Aptitude Software Group (LON:APTD) Has Affirmed Its Dividend Of £0.018

The board of Aptitude Software Group plc (LON:APTD) has announced that it will pay a dividend of £0.018 per share on the 26th of August. This payment means the dividend yield will be 1.3%, which is below the average for the industry.

Check out our latest analysis for Aptitude Software Group

Aptitude Software Group's Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, the company was paying out 114% of what it was earning. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 36%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Dividend Volatility

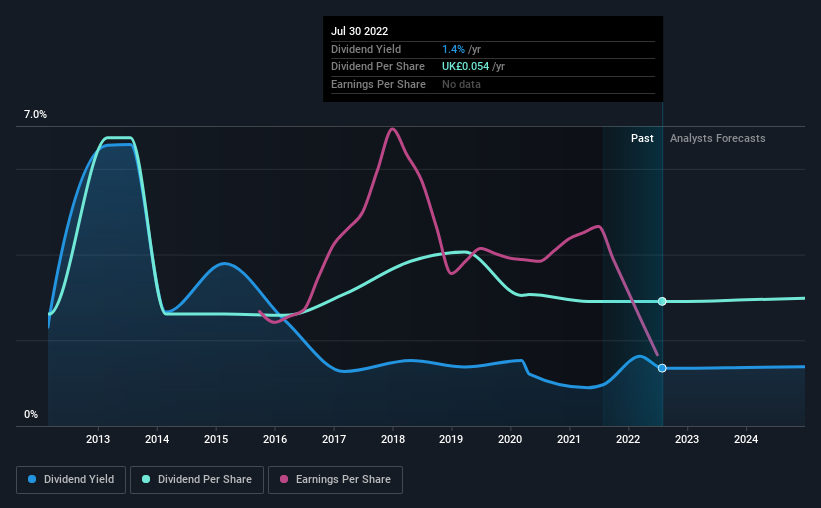

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2012, the annual payment back then was £0.0485, compared to the most recent full-year payment of £0.054. This implies that the company grew its distributions at a yearly rate of about 1.1% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Earnings per share has been sinking by 20% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

We're Not Big Fans Of Aptitude Software Group's Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for Aptitude Software Group that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here