AptarGroup (ATR) Scales 52-Week High: More Room to Run?

Shares of AptarGroup ATR scaled a new 52-week high of $140.47 on Feb 12, before closing the session lower at $137.61.

ATR has a market capitalization of $9.09 billion and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

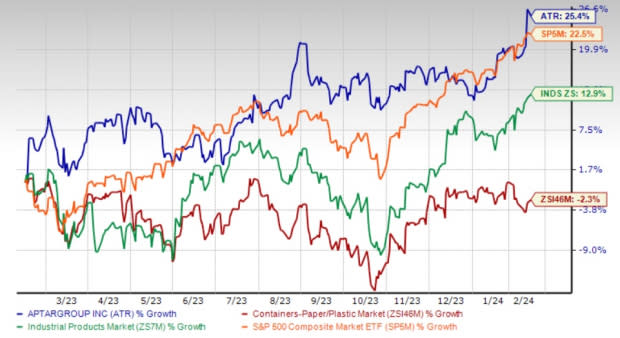

In the past year, AptarGroup’s shares have gained 25.4% against the industry’s 2.3% decline. The Industrial Products sector and the S&P 500 have gained 14% and 11.2%, respectively, in the same timeframe.

Image Source: Zacks Investment Research

Solid Q4 & 2023 Results

AptarGroup recently reported fourth-quarter 2023 adjusted earnings per share of $1.21, which increased 27% year over year. Total revenues increased 5.3% year over year to $838 million. Core sales, excluding currency and acquisition effects, improved 2% year over year. ATR’s top and bottom-line figures beat the Zacks Consensus Estimate.

AptarGroup’s sales rose 5% year over year to $3.49 billion in 2023, driven by a favorable product mix, volume growth and pricing. The company also delivered a year-over-year improvement of around 20% in net income and a 15% increase in adjusted EBITDA in the year attributed to the company’s cost management efforts, a mix of higher value products, improved productivity and lower input costs. Adjusted earnings per share improved 24% year over year to $4.78 in 2023 (including comparable exchange rates).

Solid Performance of Segments

The Pharma segment is witnessing strong demand for its proprietary drug delivery systems used for emergency medicines, allergic rhinitis, central nervous system therapeutics, as well as eye care, nasal saline rinses and nasal decongestants. In 2023, the segment witnessed the highest number of new product launches in five years. The segment delivered an 11.7% year-over-year improvement in revenues to $1.5 billion in 2023. Operating margins were 25.9% in 2023 compared with 25.5% in 2022.

The Beauty segment’s revenues improved 3.7% year over year to $1.27 billion in 2023. Even though Aptar Beauty’s core sales declined in the fourth quarter due to market softness in North America, it was offset by healthy demand for fragrance dispensing solutions in Europe and Latin America.

Momentum to Continue in 2024

AptarGroup expects demand of Pharma’s proprietary drug delivery systems and elastomeric components for biologics to continue to grow this year. The Beauty and Closures segments are expected to benefit from a recovery in the North American market. The company expects the demand for fragrance dispensing solutions to remain strong.

The company’s cost-control measures and pricing actions will help sustain margins in the upcoming quarters.

Earnings estimates for ATR have also moved up over the past 30 days. The Zacks Consensus Estimate for the ongoing quarter’s bottom line has moved up 2%. The consensus mark for 2024 has been revised upward by 2% and for 2025, by 3%. The favorable estimate revisions instill investors’ confidence in the stock.

Focus on Expansion & Innovation Boosts Growth

AptarGroup has been committed to expanding its business through acquisitions to expand the scope of technologies, geographic presence and product offerings. It is poised to gain from innovative product launches and continues to be the preferred choice for renowned brands worldwide.

Solid Balance Sheet Bodes Well

As of Dec 31, 2023, AptarGroup had available cash and equivalents of approximately $223 million, which marked a substantial improvement from $142 million as of Dec 31, 2022. The company’s total debt-to-capital ratio was 0.33 as of Dec 31, 2023, lower than 0.36 as of Dec 31, 2022. The company’s strong balance sheet enables it to continue to invest in the business, pursue strategic opportunities and continue to return value to shareholders as dividends and share repurchases.

In July, it announced an increase to the quarterly dividend by around 8% to 41 cents per share. It is on track to achieve 30 consecutive years of paying an increasing total annual dividend.

Other Stocks to Consider

Some other top-ranked stocks from the Industrial Products sector are Cadre Holdings, Inc. CDRE, AZZ Inc. AZZ and Applied Industrial Technologies AIT. CDRE and AZZ currently sport a Zacks Rank #1, and AIT carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Cadre Holdings’ 2024 earnings is pegged at $1.11 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days and suggests year-over-year growth of 16.7%. The company has a trailing four-quarter average earnings surprise of 33%. CDRE shares have gained 51% in the past year.

The Zacks Consensus Estimate for AZZ’s fiscal 2024 earnings per share is pegged at $4.19. The consensus estimate for 2024 earnings has moved 2% north in the past 60 days. The company has a trailing four-quarter average earnings surprise of 37.6%. AZZ shares have rallied 78% in the past year.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have been unchanged in the past 60 days. The company’s shares have gained 31.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report