Arbor Realty Trust Inc (ABR) Announces Solid Earnings and Dividend Increase for Q4 and Full ...

Net Income: $330.1 million for the full year, a 5% increase from the previous year.

Distributable Earnings: $2.25 per diluted common share for the full year, slightly up from $2.23 last year.

Dividend: Quarterly cash dividend raised to $0.43 per share, reflecting a 7.5% increase over the prior year.

Agency Loan Originations: $5.11 billion for the full year, a 7% increase from the previous year.

Structured Portfolio: Reduction of 13% with significant multifamily loan runoff.

Liquidity: Approximately $1 billion in cash and liquidity, with ~$600 million of restricted cash in CLO vehicles.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

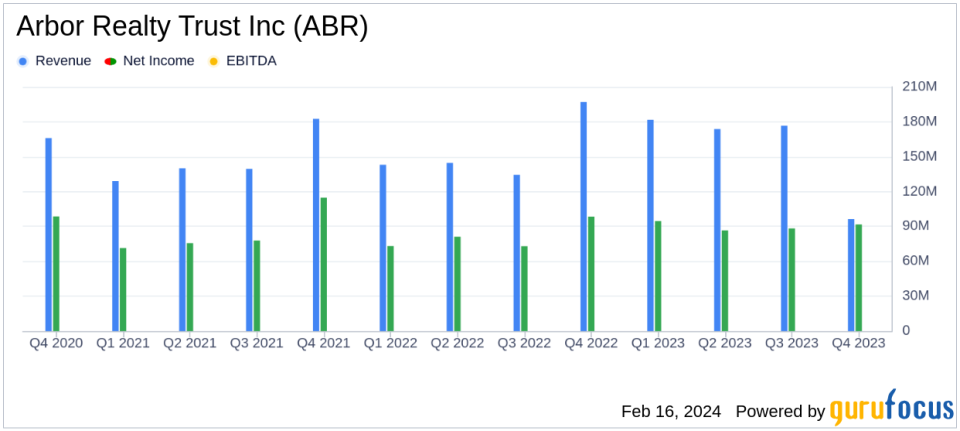

On February 16, 2024, Arbor Realty Trust Inc (NYSE:ABR) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company reported a GAAP net income of $91.7 million, or $0.48 per diluted common share for the quarter, and a full-year net income of $330.1 million, or $1.75 per diluted common share, representing a 5% increase over the previous year. Distributable earnings for the year were reported at $452.5 million, or $2.25 per diluted common share.

Arbor Realty Trust Inc is a specialized real estate finance company that invests in a diversified portfolio of structured finance assets in the multifamily and commercial real estate markets. The company operates two business segments, Structured Business and Agency Business, with the majority of its revenue generated from the Structured Business Segment. Arbor is externally managed and advised by Arbor Commercial Mortgage, LLC.

The company's strong performance is underscored by a 7.5% increase in its annual dividend rate to $1.72 per share. This reflects Arbor's commitment to delivering shareholder value and its confidence in the sustainability of its earnings. The increase in agency loan originations, which grew by 7% to $5.11 billion for the full year, also highlights the company's robust origination platform and its ability to capitalize on market opportunities.

Arbor's liquidity position remains strong, with approximately $1 billion in cash and liquidity, and around $600 million of restricted cash in replenishable CLO vehicles, which is crucial for the company's ongoing operations and investment activities. The structured loan portfolio experienced a reduction, with a runoff of $817.4 million for the quarter, reflecting the company's strategic portfolio management.

Despite these positive results, the company faced challenges, including a decrease in distributable earnings per share for the quarter, from $0.60 to $0.51, and an increase in non-performing loans. These challenges highlight the importance of maintaining strong credit quality and managing risk in the company's loan portfolio.

Arbor's financial achievements, such as the growth in net income and the increase in distributable earnings, are significant for a real estate investment trust (REIT) as they directly impact the company's ability to generate and distribute income to shareholders. The company's performance is also a positive indicator for the REIT industry, demonstrating the potential for growth and profitability even in a complex economic environment.

The company's balance sheet remains solid, with a loan and investment portfolio's unpaid principal balance of $12.62 billion. The weighted average current interest pay rate of the portfolio was 8.42%, reflecting the company's ability to secure favorable borrowing terms. The total allowance for loan losses was $195.7 million, which provides a cushion against potential credit losses.

In conclusion, Arbor Realty Trust Inc's performance in the fourth quarter and full year of 2023 demonstrates its resilience and strategic execution in a challenging market. The company's increased dividend and solid financial metrics are testament to its commitment to shareholder value and position it well for continued success in the future.

For a more detailed analysis of Arbor Realty Trust Inc's financial results, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Arbor Realty Trust Inc for further details.

This article first appeared on GuruFocus.