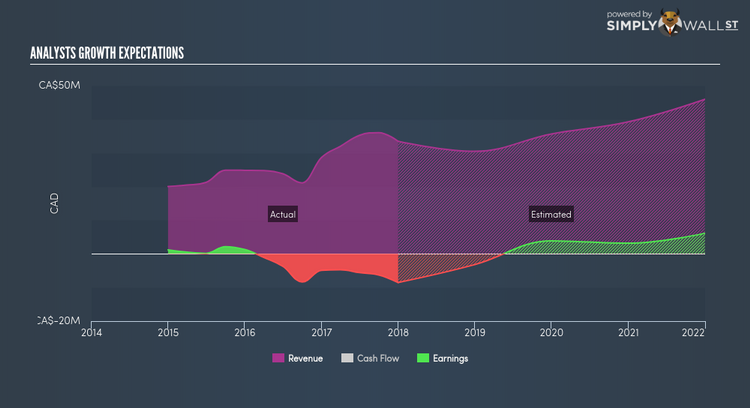

Espial Group Inc. (TSX:ESP)

Espial Group Inc. develops and markets computer software solutions in North America, Europe, and the Asia Pacific. Formed in 1997, and currently lead by Jaison Dolvane, the company employs 174 people and with the company’s market capitalisation at CAD CA$68.27M, we can put it in the small-cap category.

ESP is expected to deliver an extremely high earnings growth over the next couple of years of 85.21%, driven by a positive revenue growth of 6.59% and cost-cutting initiatives. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 9.00%. ESP ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Other fundamental factors you should also consider can be found here.

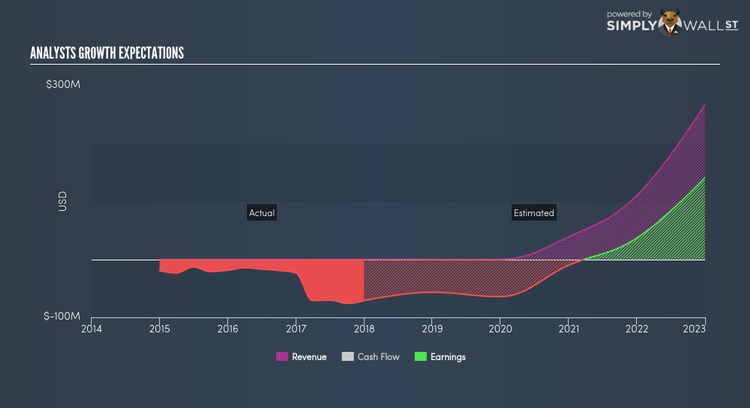

Aurinia Pharmaceuticals Inc. (TSX:AUP)

Aurinia Pharmaceuticals Inc., a clinical stage biopharmaceutical company, engages in the development of a therapeutic drug to treat autoimmune diseases in Canada and internationally. Established in 1993, and run by CEO Richard Glickman, the company employs 33 people and with the market cap of CAD CA$567.35M, it falls under the small-cap category.

AUP’s forecasted bottom line growth is an exceptional 55.46% over the next few years, increasing from the existing net income level of -US$70.79M. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 8.87%. AUP’s impressive earnings outlook makes it a worthy company to spend more time to understand. Could this stock be your next pick? Check out its fundamental factors here.

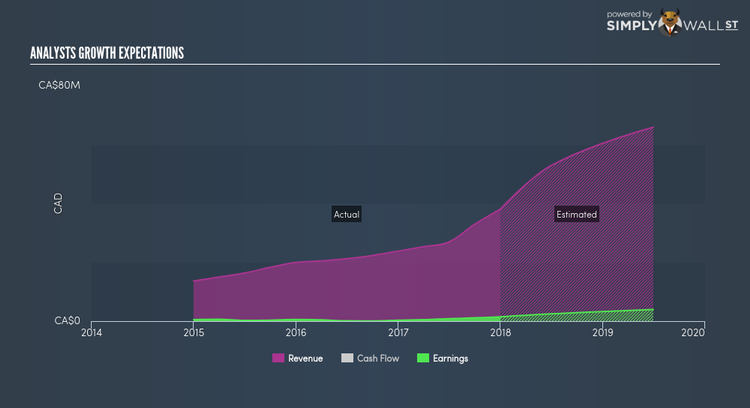

Sangoma Technologies Corporation (TSXV:STC)

Sangoma Technologies Corporation develops, manufactures, distributes, and supports voice and data connectivity components for software-based communication applications worldwide. The company was established in 1984 and with the market cap of CAD CA$55.02M, it falls under the small-cap stocks category.

Considering STC as a potential investment? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.