Aptorum Group (NASDAQ:APM) shareholders are up 12% this past week, but still in the red over the last three years

Aptorum Group Limited (NASDAQ:APM) shareholders will doubtless be very grateful to see the share price up 63% in the last quarter. But only the myopic could ignore the astounding decline over three years. The share price has sunk like a leaky ship, down 90% in that time. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

While the last three years has been tough for Aptorum Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Aptorum Group

With just US$1,541,778 worth of revenue in twelve months, we don't think the market considers Aptorum Group to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Aptorum Group has the funding to invent a new product before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. It certainly is a dangerous place to invest, as Aptorum Group investors might realise.

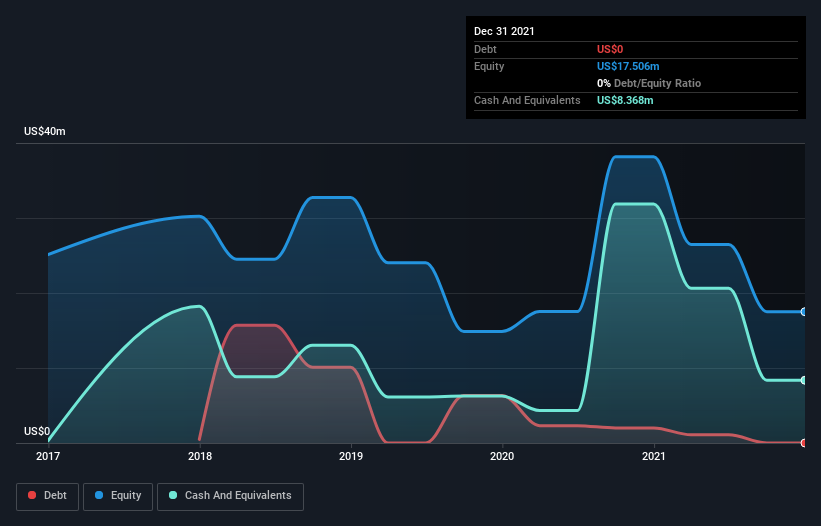

When it reported in December 2021 Aptorum Group had minimal cash in excess of all liabilities consider its expenditure: just US$4.0m to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. With that in mind, you can understand why the share price dropped 24% per year, over 3 years. You can click on the image below to see (in greater detail) how Aptorum Group's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Aptorum Group shareholders are down 37% for the year, falling short of the market return. Meanwhile, the broader market slid about 10%, likely weighing on the stock. However, the loss over the last year isn't as bad as the 24% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Aptorum Group better, we need to consider many other factors. Take risks, for example - Aptorum Group has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here