Arbutus Biopharma Corp (ABUS) Reports Year-End Financial Results and Progress in Clinical Trials

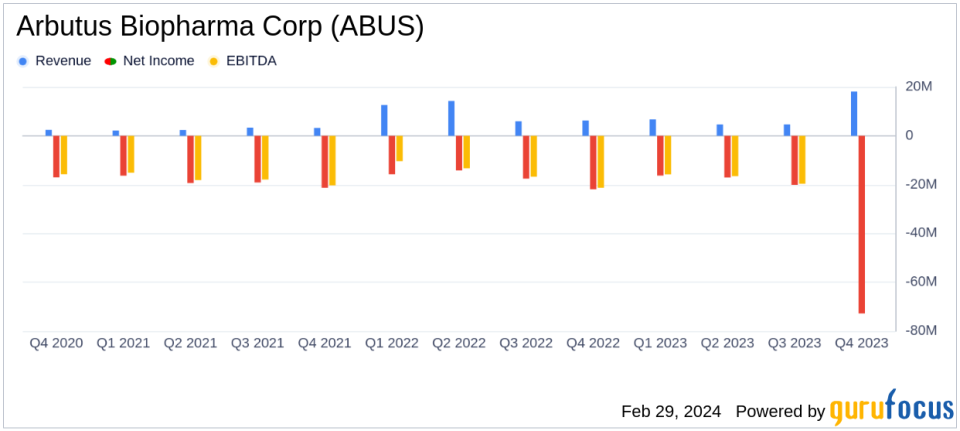

Revenue: Total revenue for 2023 was $18.1 million, a decrease from $39.0 million in 2022.

Operating Expenses: Research and development expenses decreased to $73.7 million in 2023 from $84.4 million in 2022.

Net Loss: The company reported a net loss of $72.8 million, or $0.44 per share, compared to a net loss of $69.5 million, or $0.46 per share in 2022.

Cash Position: Arbutus ended the year with $132.3 million in cash, cash equivalents, and investments, projecting a cash runway into Q1 2026.

Clinical Trials: Progress in ongoing Phase 2a clinical trials with imdusiran and Phase 1a/1b trial with AB-101, with key data expected in 2024.

On February 29, 2024, Arbutus Biopharma Corp (NASDAQ:ABUS) released its 8-K filing, detailing the financial results for the fourth quarter and year end of 2023, along with updates on its clinical development programs. Arbutus, a biopharmaceutical company focused on developing a functional cure for chronic hepatitis B virus (cHBV) infection, anticipates a productive 2024 with multiple clinical data readouts expected.

Financial Highlights and Clinical Progress

Arbutus reported a decrease in total revenue to $18.1 million for 2023, down from $39.0 million in the previous year. This decline was primarily attributed to a reduction in revenue recognition from the company's license agreement with Qilu and decreased royalty revenues from Alnylam's sales of ONPATTRO. Operating expenses saw a decrease, with research and development expenses dropping to $73.7 million due to lower manufacturing and clinical expenses, partially offset by increased costs associated with the AB-101 Phase 1a/1b clinical trial.

The company's net loss widened slightly to $72.8 million, or $0.44 per share, compared to a net loss of $69.5 million, or $0.46 per share in the previous year. Despite the increased net loss, Arbutus maintains a strong financial position with cash, cash equivalents, and investments totaling $132.3 million, providing a cash runway into the first quarter of 2026.

Strategic Clinical Developments

Arbutus is on track to report key clinical data from two ongoing Phase 2a clinical trials with imdusiran, an RNAi therapeutic, and a Phase 1a/1b clinical trial with AB-101, an oral checkpoint inhibitor. The company plans to initiate a third Phase 2a clinical trial with imdusiran in the first half of 2024. Michael J. McElhaugh, Interim President and CEO, expressed optimism about the potential of combination therapies to functionally cure HBV.

We believe that a combination therapy that reduces surface antigen, suppresses HBV DNA and boosts the host immune response will be necessary to functionally cure HBV," said McElhaugh.

Arbutus also continues to protect its intellectual property, with ongoing litigation against Moderna and Pfizer/BioNTech over the use of its patented lipid nanoparticle (LNP) technology.

Analysis and Outlook

While the decrease in revenue and the net loss present challenges, Arbutus's continued investment in its clinical programs and strong cash position suggest a strategic focus on long-term value creation through its pipeline of drug candidates. The upcoming clinical milestones could provide significant insights into the company's prospects for developing a functional cure for HBV.

For value investors, Arbutus's commitment to advancing its clinical pipeline, coupled with a prudent financial management that ensures a multi-year cash runway, may present an opportunity to invest in a company with potential for future growth driven by scientific innovation.

Arbutus's full financial statements and further details on its clinical trials and litigation updates can be found in the company's 8-K filing.

Investors and interested parties are encouraged to follow Arbutus's progress as it navigates the biopharmaceutical landscape with a focus on addressing the unmet medical needs of chronic HBV patients.

Explore the complete 8-K earnings release (here) from Arbutus Biopharma Corp for further details.

This article first appeared on GuruFocus.