Aramark (ARMK) Reports Strong First Quarter with Revenue and Earnings Growth

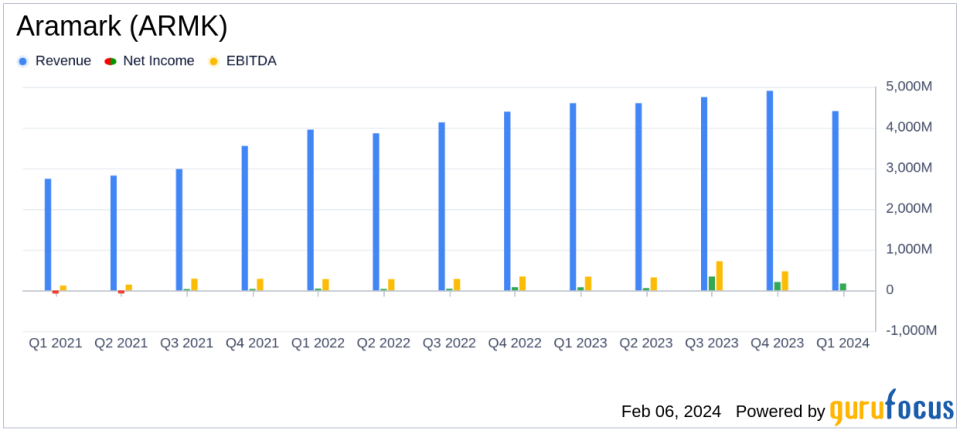

Revenue: Increased by 13% year-over-year to $4.4 billion, with organic revenue also up 13%.

Operating Income: Grew 10% to $167 million; Adjusted Operating Income (AOI) surged 28% to $231 million.

GAAP EPS: Declined 27% to $0.11, impacted by expenses from the Uniform Services spin-off; Adjusted EPS rose 33% to $0.41.

Net Debt Position: Reduced by more than $2.2 billion compared to the prior year period.

Dividend: A quarterly dividend of 9.5 cents per share declared, payable on February 28, 2024.

Outlook: Aramark updated its fiscal 2024 outlook for AOI and Adjusted EPS growth, reaffirmed expectations for Organic Revenue growth and Leverage Ratio.

Aramark (NYSE:ARMK) released its 8-K filing on February 6, 2024, detailing a robust start to the fiscal year with significant growth in both revenue and earnings. The company, a global provider of food, facilities, and uniform services, saw a 13% increase in revenue, reaching $4.4 billion, driven by strong sales volume, pricing, and net new business. The growth was particularly notable in the Food and Support Services (FSS) United States and International segments.

Financial Highlights and Segment Performance

Operating income for the quarter was reported at $167 million, a 10% increase from the previous year, while adjusted operating income saw a more significant jump of 28%, amounting to $231 million. This was attributed to scale efficiencies from higher revenue, supply chain initiatives, and cost management. Despite a decrease in GAAP earnings per share (EPS) by 27% to $0.11, due to expenses related to the completion of the Uniform Services spin-off, adjusted EPS increased by 33% to $0.41.

Aramark's net debt position improved markedly, with a reduction of over $2.2 billion compared to the prior year period, including the repayment of $1.5 billion of Senior Notes due in 2025. The company also reported over $1.0 billion in cash availability at the end of the quarter.

Operational Insights and Future Outlook

CEO John Zillmer highlighted the company's successful execution of growth strategies, which have driven top- and bottom-line performance. He noted that inflation moderation provided a tailwind to profitability during the quarter. Looking ahead, Aramark anticipates continued profitable growth and margin expansion, supported by new business operations, supply chain initiatives, and cost control measures.

"Aramark is off to a great start in this new fiscal year, achieving record revenue across both our FSS U.S. and International segments, along with record first quarter profit in International, said John Zillmer, Aramark's Chief Executive Officer.

The company has updated its fiscal 2024 outlook, expecting organic revenue growth of 7% to 9%, adjusted operating income growth of 17% to 20%, and adjusted EPS growth of 30% to 35%. The leverage ratio is anticipated to be around 3.5x.

Value investors may find Aramark's strong performance in the first quarter, along with its positive outlook for the fiscal year, an attractive proposition. The company's ability to manage costs effectively while growing its top line suggests a solid foundation for sustained profitability and shareholder value creation.

For more detailed information, investors are encouraged to review the full earnings report and listen to the earnings call. Aramark continues to demonstrate its commitment to delivering value through strategic growth and operational excellence.

For the latest financial news and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Aramark for further details.

This article first appeared on GuruFocus.