AptarGroup (ATR) Inks Deal to Create Digital Health Solutions

AptarGroup, Inc.’s ATR Aptar Digital Health announced it signed an enterprise agreement with Biogen Inc. BIIB to operate and develop digital health solutions for neurological and rare diseases.

This move will allow AptarGroup to strengthen its role as a go-to partner for the pharmaceutical industry, providing a full portfolio of device solutions, services and technology to help enhance the lives of patients worldwide.

As part of the deal, BIIB will transfer the ownership of certain digital health solutions to Aptar Digital Health. AptarGroup will provide Biogen with a comprehensive range of services, including product management, software design, development, and maintenance, secure cloud hosting, and customer and marketing support.

Biogen has successfully developed numerous flagship digital health products that have helped patients in more than 15 countries over the years. Aptar Digital Health's activities in neurology and immunology, which are two strategic therapeutic areas, will expand considerably under this collaboration.

AptarGroup's first solutions for operations in North America, Europe/the U.K., the Asia Pacific, and Latin America include Cleo/Aby and Physio.me. In addition to these solutions, Biogen and AptarGroup will work to develop and sell digital health solutions for the management of spinal muscular amyotrophy, Friedreich's ataxia and lupus in certain countries.

AptarGroup reported fourth-quarter 2023 adjusted earnings per share of $1.21, beating the Zacks Consensus Estimate of $1.12. The bottom line increased 27% from the 95 cents per share (including comparable exchange rates) reported in the year-ago quarter.

Total revenues increased 5.3% year over year to $838 million in the reported quarter. The top line surpassed the Zacks Consensus Estimate of $832 million.

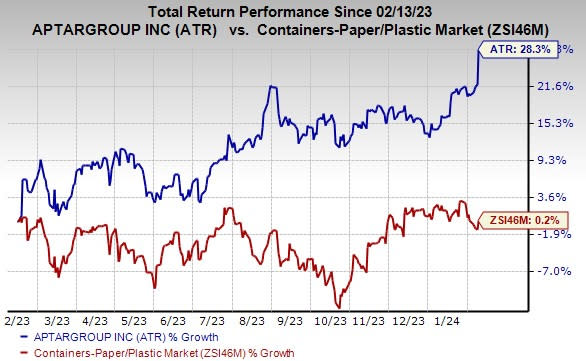

Price Performance

Shares of the company have gained 28.3% in the past year compared with the industry’s 0.2% rise.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

AptarGroup currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Cadre Holdings, Inc. CDRE and AZZ Inc. AZZ. CDRE currently sports a Zacks Rank #1 (Strong Buy) and AZZ carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cadre Holdings’ 2024 earnings is pegged at $1.11 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days and suggests year-over-year growth of 16.7%. The company has a trailing four-quarter average earnings surprise of 33%. CDRE shares have gained 49.2% in the past year.

The Zacks Consensus Estimate for AZZ’s fiscal 2024 earnings per share is pegged at $4.19. The consensus estimate for 2024 earnings has moved 2% north in the past 60 days. The company has a trailing four-quarter average earnings surprise of 37.6%. AZZ shares have rallied 51.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report